Key Takeaways

- SharpLink offloaded 10,975 ETH, worth $33.54 million, to Galaxy Digital as the company’s unrealized losses soared to $443 million.

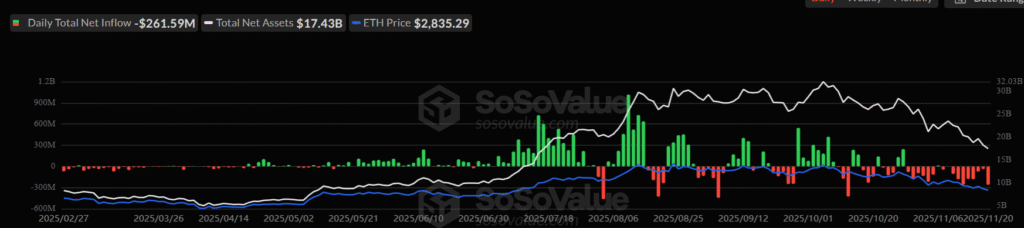

- US Ethereum Spot ETFs have registered a record outflow for eight consecutive days, hinting at fading interest from traditional investors in the fund.

- Ethereum price tanks 4.35%, reaching a key support of $2,715, a make-or-break point for holders.

With Ethereum (ETH) prices falling, SharpLink has dumped its ETH holdings for the second consecutive day. The move comes amid persistent ETF outflows, rising unrealized losses, and overall bearish market sentiment.

For context, SharpLink (Nasdaq: SBET) is a publicly listed gaming firm and the first company to use Ethereum (ETH) as its primary reserve asset.

SharpLink’s $33.5M Ethereum Dump

On November 20, blockchain-based crypto tracker Onchain Lens shared a post on X revealing that SharpLink deposited a massive 10,975 ETH, worth $33.54 million, to the OTC exchange Galaxy Digital over two separate transactions of 5,533 ETH and 5,442 ETH.

The transfers by SharpLink come as the ETH price has tanked 22% so far in November 2025, following a surge in its unrealized losses. It seems the company might be offloading its ETH holdings to reduce these losses.

SharpLink Faces $443M Unrealized Losses

According to the on-chain analytics platform CryptoQuant, SharpLink’s unrealized losses have soared to $443.7 million amid the declining ETH price. Data shows that the firm’s average buying price for Ethereum is $3,609, which it purchased a month ago, and it has not added any ETH since then.

Currently, Ethereum is trading at $2,715, down 4.35% today, but traders and investors have shown strong interest amid this situation, as reflected in the trading volume, which jumped 55% to $59.16 billion.

U.S. Ethereum Spot ETFs See 8 Days of Outflows

In addition to the unrealized losses and falling asset price, another key factor driving SharpLink’s ETH sell-off is the continuous outflow from U.S. Ethereum Spot ETFs. According to SoSoValue, Ethereum Spot ETFs recorded eight consecutive days of outflows, indicating waning interest and growing fear among traditional investors as they continue to withdraw capital from these funds.

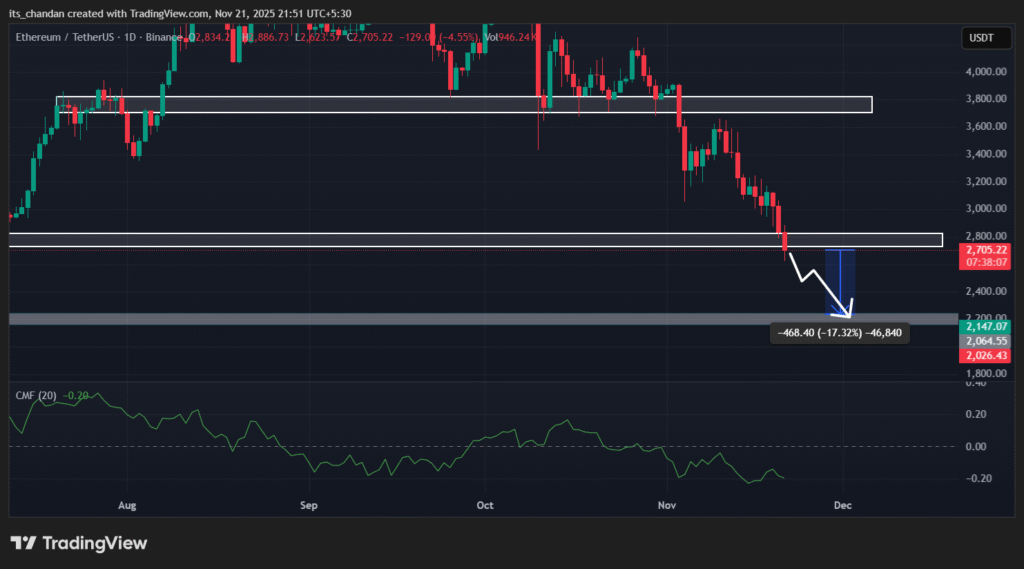

Ethereum (ETH) Technical Outlook: Key Levels to Watch

On the daily chart, the Ethereum price is in a continuous downtrend in the short term, and today’s 4.35% dip has pushed the asset near a key support level of $2,715.

Current price action indicates that if the downside momentum continues and ETH breaks this support, it could trigger the liquidation of millions of dollars’ worth of long positions, ending the bulls’ dominance and opening the door for sellers.

Meanwhile, the Chaikin Money Flow (CMF) value has reached -0.20, indicating sustained selling pressure in the market as outflows outweigh inflows.