Key Takeaways

- Worldcoin (WLD) defies the broader market with a 50% price jump.

- WLD’s upside rally follows the $250 million treasury strategy, bullish breakout, and strong on-chain metrics.

- Price action hints at a potential 61% rally if WLD sustains above the $1.42 level.

The bullish sentiment around Worldcoin (WLD) has pushed the asset to a new high, garnering massive attention from crypto enthusiasts. This is followed by Eightco’s $250 million treasury strategy, bullish on-chain metrics, and strong price action.

Eightco Selects Worldcoin (WLD) as $250 Million Treasury Reserve Asset

As per the recent report, Eightco Holding (NASDAQ; OCTO) has chosen Worldcoin (WLD) as its primary reserve for its $250 million treasury, followed by Ethereum as the secondary reserve.

This announcement propelled the WLD coin by 50%, triggering multiple breakouts, including a prolonged descending trendline.

Meanwhile, another catalyst driving this upside momentum is the $20 million contribution from Tom Lee and Bitmine to the $250 million treasury, alongside support from Kraken, Pantera, Coinfund, the World Foundation, and others.

Also Read: Is BTC Still in Mid-Bull Market? Read What Market Experts Predict!

WLD Price Rally With 335% Surge in Trading Volume

At press time, WLD price has reached the $1.55 mark, reflecting a 50% uptick over the past 24 hours. This rally has triggered record participation from investors and traders, resulting in a 335% surge in trading volume during the same period.

Rising trading volume along with the price indicates strong momentum in the asset, signaling a bullish outlook for token holders.

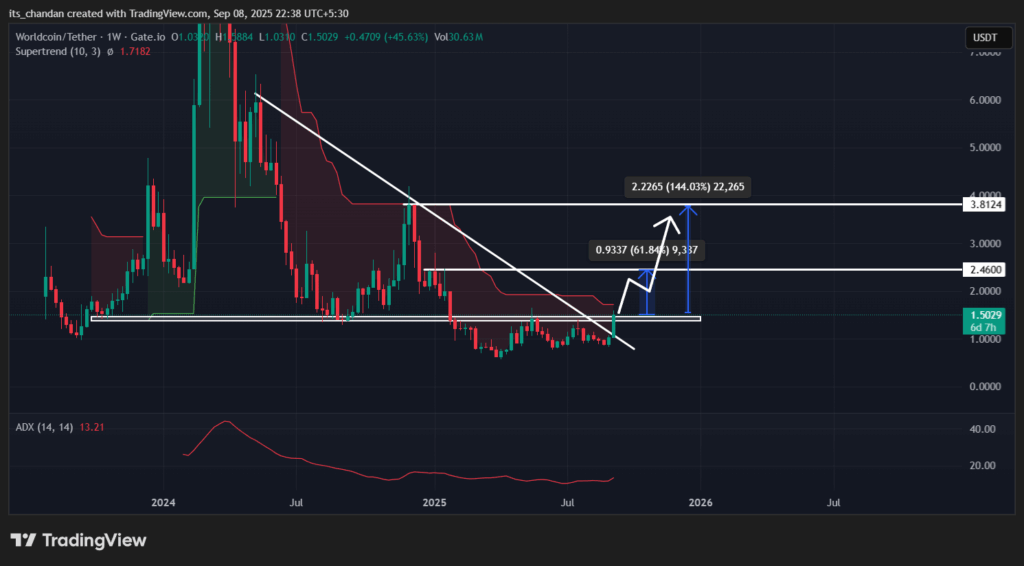

Worldcoin (WLD) Price Action and Key Upcoming Levels

TimesCrypto’s technical analysis reveals that the massive 50% price uptick has triggered a breakout from a prolonged descending trendline, along with the $1.42 resistance level. On the weekly chart, this breakout appears to have opened WLD’s path for a significant upside rally.

Based on the current price action, if WLD holds its gains and sustains above the $1.42 level, there is a strong possibility the asset could see another 61% jump, reaching the $2.46 level. Meanwhile, if the momentum continues, the price may test the next resistance near $3.81.

With the huge price gain, the WLD coin has also crossed the 50-day Exponential Moving Average (EMA) and turned it into a strong support level.

Whereas, the Average Directional Index (ADX) value of 13.20 suggests a weak trend, indicating that the current price momentum lacks strong directional strength.

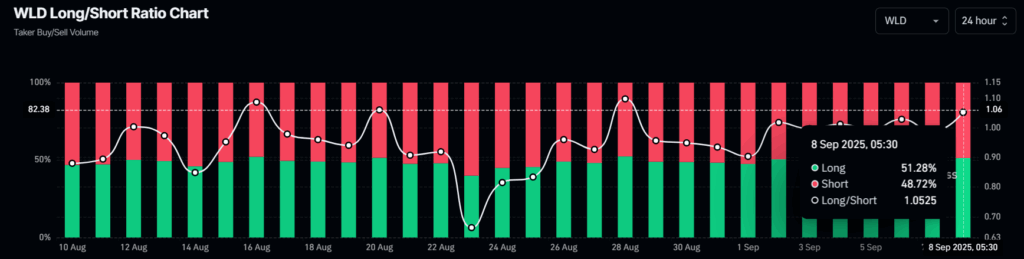

Traders Eye Long Positions Amid Bullish Sentiment

Despite the weak trend, traders’ interest and confidence in the asset have skyrocketed.

On-chain analytics platform Coinglass reveals that WLD’s Long/Short ratio has climbed above 1, currently standing at 1.05, indicating strong bullish sentiment among traders. In addition, the data shows that 51.28% of traders hold long positions, while 48.72% hold short positions.

Combining Eightco’s $250 million treasury announcement, institutional bets, the bullish breakout, and strong trader interest, sentiment appears to have turned positive with bulls dominating the asset.

However, a correction is still possible, and the rally can only continue if the price holds above the $1.42 level.