Key Takeaways

- Whales and smart traders’ bearish bets on Ethereum (ETH) continue to rise, suggesting the asset could extend its downtrend, which has been ongoing since October 2025.

- Ethereum exchange reserves across all exchanges have soared by 87,901 ETH in the past 48 hours, signaling ongoing dumping.

- Price action suggests that if the ETH price fails to break above the $3,250 level, it could see a 12% drop and potentially reach the $2,750 level.

Ethereum whales’ interest in ETH appears to be fading as the price fails to maintain its upward momentum. Yesterday, during an upside move, a smart trader opened millions’ worth of short positions. Later, when the price failed to hold its gains, SharpLink, a publicly listed company holding ETH as its primary reserve asset, dumped millions’ worth of tokens, signaling that the asset could extend its downward momentum.

Ethereum Whales Increase Bearish Bets, Is It Time to Sell?

The crypto transaction tracker, Onchain Lens, shared a post on X noting that a crypto whale deposited 1.71 million USDC into Hyperliquid to increase the short margin on his 7.2K ETH short position worth $22.5 million.

Meanwhile, this smart trader believes that the ETH price won’t cross the $3,688.3 level anytime soon, as this level acts as his liquidation point.

In addition, the crypto tracker reveals that SharpLink, a publicly listed firm, dumped 5,442 ETH worth $17.02 million to Galaxy Digital. The sell-off by SharpLink comes as ETH has fallen 20% so far in November.

Such bearish activity by whales and institutions always raises the question of whether this is an ideal time to sell holdings or if the price could bounce back from the current level.

Ethereum Exchange Reserves Soar 87.9K

Adding to the bearish outlook, on-chain analytics platform CryptoQuant reveals that Ethereum exchange reserves across all exchanges have surged by 87,901 ETH over the past 48 hours, indicating that whales and investors are dumping their assets.

As per the latest TradingView data, Ethereum (ETH) is currently trading at $3,090, posting a 1.05% price dip. During the same period, market activity has declined notably, as evidenced by trading volume dropping 35% to $35.13 billion.

Also Read: Is Bitcoin Crash Coming? Mt. Gox Moves $953 Million in BTC

Ethereum Price Action and Technical Analysis

TimesCrypto technical analysis reveals that ETH is in a downtrend, and with recent downside momentum, it has already broken its key support at the $3,250 level. Following the support breakdown, ETH has been hovering near this level for nearly five trading days.

On the daily chart, it appears that ETH could only shift market sentiment if it ends its ongoing consolidation and reclaims the $3,250 level.

Based on the current price action, an ETH rally is only possible if it closes a daily candle above the $3,250 level. If this occurs, the asset could see a 15% price uptick, potentially reaching $3,700.

However, if the current sentiment and whale activity remain unchanged and the price fails to break the $3,250 level, a further 12% dip could occur, potentially pushing ETH down to $2,750.

As of now, ETH’s Average Directional Index (ADX) has reached 40.75 — well above the key threshold of 25 — indicating strong directional momentum in the asset.

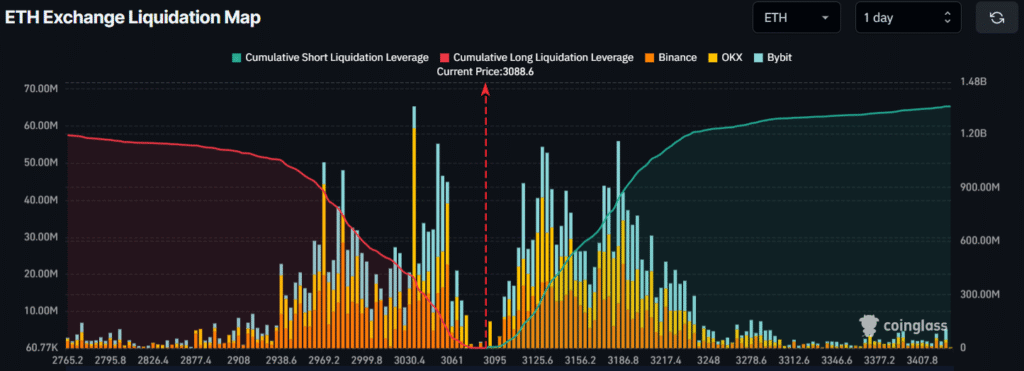

Traders Build $1.49 Billion in Long Positions

Besides the bearish price action, analytics platform Coinglass reveals that traders’ short-term sentiment is bullish, as they appear to be betting on long positions.

Data shows that ETH’s major liquidation levels stand at $2,960 on the lower side and $3,174.5 on the upper side. At these levels, traders are over-leveraged and have built $1.49 billion worth of long positions and $851.12 million worth of short positions, suggesting bullish dominance on the asset.