Key Takeaways

- Hyperliquid (HYPE) short-term price action signals a potential 11% correction until it retests the breakout level of $49.75.

- Digital Asset Treasuries (DAT) have added 18.43 million HYPE tokens, equivalent to 6.811% of the circulating supply.

- HYPE’s major liquidation levels are at $54.97 on the lower side and $59.89 on the upper side.

Despite the ongoing market correction, bullish sentiment around Hyperliquid (HYPE) is heating up. Thanks to Digital Asset Treasuries (DAT), which appears to be accumulating HYPE tokens.

Hyperliquid (HYPE) Shows Strong Bullish Fundamentals

Recently, crypto analytics tool DeFiLlama shared a post on X (formerly Twitter) stating that a total of 18.43 million HYPE tokens have been accumulated by DAT. With this accumulation, these treasuries now own 6.811% of HYPE’s circulating supply.

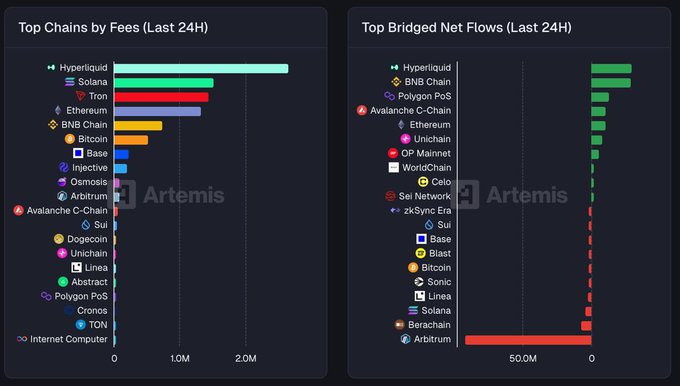

Adding to the bullish sentiment, a crypto expert recently shared the Artemis report, which has garnered massive attention from crypto enthusiasts.

In a post on X, the expert shared data on network fees and bridged net flows, showing that Hyperliquid (HYPE) outperformed giants like Solana, Tron, Ethereum, and even the BNB Chain by securing the top spot in both metrics.

These metrics highlight that HYPE is currently leading in terms of user activity, resulting in the highest collection of fees compared to other chains. In addition, it also leads in net inflows of assets bridged into the chain, indicating growing demand and more capital flowing into Hyperliquid than out of it.

The combination of high user activity and capital inflows from multiple chains positions HYPE as one of the strongest coins in the crypto market right now.

Current Price Momentum and Market Activity

Despite the overall bullish outlook, HYPE price is witnessing a correction. Over the past 24 hours, it has slipped 3.10% and is currently trading near $56.08.

During the same period, traders and investors also appear to be showing less interest in pushing the price lower, as trading volume has declined by 25% compared to the previous day.

HYPE Price Action: Potential Correction Ahead

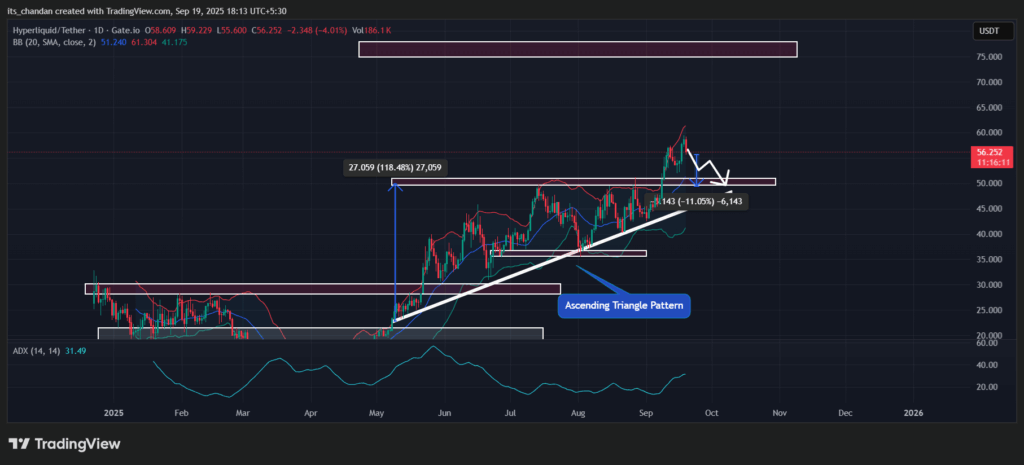

TimesCrypto technical analysis reveals that HYPE is in an uptrend, but a potential correction is on the horizon.

This follows a strong upside rally in recent days without a proper retest of the breakout level. In addition, HYPE’s Bollinger Bands have broadened, and the price is hovering at the upper boundary, suggesting the asset is in an overbought condition and may potentially face a correction.

On the daily chart, HYPE appears to be forming a bearish engulfing candlestick pattern. Based on the current price action, if the asset fails to close the daily candle above the $59.40 level, there is a strong possibility that it could see a price dip of 11%, potentially reaching the breakout level of $49.75 for a retest.

At press, the Average Directional Index (ADX) value has reached 31.50, indicating that HYPE is in a strong downtrend, with the price likely to continue declining in the near term.

Traders’ Bearish Sentiment Signals Short-Term Pressure

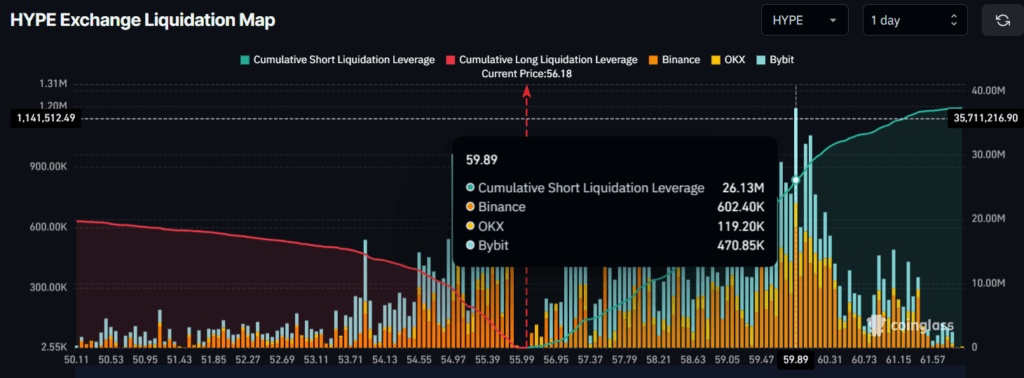

Given the current market sentiment, traders seem to be following a bearish trend. According to the on-chain analytics tool Coinglass, HYPE’s major liquidation levels are at $54.97 on the lower side and $59.89 on the upper side, attracting strong trader interest.

At these levels, traders have built $9.10 million worth of long positions and $26.13 million worth of short positions. This metric highlights that the current market sentiment for HYPE is bearish, but the long-term outlook remains bullish.