Key Takeaways

- Following its Robinhood listing, Hyperliquid (HYPE) turned bullish, breaking through multiple resistance levels and opening the door for a potential rally.

- Price action suggests that HYPE is poised for a 20% price uptick if it holds above the $38.30 level.

- Hyperliquid’s multi-million-dollar daily HYPE buybacks and traders’ strong bullish bets have further strengthened the asset’s bullish outlook.

Hyperliquid (HYPE)’s debut on the Robinhood cryptocurrency exchange has strengthened the asset’s bullish outlook, opening the door for further upward momentum. This bullish sentiment is driven not only by the Robinhood listing but also by a recent breakout, a shift in market sentiment, millions in buybacks, and aggressive buying activity by market participants over the past week.

Current Price Momentum

Today, HYPE continued its upward momentum by posting a 3.95% price gain, according to TradingView data. The asset is currently trading at $41.25; however, investors and traders have shown less interest, as evidenced by its trading volume, which has plunged by 33% to $261.45 million, according to CoinMarketCap data.

Hyperliquid (HYPE) Price Action and Technical Analysis

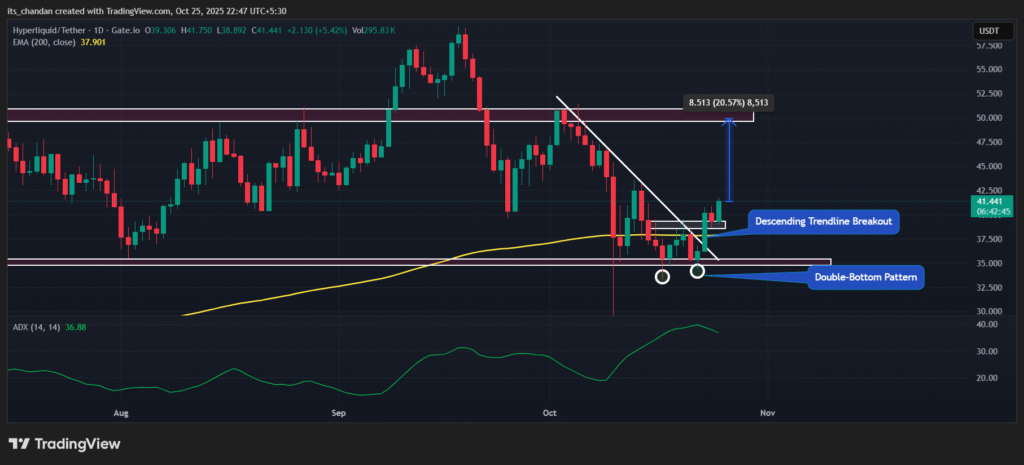

Despite lower market participation, HYPE continues to display strong bullish price action. According to TradingView, the asset has surged over 18% between October 22 and October 25.

During this period, the rally triggered multiple breakouts, including a descending trendline that had held since October 3, 2025, and a bullish double-bottom pattern. Additionally, HYPE has successfully retested the pattern’s neckline while also breaking above the previous two days’ highs.

Based on the current price action, if HYPE’s upward momentum continues and the asset holds above the $38.30 level, it could soar by 20% to reach the $50 level. However, this bullish thesis remains valid only as long as HYPE holds above $38.30; otherwise, it could be invalidated.

At press time, the asset’s Average Directional Index (ADX) value stands at 36.88, indicating strong directional momentum. The ADX measures the strength of an asset’s trend — a value below 25 suggests weak momentum, while a value above 25 indicates strong directional movement.

Meanwhile, the recent price surge has pushed HYPE’s price above the 200-day Exponential Moving Average (EMA), indicating that the asset is currently in an uptrend.

HYPE Buyback Details

This bullish outlook has been further strengthened by Hyperliquid’s multi-million-dollar HYPE buybacks.

Recently, a well-followed crypto expert shared a post on X, noting that yesterday Hyperliquid purchased $2.01 million worth of HYPE at an average price of $39.77.

Moreover, over the past week and the past 30 days, the protocol has conducted buybacks totaling $19.81 million and $105.19 million worth of HYPE, respectively.

HYPE’s Major Liquidation Levels

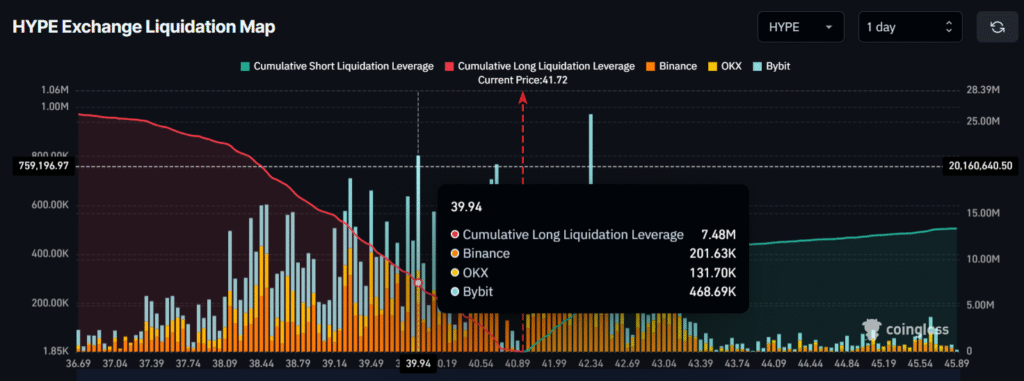

Given the current market sentiment, it appears that traders are following the trend by betting heavily on long positions.

Today, derivatives data platform Coinglass revealed that HYPE’s major liquidation levels currently stand at $39.94 on the lower side and $42.34 on the upper side. At these levels, traders are over-leveraged, having built $7.48 million worth of long positions and $4.65 million worth of short positions.

Combining these metrics with technical analysis, token buybacks, and the recent listing, it appears that HYPE holds a strong bullish outlook in both the short and long term.