Apollo Global Management (“Apollo“) is making a major bet in their investment strategy to include part of the emerging decentralized finance (DeFi) market. According to a post issued by the Morpho Association, Apollo, with a total of USD 938 billion of assets under management (AUM), has entered into a non-binding cooperation agreement with Morpho to purchase, for up to 90 million in total MORPHO tokens (9% of the total supply), over the next 48 months. Following this announcement, MORPHO token prices immediately surged by 16% to near-term resistance at USD 1.42.

Apollo’s Token Play

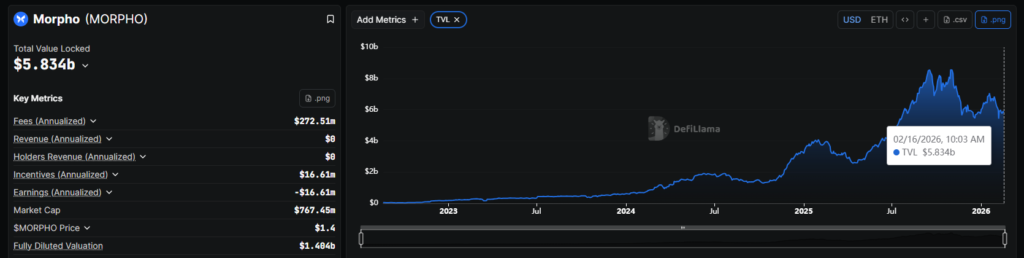

The cooperation agreement provides a framework on which Apollo can accumulate MORPHO tokens through the open market, over-the-counter (OTC) transactions, or other arrangements while adhering to certain transfer restrictions and an ownership cap. Not only did Apollo acquire MORPHO tokens, but both organizations will work together to develop onchain lending markets using the Morpho technology; the total value locked in Morpho’s DeFi protocol is approximately USD 5.8 billion, representing the sixth highest of all DeFi protocols.

Galaxy Digital UK acted as exclusive financial adviser to the Morpho Association for this collaboration. This is Apollo’s second major step toward building up its investment presence in the DeFi market; they formed a partnership with Coinbase in 2025 to establish stablecoin-based credit strategies, as well as made some investments in tokenization projects to create real-world assets (RWAs).

Technical Indicators Support Fundamental Data

The announcement created a confluence of long-sided signals. MORPHO’s open interest increased by 25.99%, to USD 29.80 million (now over USD 27 million), while its trading volume totaled USD 41.25 million; both high levels point to increasing participation. The ОI-Weighted Fоunding Ratio moved up to positive territory, approximately 0.005%, indicating that buyers are becoming increasingly committed to long positions.

Morpho Price Overview

From a technical case point of view, MORPHO created a second bottom after successfully defending a USD 1.08 demand zone on two occasions, reclaiming the USD 1.42 neckline with conviction.

The structural completion of these two bases aligns with a larger rotation of capital as measured by the CMC Altcoin Season Index, which surged 50% in just one week to 31 at the time of writing.