Key Takeaways:

- Coinbase’s Base layer faced a network outage for 29 minutes on August 5th, 2025.

- Coinbase’s stock opened Tuesday’s trading session with a 3% decline.

- With more than $4.15 billion in TVL, Base’s temporary suspension prompted concerns about the resilience of high-value DeFi infrastructure.

Coinbase’s (COIN) stock has declined by 16% over the last five trading sessions, a downturn primarily triggered by the company’s disappointing Q2 earnings report. Upon missing analyst forecasts, the share price fell from $379 to as low as $305 and is currently trading at $311 at the time of writing.

On August 5th, 2025, the Base network experienced its first network outage since 2023. Coinbase created Base, a Layer-2 blockchain built on top of Ethereum, to make transactions faster and cheaper while staying secure and decentralized. It is part of the Optimism Superchain ecosystem. The network outage resulted in core functions being dismantled, such as block production, all deposit and withdrawal operations.

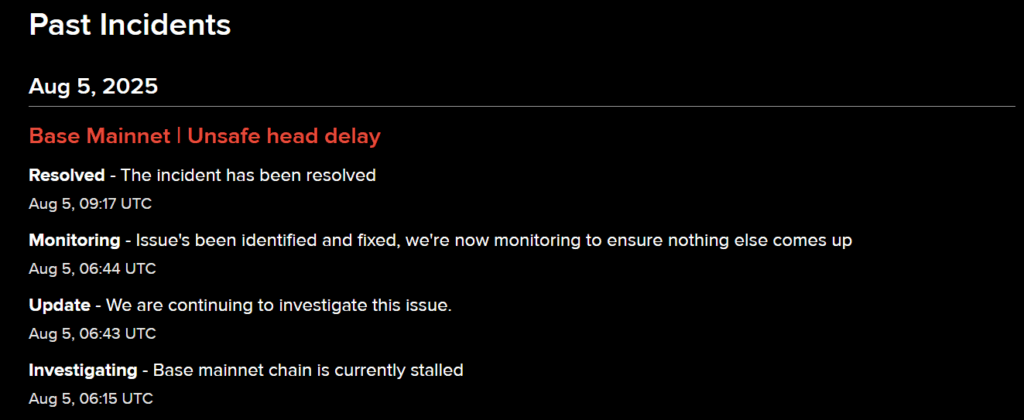

Base’s incident status page shows that the mainnet chain stopped functioning around 6:15 UTC. By 6:44 UTC, the issues were identified and fixed, after which monitoring was going in order to ensure smooth operability. Within 29 minutes, the Base team was able to identify the issue and fix it. Even though by 9:17 UTC, an update regarding the entire incident has been resolved were informed through the incident status page.

Since its inception, the Base network has become an important part of the Ethereum Layer-2 ecosystem, with $4.15 billion in total value locked (TVL). TVL is the total money that has been locked into the smart contracts of a specific DeFi protocol or an entire blockchain ecosystem. According to DeFiLlama, the Morpho lending protocol is a key driver of this expansion, accounting for $1.5 billion out of the total TVL.

The time of the outage was noteworthy since it occurred just weeks after Base added Flashblocks, a new feature from Flashbots. The system generates “preconfirmation blocks” every 200 milliseconds, allowing on-chain apps to reveal transaction statuses almost instantly.

Several users showed concerning reactions as Base is a huge network empowering over $4 billion in TVL. A network outage for one of the busiest L2s is a concerning sign.

A key opinion leader (KOL) on X, going by the username @NathanHeadPhoto with over 106K followers, expressed disappointment. Essentially, implying that there’s a bias towards Base

If it were Solana you’d never hear the end of it.

After closing at $318 on August 4th, Coinbase’s stock declined by 3% as it opened sharply lower the next day at $307 in an apparent reaction to the Base network outage, along with ongoing negative sentiment due to a weaker-than-expected earnings report. The stock subsequently showed signs of recovery during the trading session, climbing back to the $311 level.

Coinbase’s disappointing Q2 earnings report and a rare outage on its Base Layer-2 network have triggered a sharp drop in its stock price. While the Base outage was quickly resolved, it raises a huge concern among blockchains handling billions in TVL. The event highlights the significance of maintaining operational resilience, as Base continues to play a critical role in Ethereum’s Layer-2 ecosystem.