Key Takeaways

- Ethereum whales and smart traders added $97 million in ETH and opened 25x long positions worth $95 million.

- Price action suggests a reversal is possible only if ETH closes a daily candle above the $3,200 level; otherwise, a 13.65% dip could occur.

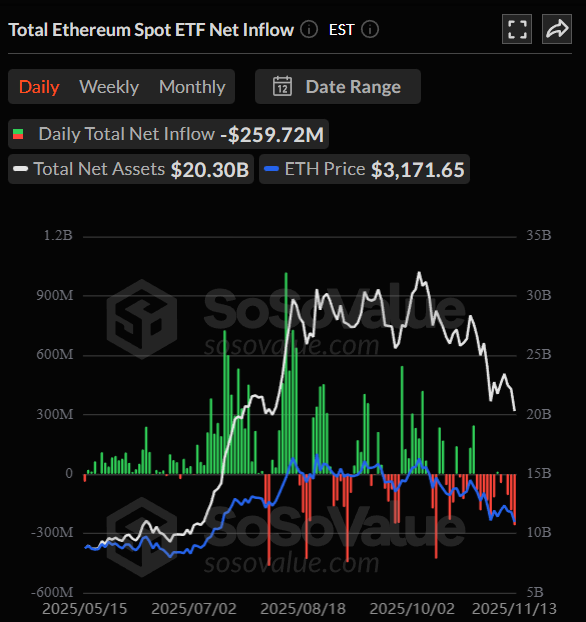

- US ETH spot ETFs recorded an outflow of $259.72 million, indicating fading interest from traditional investors in the asset.

Despite the rising fear of a market crash, Ethereum whales and smart traders have been showing strong interest and confidence in the asset. Today, crypto transaction tracker Onchain Lens shared multiple posts on X revealing how whales are accumulating ETH and placing significant bets on long positions.

Whale and Smart Trader Bullish Activity

According to the latest posts on X, Ethereum whales have purchased 30,895 ETH, worth $97 million, over the past 12 hours. The whales involved in these massive ETH purchases include Bitmine, 7 Siblings, and an unknown wallet.

In addition, smart traders have placed millions in ETH long positions. Onchain Lens revealed that two unknown smart traders continue building long positions despite the ETH price declining. A post on X showed that these traders have opened long positions worth $95 million in ETH with 25x leverage.

When combining the activity of these whales and smart traders, it shows strong confidence in the asset and a belief that the ETH price could rebound.

Current Price Momentum and Rising Trading Volume

According to the latest TradingView data, ETH is currently trading at $3,165, down 1.75%, marking its fifth consecutive day of decline. Despite the persistent drop, ETH’s trading volume has surged 42% to $53.50 billion.

This surge in trading volume suggests that market participants are focused on the asset’s downward movement, which is a bearish sign.

Also Read: Bitcoin (BTC) $100K Support Shattered; Read the Catalyst here!

Ethereum Price Action and Technical Analysis

Despite the bullish activity of whales and smart traders, Ethereum’s price action shows a bearish outlook and suggests a major dip may be on the horizon.

According to TimesCrypto’s technical analysis, ETH has broken down from a small consolidation on the daily chart, which had formed between the $3,200 and $3,700 levels. Following this breakdown, it is not yet clear whether today’s downward momentum will continue or if a rebound will occur, as it has in the past.

The current price action indicates that the downward momentum may continue only if ETH closes a daily candle below the $3,200 level. If this occurs, there is a strong possibility that the asset could drop over 13.65%, potentially reaching the $2,750 level.

On the other hand, a price reversal is possible only if ETH closes a daily candle above the $3,200 level.

However, the current Chaikin Money Flow (CMF) value of ETH stands at -0.17, indicating persistent selling pressure and weak capital inflows, as the CMF shows that more money is flowing out of the asset than coming in.

ETH ETF Continues Outflow

Ethereum’s bearish outlook has been further reinforced by US ETH spot ETFs, which recorded a massive outflow of $259.72 million, according to on-chain analytics platform SoSoValue.

This outflow suggests that traditional investors are significantly pulling back their capital from these funds, reflecting strong fear among investors.