Key Takeaways

- A whale purchased 14.56 million Ethena (ENA) tokens, worth $4.06 million, from Binance and Wintermute, at the level where it previously soared 200%.

- Price action indicates strong long-term potential for ENA, and if its price holds above $0.20, it could rise by 200% as it did in the past. However, several hurdles remain a challenge.

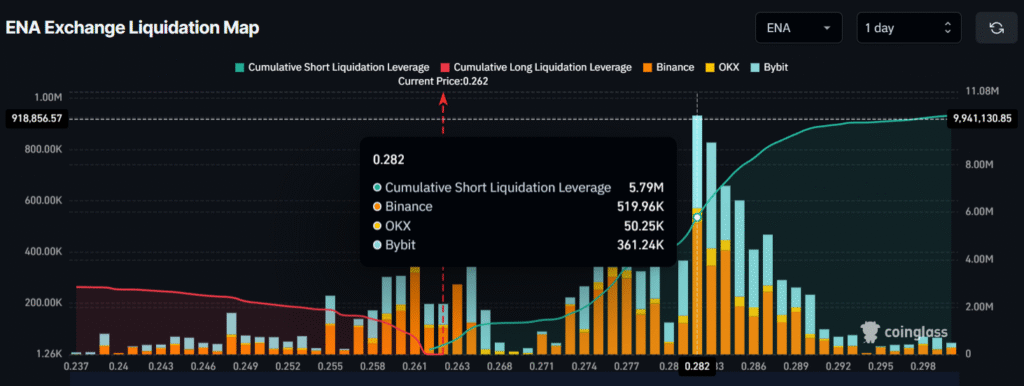

- In the short term, ENA’s sentiment is bearish, as traders are over-leveraged at $0.261 on the lower side and $0.282 on the upper side.

Ethena (ENA) has been in a downtrend, posting a 70% price drop since September, but it’s on whales’ radar now. Crypto transaction tracker Onchain Lens reveals that a whale wallet (“0x7BE1”) has purchased 14.56 million ENA tokens, worth $4.06 million, from Binance and Wintermute.

With recent purchases, the whale’s ENA holdings have soared to 17.56 million tokens, now valued at $5.38 million, accumulated over the past month. However, the ongoing price decline has caused a loss of $522K on these holdings, according to crypto tracker data.

Ethena (ENA) Price Drops Despite Accumulation

Despite accumulating millions of tokens, ENA’s price continues to decline. It is currently trading at $0.27, posting a modest gain of 0.52% today, while its trading volume has increased by 3% to $322.15 million, according to CoinMarketCap.

You might be wondering what is driving the whale to accumulate ENA even as its price continues to decline. With today’s dip, the asset has now lost nearly 70% of its value since September 2025.

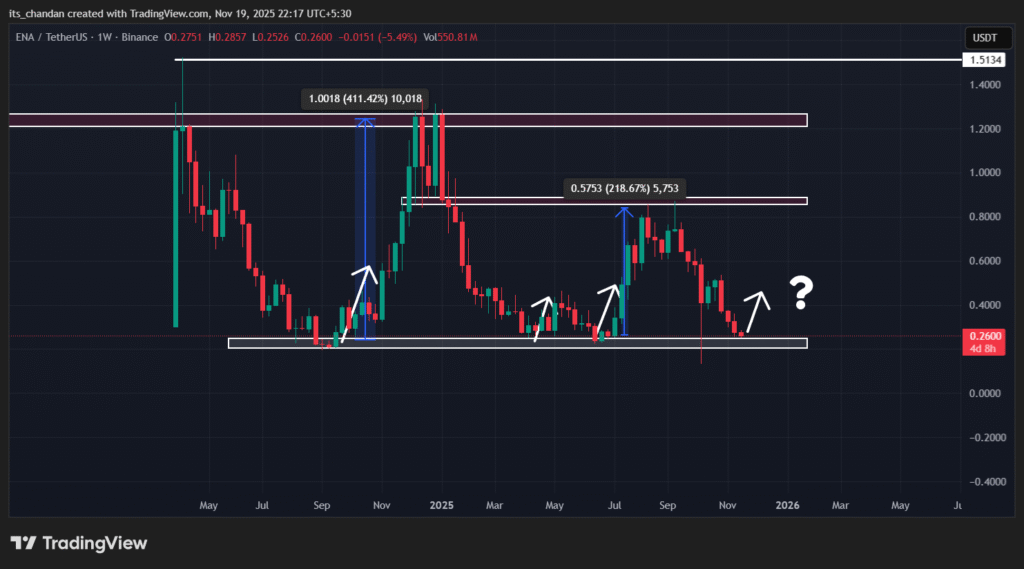

The answer lies in the current price action. On the weekly chart, ENA’s continuous price decline has brought it back to a level that has historically triggered strong price reversals multiple times. The chart shows that the last time ENA reached this level, it surged by more than 200%.

ENA Technical Outlook: Key Levels to Watch

On the weekly timeframe, Ethena (ENA) is in a downtrend and is currently hovering near the key support level of $0.207.

Based on the current price action and historical patterns, if ENA sustains above the current level or above $0.207, it could see an impressive price uptick and may reclaim the $0.86 level in the future. However, it will be challenging for ENA to soar due to multiple hurdles at $0.41, $0.54, $0.635, and $0.78.

However, if ENA’s ongoing downside momentum continues and the price falls below $0.20, the potential rebound could be invalidated. This is because a key support level would break, and since it has a history of triggering price reversals, its breakdown could end bullish dominance. Additionally, millions of dollars’ worth of long positions at this level could also be liquidated.

As of now, ENA’s Chaikin Money Flow (CMF) value has reached 0.12, indicating that buying pressure is slightly outweighing selling pressure and that whales may be accumulating the token, which is exactly what the crypto tracker reveals.

Trader Sentiment Remains Bearish

Despite potential price recovery signals, traders’ sentiment remains bearish, as they are strongly betting on short positions.

According to Coinglass data, ENA’s major liquidation levels stand at $0.261 on the lower side and $0.282 on the upper side. At these levels, traders have built $704.19K worth of long positions and $5.79 million worth of short positions.

ENA’s short-term sentiment remains bearish, with intraday bears dominating. However, whales’ accumulation and the strong history of price reversals from key support suggest that ENA still has significant long-term potential.

Also Read: Bitcoin Retreats to $91K as Fed Minutes, Nvidia Eyed