Key Takeaways

- HBAR price appears to be on edge as the asset reaches a key resistance level, but today’s decline suggests a potential downside move may be on the horizon.

- Price action indicates that if HBAR fails to rally and break above the $0.20 level, it could experience a price dip of over 15%.

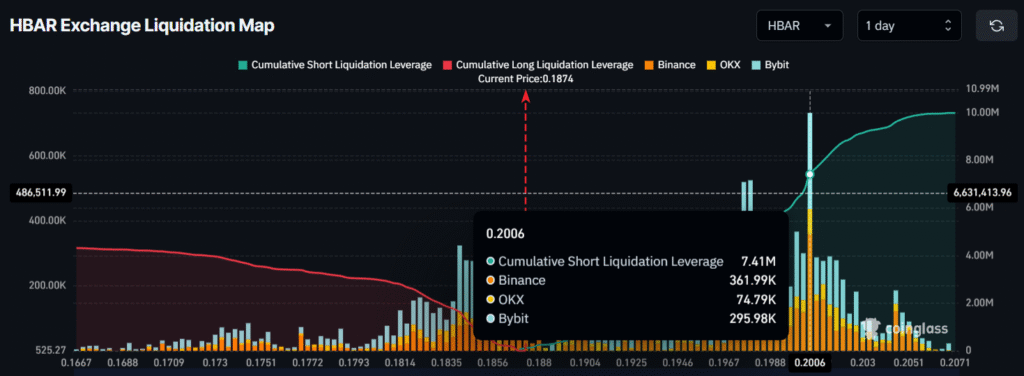

- Despite today’s price decline, traders remain bullish as they have built $7.41 million worth of short positions at $0.2006.

After yesterday’s gains, HBAR price reached a key resistance level, but today’s decline raises concerns about a potential repeat of past plunges. The market sentiment has once again shifted, with most cryptocurrencies, including Bitcoin (BTC) and Ethereum (ETH), in the red, reinforcing a bearish outlook.

HBAR Price Momentum and Rising Trading Volume

According to the latest TradingView data, the HBAR price is currently trading at $0.186, posting a 3.75% dip today. Despite the decline, market participants have shown strong interest in the asset, evident in the trading volume, which surged over 72% to $522 million.

Rising volume during a period of price decline suggests that traders and investors are focused on pushing the asset price lower, which is a bearish signal.

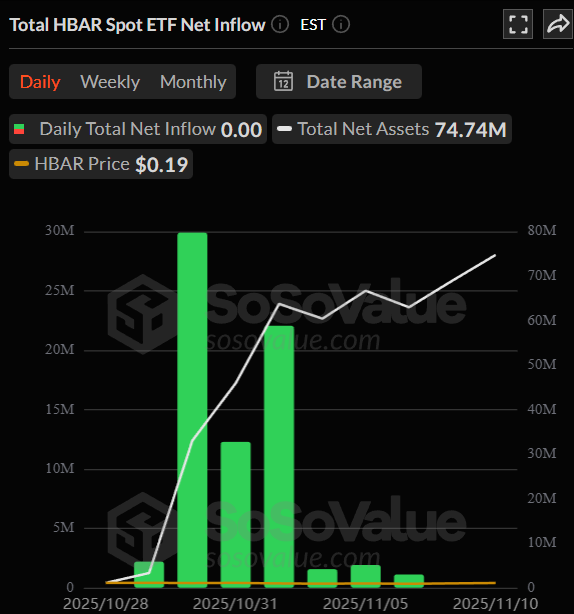

What is still giving investors hope for a potential HBAR price reversal is the persistent inflow into the HBAR spot ETF. According to data from the on-chain analytics platform SoSoValue, since the launch of the HBAR spot ETF by Canary Capital, American investors have shown strong interest in the asset.

HBAR Technical Outlook: Key Levels to Watch

According to TimesCrypto’s technical analysis, HBAR has been hovering within a descending channel pattern between its upper and lower boundaries since the beginning of November 2025. With today’s decline, the asset appears to be repeating its historical momentum, as it seems to be forming a bearish candlestick pattern near the upper boundary.

The current price action suggests that if today’s decline continues and HBAR fails to break out of the upper boundary of the descending channel pattern, the price could drop by over 15%, potentially reaching the $0.16 level. On the other hand, if momentum shifts and HBAR breaks above the upper boundary and closes a daily candle above $0.20, it could see a 25% price increase, potentially reaching the $0.25 level.

So far today, HBAR’s Chaikin Money Flow (CMF) value has reached the 0.08 level, indicating mild buying pressure and suggesting that capital inflows are slightly outweighing outflows in the market.

Whereas the Supertrend indicator continues to display a red trend above the asset’s price, indicating that HBAR remains in a downtrend with strong selling pressure.

Also read: Oman Steps Up Efforts To Grow Digital Economy, Targets 10% Of GDP Under Vision 2040

Experts’ Price Predictions

Despite the price bleeding, several bold predictions have recently surfaced on X. Some suggest that HBAR is poised to reach a new all-time high, citing $0.60 and $0.70 as potential targets. Meanwhile, others believe HBAR is preparing for a strong bullish breakout, which, if it occurs, could deliver a massive 70–80% rally similar to the previous one.

Traders’ Eyes on Potential Reversal

Given the current market sentiment, it appears that traders are following the same trend by heavily betting on the bearish side, according to derivatives platform Coinglass.

The latest Coinglass data shows HBAR’s major liquidation levels at $0.1841 on the lower side and $0.2006 on the upper side, where strong interest has been recorded. At these levels, traders have built $1.62 million in long positions and $7.41 million in short positions.

When combining traders’ bets with technical analysis, it appears that the current trend for the asset is bearish, and HBAR could repeat its historical pattern observed previously from the upper boundary of the descending channel.