Key Takeaways

- Chainlink whales dumped 407,084 LINK, worth $8.37 million.

- LINK price action suggests the asset is at a make-or-break level, with a potential reversal or further decline possible.

- Despite the price decline, exchanges continue to record LINK outflows, hinting at possible accumulation.

Chainlink whales appeared fearful on Thursday, dumping millions worth of LINK, after the price broke a key support at $21.10.

Chainlink (LINK) Faces Major Selloff

Crypto transaction tracker Onchain Lens reveals that whale wallet addresses 0xbf1b and 0xc6f dumped 407,084 LINK worth $8.37 million. It came when major crypto assets, including Bitcoin (BTC) and Ethereum (ETH), recorded price declines of 2.15% and 2.80%, respectively, according to CoinMarketCap data.

Meanwhile, the impact of whale sell-offs and market downturns is evident on the LINK price, which tumbled 4.85% over the past 24 hours. Currently, the asset is trading near the $20.10 level, with a significant 50% increase in trading volume, reaching $1.12 billion during the same period.

Expert Comments on LINK

However, several posts by experts have recently surfaced on X, sharing a bearish outlook.

Some suggested that LINK could drop to the $17.85 level, as it is holding around the Fibonacci retracement zone of 0.618–0.79 along with the 200 EMA.

Others noted that LINK appears to be weakening after losing the key $22 level. One expert on X cited that LINK’s chart is showing a bearish deviation but remains in an uptrend on higher time frames. Still, the probability is high that it could retest the $17 level as a higher low before the next leg up.

LINK Price Action and Key Levels to Watch

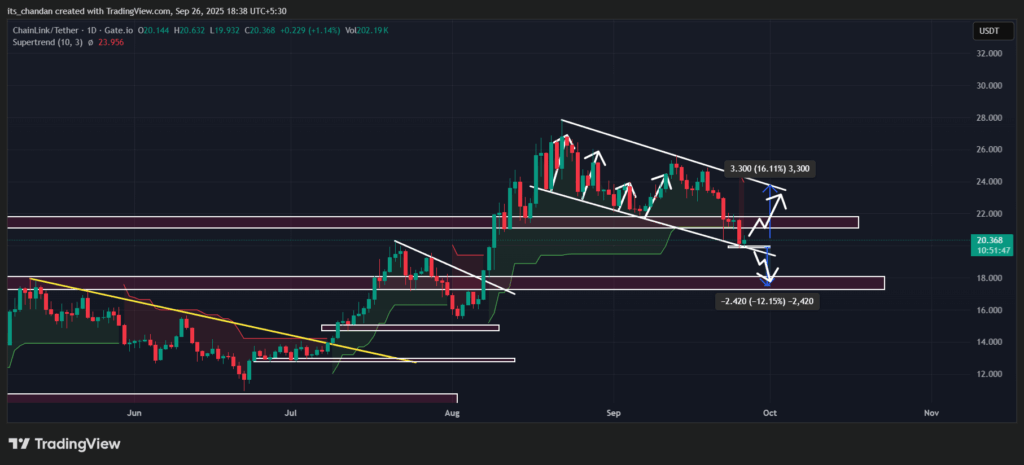

On the daily chart, TimesCrypto’s technical analysis reveals that LINK has been hovering in a descending channel pattern, which began in August 2025 between the upper and lower boundaries. However, the continuous price decline over the past week has pushed the price down to the lower boundary of the channel.

One thing currently giving hope to LINK holders is the history of the lower boundary. The daily chart reveals that LINK has touched this lower boundary nearly four times, and each time it recorded a price reversal, something that could happen again if it sustains above the boundary.

Based on the current price action, LINK currently holds a minor support at the $19.85 level. If selling pressure intensifies and the price breaches this support, a potential 12% decline could occur, reaching the $18 level.

Conversely, if it holds the lower boundary or local support, a 16% price surge could be possible, reaching the $23.47 level.

Exchanges See $10.5M LINK Outflow

Despite the price continuing to decline, some investors and long-term holders appear to be taking advantage of LINK’s lower price, as they seem to be accumulating.

Coinglass, an on-chain analytics tool, reveals that exchanges have recorded an outflow of $10.50 million worth of LINK tokens over the past 24 hours. This massive outflow of tokens hints at potential accumulation.