Key Takeaways

- Solana (SOL) price action suggests a major crash could be possible if it loses the $155 level.

- Solana’s bearish outlook is developing even after persistent inflows into spot Solana ETFs.

- Today, exchanges recorded an outflow of $33.43 million worth of SOL, indicating potential accumulation amid the recent dip.

Solana (SOL)’s risk of crashing continues to rise, even amid continuous inflows into U.S.-based Exchange-Traded Funds (ETFs). Over the past seven trading days, SOL has lost 14% of its value. However, since reaching the key support level of $155, the price has been moving sideways.

Rising SOL ETF Demand in the United States

Despite the losing streak and downward momentum, spot Solana ETFs continue to register inflows, indicating investors’ confidence and interest in the asset. While this is a bullish sign, it has failed to lift the price.

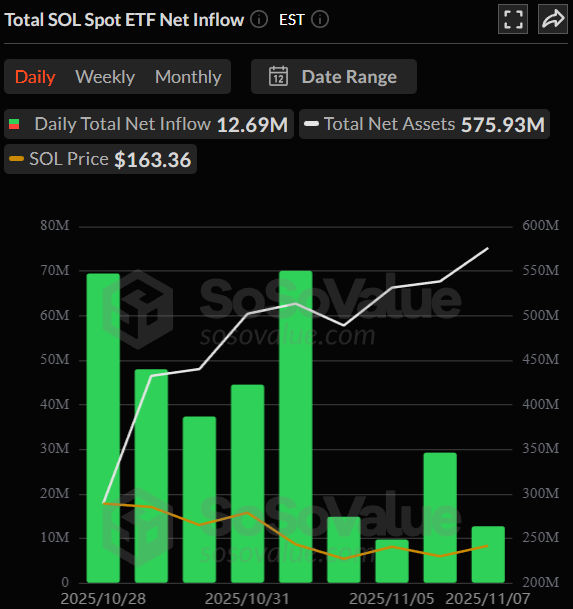

Currently, there are two SOL ETF issuers in the United States, the Bitwise Solana Staking ETF and the Grayscale Solana Trust, with ticker symbols BSOL and GSOL, respectively. So far today, SOL ETFs have recorded an inflow of $12.69 million.

However, since their launch, inflows have been steadily declining from $69.46 million to the current $12.69 million.

$33 Million of SOL Outflow

It’s not just American traditional investors showing interest in SOL — data from the derivatives platform Coinglass reveals that crypto participants are also drawn to the asset.

According to spot SOL inflow/outflow data, exchanges have continued to see outflows of the asset to wallets, which have grown to $33.43 million today. This indicates that investors have withdrawn $33.43 million worth of SOL from exchanges to unknown wallets, a bullish signal for the asset.

When combining these factors, both the ETF inflows and the outflows of the asset from exchanges to wallets appear to play an important role in stabilizing and holding SOL’s price above the key support level of $155.

SOL Current Price Momentum

Today, according to the latest TradingView data, SOL is trading at $161 and has recorded a slight price dip of 0.30%. However, participation from investors and traders during this period has increased, as evidenced by the trading volume, which has surged 19% to $6.65 billion.

Solana (SOL) Technical Outlook: Key Levels to Watch

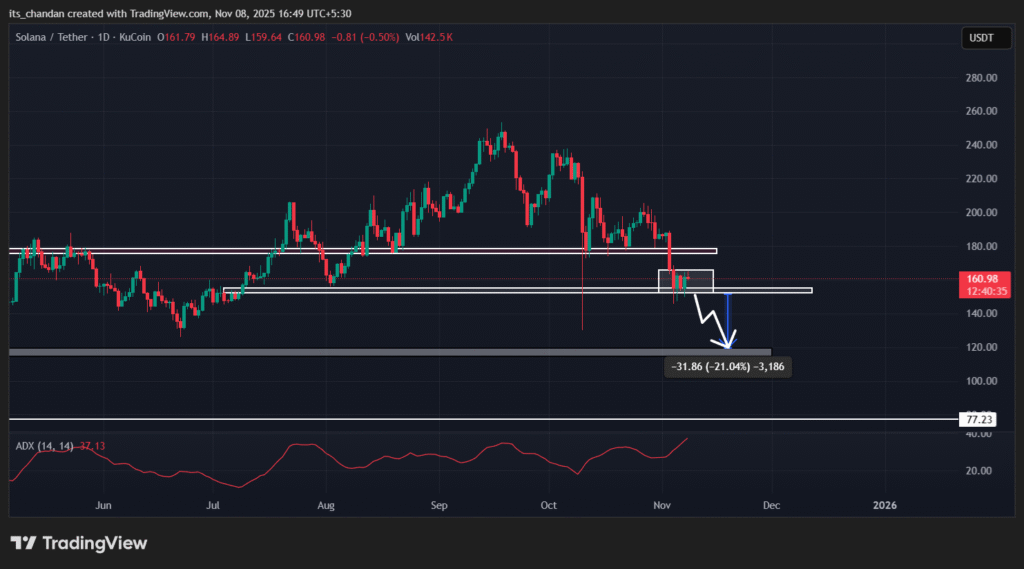

TimesCrypto’s technical analysis suggests that SOL’s broader market trend remains bearish, as the asset appears to be forming a higher-high and higher-low structure on the daily chart. However, for the past four trading days, the asset has been trading within a narrow consolidation range between $155 and $161.

This consolidation is occurring around the key support level of $155, which has a history of triggering price reversals — though it now appears to be weakening.

Based on the current price action, if SOL’s downtrend continues and the $155 level breaks, it could worsen the situation by opening the door for a further decline. If this occurs, SOL could experience a price drop of over 21% and potentially reach the $120 level in the future.

At press time, SOL’s Average Directional Index (ADX) stands at 37.13, which is above the key threshold of 25, indicating strong directional momentum in the asset.