Key Takeaways

- BlackRock dumped 57,430 ETH worth $175.93 million, strengthening the asset’s bearish sentiment.

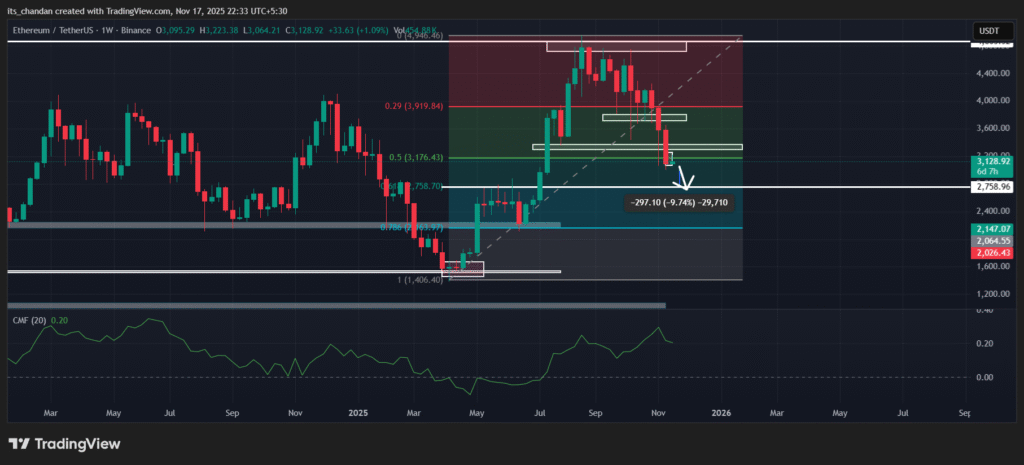

- Price action suggests that if ETH breaks below the local support at $3,067, it could see a sharp sell-off and potentially drop to the $2,758 level.

- On the weekly chart, the $2,758 level appears to be a key support zone, as it aligns with the 61.8% Fibonacci retracement level.

Ethereum’s weakening price action, combined with recent activity from asset-management giant BlackRock, suggests that ETH may continue its downside move in the coming days. The cryptocurrency has already broken below its key $3,200 support level and is now trading near price zones last seen in July 2025.

Ethereum (ETH) Price Momentum and Whale Activity

As per the latest TradingView data, ETH is currently trading at $3,080 and has posted a 0.55% price uptick today. This modest surge appears to be a retest of the recent breakdown before a potential continuation of the downside.

Meanwhile, despite the slight price increase, investors and traders have shown strong interest in the asset, as evident from the trading volume, which has surged over 67% to $37.08 billion.

Also Read: Is Crypto Bull Run Over? $1.1 Trillion Wiped Out from the Market!

However, the surge in trading volume was recorded when the price had already broken a key support level, and BlackRock dumped 57,430 ETH worth $175.93 million into Coinbase, as shared by the on-chain analytics platform Onchain Lens. This suggests that market participants are interested in pushing the price in line with the current trend, which remains bearish.

Besides this, whales like Arthur Hayes also dumped 700 ETH worth $2.23 million to B2C2. Not just that, but several recent transactions have surfaced that directly point toward a potential sell-off.

When combining the sell-off activity from whales and institutions, it directly questions ETH’s long-term potential and suggests a growing bearish sentiment.

Ethereum Price Action and Technical Analysis

TimesCrypto’s technical analysis on the daily chart appears bearish, as ETH has broken down its key support at the $3,200 level. Besides this, the price also seems to be retesting its breakdown level within a small consolidation range between $3,067 and $3,253, which has further strengthened the asset’s downside momentum.

TimesCrypto’s technical analysis on the daily chart appears bearish, as ETH has broken down its key support at the $3,200 level. Besides this, the price also seems to be retesting its breakdown level within a small consolidation range between $3,067 and $3,253, which has further strengthened the asset’s downside momentum.

This level is not just a usual support for ETH; it is the 61.8% golden Fibonacci level on the weekly timeframe. This suggests that ETH has strong potential to experience a price reversal from this golden level.

On the other hand, if ETH’s downside momentum continues and it falls below the $2,758 level, it could bring even more downward pressure in the coming days.

As of now, ETH’s CMF value reaches -0.22, indicating strong selling pressure in the market, as the Chaikin Money Flow (CMF) shows increased capital outflows and weakening buyer strength.