Key Takeaways

- The crypto giant’s recent $10.54 million Uniswap (UNI) offload appears to be fading the asset’s bull run.

- Price action suggests that a further UNI rally could only be possible if it clears the $10.15 level; otherwise, it may continue to struggle.

- Technical outlook indicates that UNI is in an uptrend, but if it fails to break above the $10.15 level, it could face a price dip of over 21.50%.

Uniswap (UNI) bull run seems to be fading. Over the past seven days, the asset has gained over 115%, breaking through multiple hurdles, including a descending trendline and key horizontal resistance levels. However, the price now appears to be entering a correction phase.

Whale Dump $10.5 Million of Uniswap (UNI)

Amid the ongoing correction, on-chain analytics platform Onchain Lens shared a post on X revealing that a crypto giant wallet address “0x4c64” has dumped 1.19 million UNI tokens, worth $10.54 million, into Binance. Despite UNI’s significant bull run over the past week, this whale booked a loss of $914,000.

The post further revealed that this wallet had accumulated these UNI tokens for $11.54 million between February and October 2025. It appears that the whale has taken advantage of UNI’s recent price uptick to offload holdings that were accumulated over a longer period.

Looking at this massive dump, it appears that not only is the current market sentiment responsible for today’s UNI decline, but the crypto giant’s multi-million token sell-off also played an important role in it.

UNI Current Price Momentum

At press time, Uniswap (UNI) is trading at $8.72, showing a price dip of over 7.10%, according to TradingView data. During the Asian trading session, the asset reached an intraday high of $10.29 but failed to sustain that level.

Despite UNI’s price decline, the market has seen significant participation from traders and investors, as reflected in the trading volume. CoinMarketCap data reveals that over the past 24 hours, the asset’s trading volume has surged by 730% to $3.87 billion.

Now, the question is whether UNI’s price will bounce back or continue to dip further.

Also Read: Bitcoin Slips to $104K, but Gold Tops $4,100 on Fading Risk Appetite

Uniswap Technical Outlook: Key Levels to Watch

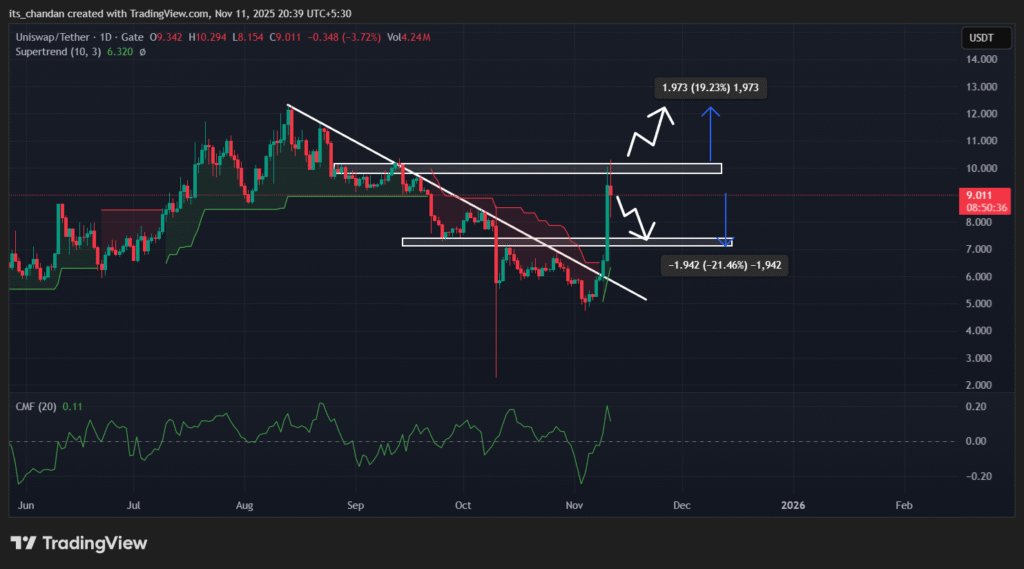

According to TimesCrypto’s technical analysis, UNI is in an uptrend on the daily chart, having broken out of a descending trendline along with a key resistance level at $7.20.

However, yesterday’s rally pushed the asset toward another resistance level at $10.10, which it failed to breach, indicating that UNI is currently experiencing selling pressure.

The current price action suggests that if the asset’s price continues to decline and remains below the $10.15 level, it could experience another 21.50% dip, potentially reaching the $7.20 level.

Conversely, a UNI upside rally could only occur if it breaks above the key resistance level of $10.10. If it does and closes a daily candle above $10.15, the price could soar by 20%, potentially reaching $12.30 in the coming days.

At press time, UNI’s Chaikin Money Flow (CMF) value stands at 0.11, indicating strong buying pressure and increasing capital inflows into the asset. Meanwhile, the Super trend indicator has turned green and moved below the asset’s price, suggesting that UNI is currently in an uptrend.

When combining the recent whale dump with the current price momentum, it appears that short-term sentiment remains quite challenging for UNI, as the asset has posted massive gains in recent days. There is also a high possibility of further profit-taking, which could trouble its upward momentum.