Key Takeaways

- Despite today’s 2.35% uptick, the XRP price remains under pressure as whale interest in the asset continues to fade.

- Experts reveal that over the past 72 hours, crypto giants have dumped more than 90 million tokens.

- Price action suggests that an XRP upside rally could only occur if it breaks above the $2.65 level; otherwise, it will continue to move sideways.

Today’s XRP rally seems to be under pressure as whales dump millions of tokens. According to on-chain data shared by a crypto expert via Santiment, whales holding between 1 million and 10 million XRP have offloaded nearly 90 million tokens in the past 72 hours.

Whales’ XRP Sell-off Soars

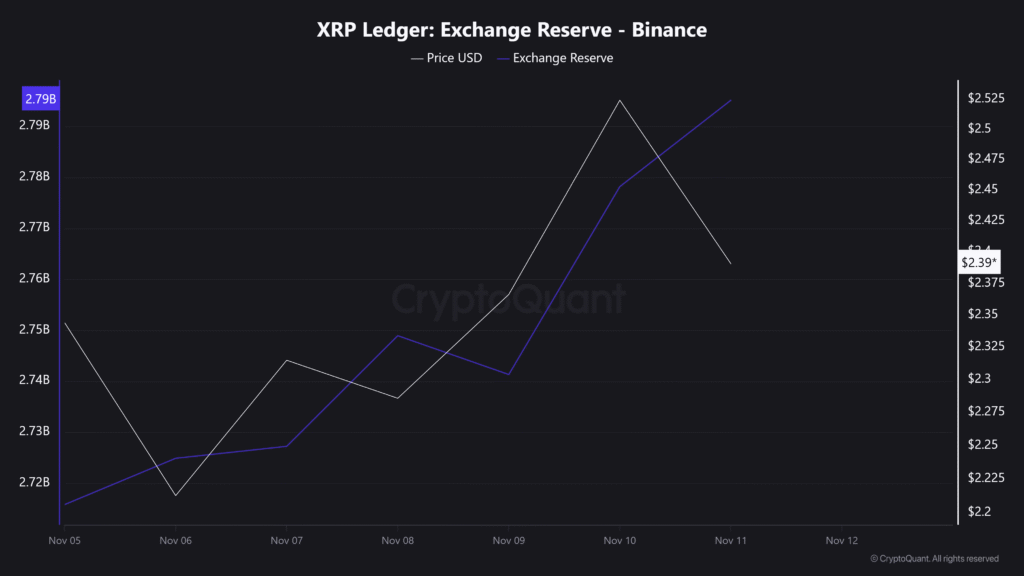

The post on X gained widespread attention from crypto enthusiasts, as it highlights whales’ fading interest in XRP tokens. Not just Santiment, but another on-chain analytics platform, CryptoQuant, has revealed a similar trend, further reinforcing this declining interest among XRP participants.

According to the latest data, XRP’s exchange reserves on Binance have continued to rise over the past week, with more than 8 million tokens moving into the exchange. This suggests that investors are transferring their XRP holdings from wallets to Binance — typically a sign of a sell-off and a bearish indicator for the asset’s price.

Current Price Momentum

Despite bearish on-chain metrics, the XRP price continues to rise today, as shown by TradingView data. The asset has surged 2.35% and is currently trading around the $2.44 level. However, despite the price increase, market participants appear less interested in the asset, as XRP’s trading volume has dropped by 32% to $4.12 billion.

In the crypto landscape, when prices rise while trading volume falls, it indicates that investors and traders are not supporting the upward rally. Such a situation can often lead to a trend reversal if the condition persists.

Also Read: Why Is Crypto Going Up Today? BTC, ETH, and XRP Lead Rally!

XRP Price Action and Technical Analysis

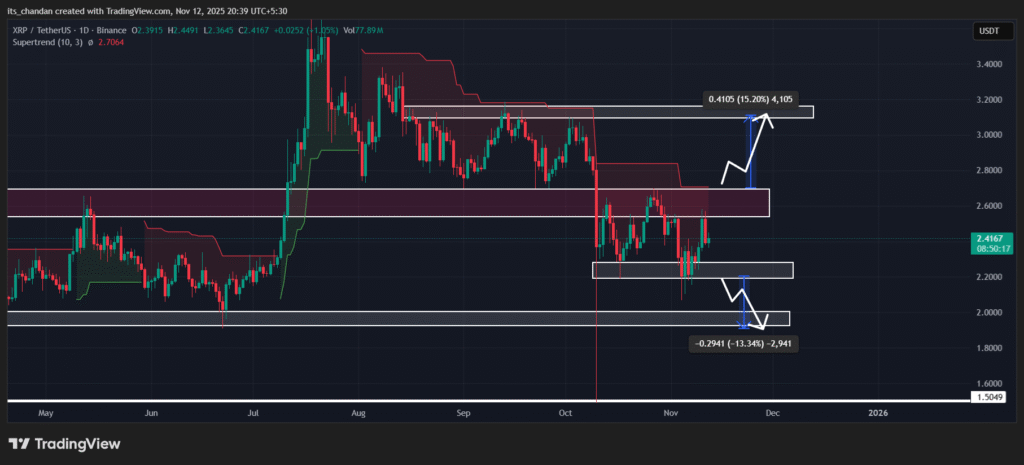

TimesCrypto’s technical analysis on the daily chart reveals that the XRP price is in a downtrend. The chart further shows that the asset continues to trade within a prolonged consolidation range between $2.20 and $2.65.

Based on the current price action, an XRP rally could only occur if the asset breaks out of its consolidation range. If the price clears the upper boundary and closes a daily candle above the $2.65 level, it could soar by 15% to reach the $3.10 mark. On the other hand, if momentum fades and the price breaks below the lower boundary with a daily close under $2.185, XRP could decline another 13%, potentially dropping to the key support level of $1.90.

As of now, XRP’s Supertrend indicator remains red and is positioned above the asset’s price, suggesting that XRP is in a downtrend with strong selling pressure, as evident from on-chain data.

When combining whale activity with the price action, it appears that despite XRP’s price rise, it is still under pressure, a condition that could only be relieved if it breaks above its consolidation’s upper boundary.