Key Takeaways

- A Dogecoin whale dumped 160 million DOGE amid market uncertainty, and bets on short positions continue to rise, hinting at growing panic among market participants.

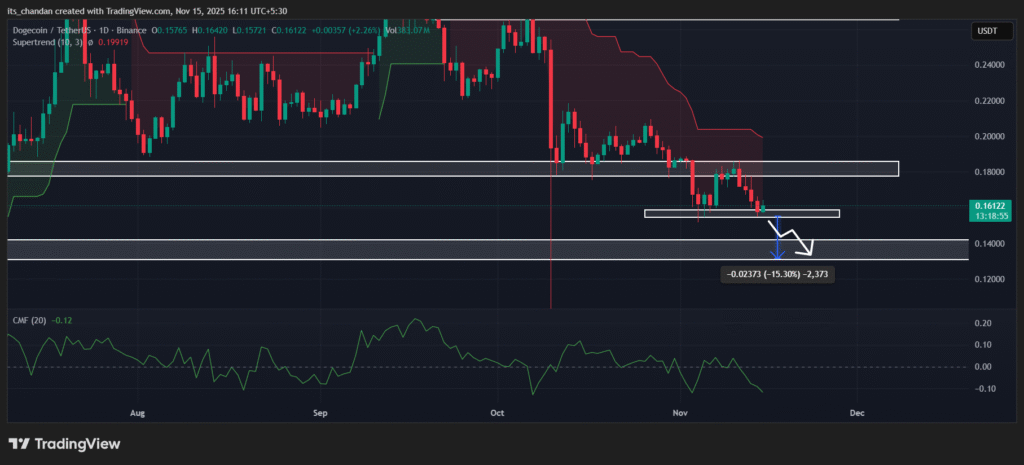

- Price action suggests that if the DOGE price fails to hold the $0.155 support level, it could see another 15.30% decline and may drop to the $0.13 level.

- Traders are heavily betting on short positions, having opened $29.06 million worth of shorts at $0.1664, hoping the price won’t cross this level anytime soon.

The crypto market is bleeding, and Dogecoin whales appear to be fueling the downward momentum. Recently, data shows that whale interest in the DOGE is fading, which explains today’s massive hundred-million-token dump.

Dogecoin Whale Dump 160M DOGE

Recently, a blockchain-based transaction tracker, Whale Alert, revealed that an unknown wallet has offloaded 160 million DOGE that worth $25.42 million, sending it directly to the Robinhood exchange.

This significant dump was recorded when DOGE was hovering at a local support level of $0.155, not only weakening that support but also suggesting that Dogecoin investors are panicking, and that the meme coin’s bleeding could continue in the coming days.

Current Price Momentum

As of press time, DOGE is trading at $0.161, showing a 2.35% price uptick after four consecutive days of bleeding. Despite today’s rise, market participation continues to decline, with trading volume falling another 23% to $2.48 billion.

Also Read: Cardano (ADA) Print Bullish Divergence, Can Bull Defend $0.50 Support?

Dogecoin (DOGE) Technical Outlook: Key Levels to Watch

TimesCrypto’s technical analysis reveals that DOGE is in a downtrend and may continue its decline in the coming days following the recent breakdown of the key support at the $0.18 level.

The support it is currently receiving appears to be local, with limited historical significance. According to the daily chart, when DOGE previously reached this level, it briefly struggled before rebounding notably, only to fall again and return to today’s price zone.

Today, selling pressure appears to have intensified, and if the DOGE price fails to hold this local support at the $0.155 level, it could see a further 15.30% decline and may drop to the $0.13 level in the coming days.

As of now, both technical indicators, including CMF (Chaikin Money Flow) and Supertrend, are strengthening the meme coin’s bearish outlook.

On the daily chart, the CMF value has reached the -0.12 level, indicating increasing selling pressure and fading buying interest in the market. Meanwhile, the Supertrend indicator continues to hold a red trend above the meme coin’s price, suggesting that DOGE remains in a downtrend with strong selling pressure.

Traders’ Short Bets on DOGE Soar

Given the current price action, it appears that traders are following the bearish trend, as bets on short positions continue to rise.

Derivatives data from Coinglass reveals that today’s major DOGE liquidation levels stand at $0.159 and $0.1664 on the lower and upper sides, respectively. These levels also act as key support and resistance zones.

Based on the derivative data, traders at these levels have built $7.87 million worth of long positions and $29.06 million worth of short positions. This clearly shows that bears are currently dominating the asset, with strong conviction that the DOGE price won’t cross the $0.1664 level anytime soon.

Combining whale activity with derivative data, it appears that both the long-term and short-term sentiment for DOGE is bearish.