Key Takeaways

- Ethereum price action suggests that ETH has the potential to reach the $3,800 level, only if it sustains above $3,490.

- On-chain platforms indicate that both institutional and smart whales are on a buying spree, showing strong interest in the asset.

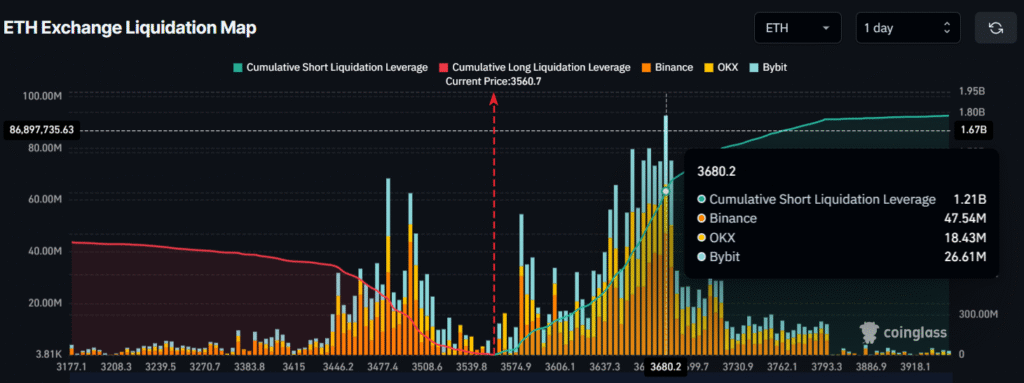

- Derivative analytics reveal that $3,680 is a key hurdle for Ethereum, as traders have built $1.21 billion worth of short positions, anticipating that the asset might not cross this level soon.

Despite today’s minor decline in the Ethereum price, whale confidence remains strong, hinting at a potential rally. This surge in interest comes after the asset cleared multiple hurdles, triggering mass accumulation and prompting smart whales to open significant long positions.

Ethereum Whales Activity and Current Price

According to the on-chain analytics platform Onchain Lens, newly created wallets—likely belonging to the largest Ethereum treasury, Bitmine—purchased 41,792 ETH worth $147.55 million today from BitGo and Kraken exchanges.

Besides this accumulation, a crypto whale, known as a Bitcoin OG, continues to increase bets on Ethereum longs. According to a recent post by Onchain Lens, this OG has increased its ETH 5x long position from 40,000 to 55,133 ETH, worth $194.5 million.

The average long of ETH currently stands at $3,468, and despite today’s market uncertainty, this smart whale’s position still holds an impressive profit of over $3.6 million.

In addition, another smart whale, known as Machi Big Brother, has also expanded his 25x ETH long. With today’s bet, the whale’s 25x ETH long position is now valued at $20 million and holds a profit of $960,000.

Looking at these bets by smart whales and institutions, it appears to be an ideal buying opportunity, or the perfect time to go long. According to the latest TradingView data, Ethereum is trading at $3,575, posting a modest decline of 0.15% today.

Also Read: Oman Steps Up Efforts To Grow Digital Economy, Targets 10% Of GDP Under Vision 2040

Ethereum Price Analysis and Technical Outlook

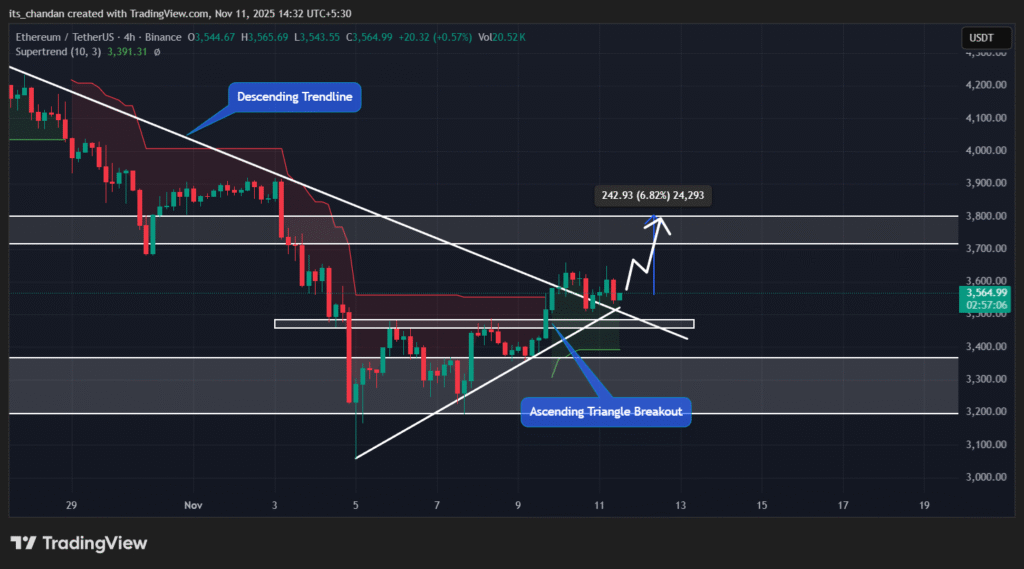

The key catalyst behind smart whales’ interest in Ethereum appears to be the recent breakout of a prolonged descending trendline, along with an ascending triangle pattern near the key $3,200 support level, which the asset has formed on the four-hour chart.

The chart shows that Ethereum has successfully closed a four-hour candle above the trendline but appears to be retesting the breakout level. TimesCrypto’s technical analysis indicates that if Ethereum holds above the $3,490 level, it could see a price uptick of over 6.8% and potentially reach the $3,800 level.

Current price action suggests that Ethereum’s bullish thesis will only be validated if the price remains above the $3,490 level; otherwise, it could be invalidated.

With the recent rally, ETH’s Supertrend indicator has turned green and is hovering above the asset’s price, indicating that it is back in an uptrend with strong buying pressure.

Traders Built $1.21 Billion Worth of Ethereum Short

As of now, the derivative analytics platform Coinglass reveals that Ethereum’s major hurdle today stands at the $3,680 level, where traders have built $1.21 billion worth of short positions.

For upward momentum, the asset needs to clear this hurdle; if it does, Ethereum could quickly see an impressive price rally.