Key Takeaways

- Wintermute’s $4.1M AAVE withdrawal from Kraken on Nov 24 signals renewed institutional confidence in the token.

- AAVE recorded its fourth straight gain today, up 0.65% at $179.20, while trading volume jumped 55%.

- Short-term traders are over-leveraged at $174.4 on the lower side and $181.6 on the upper side.

On Tuesday, a prominent market maker, Wintermute withdrew 24,124 AAVE, worth $4.1 million, from Kraken, the move catching the market attention. The strategic move indicates returning institutional confidence in the token.

Generally, token withdrawals from exchanges to wallets means potential accumulation, which is a sign of long-term holdings.

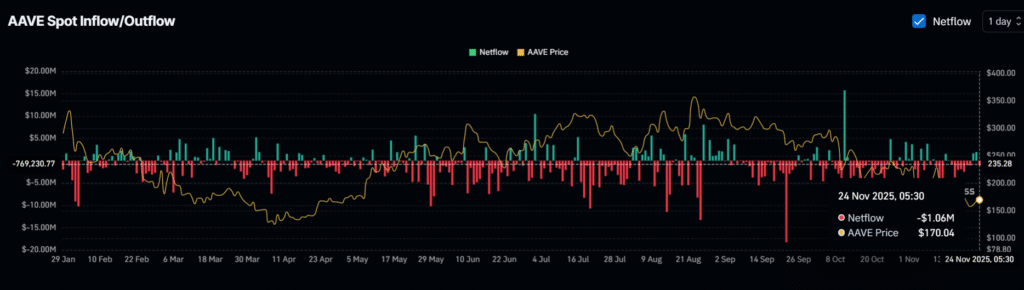

Further, Coinglass’s AAVE Spot Inflow/Outflow—a tool that tracks the movement of tokens into and out of exchanges. According to the latest data, nearly $1.6 million worth of AAVE has been withdrawn from exchanges over the past 24 hours, indicating potential accumulation.

Spot inflows mean tokens moving from wallets to exchanges, highlighting potential sell-offs. Whereas outflows, represents tokens moving from exchanges to wallets, indicating accumulation for a longer period of time.

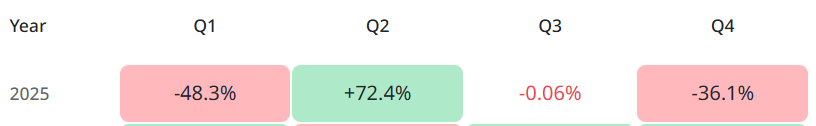

Aave price trades at $178.26, down 0.10% for the day at the time of writing. The token fell 23.5% in November 2025 and 36.1% in Q4, according to CryptoRank data. This timing of the strategic move coincides with the recovery in prices from the low of $147.39 made on Friday.

Also Read: Bitcoin Nears $86K, Gold Grinds on Mixed Fed, Geopolitical News

AAVE Bulls Attempt to Bring Lower High on Chart

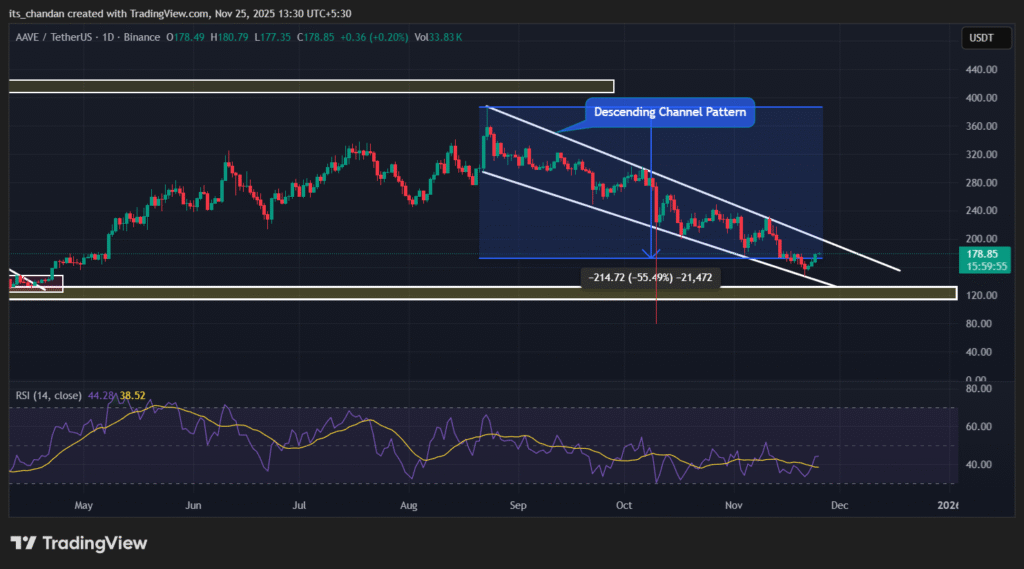

Even with consecutive gains, AAVE’s broader market structure on the daily chart still points to a downtrend. The token has been trading within a descending channel pattern since August 2025 and has lost over 55% of its value during that period, oscillating between the upper and lower boundaries while forming lower highs and lower lows.

On November 21, 2025, AAVE successfully retested the lower boundary of the descending channel and formed a lower low. Since then, it has been trending upward and now appears poised to form another lower high — similar to previous price behavior visible on the daily chart.

Since August 23, 2025, every time the price reached the lower boundary of the descending channel, it recorded a slight rebound after the retest — a pattern AAVE has repeated over the past three trading sessions.

The Relative Strength Index (RSI) is a momentum indicator that ranges from 0 to 100 and signals whether an asset is overbought or oversold.

An RSI above 70 typically indicates overbought conditions, suggesting a potential price pullback, while an RSI below 30 indicates oversold conditions, signaling a possible price rebound.

In the current scenario, AAVE’s RSI reaches 44.44 and is moving above the average, suggesting that the asset is gaining momentum and gradually recovering from an oversold area.

Long Traders Dominate on Exchange

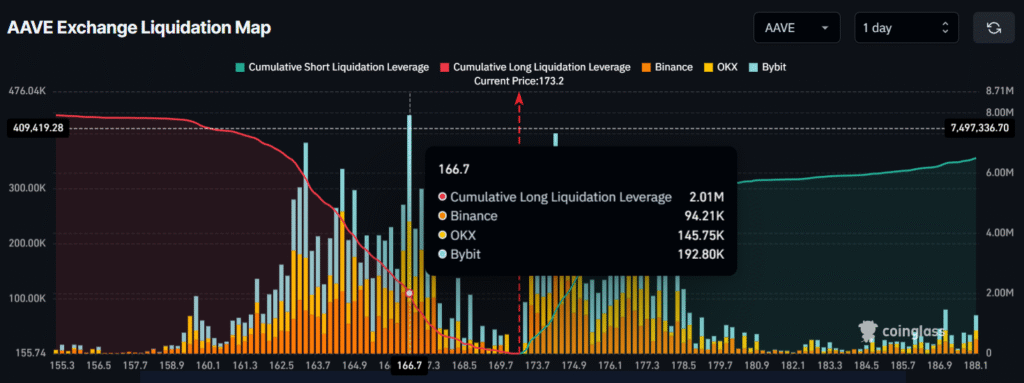

On-chain analytics platform Coinglass indicates that short-term sentiment has been tracking the current price momentum, as the token recorded a notable gain today.

The AAVE Exchange Liquidation Map—highlighting traders’ positions and potential long/short liquidations, and offering a clear view of leveraged market activity—shows that traders are currently over-leveraged at $174.4 on the lower side and $181.6 on the upper side.

In addition, the tool shows that traders at these levels have built $3.32 million worth of long positions and $842.16k worth of short positions.

According to the data, if the price moves in either direction and reaches certain levels, these positions could be liquidated. So far, it appears that bullish bets outweigh bearish ones.