Key Takeaways

- Ondo Finance (ONDO) has reached a key resistance level with a history of strong reversals.

- Price action suggests a 38% rally could be possible if ONDO clears the $1.15 level; otherwise, a 20% drop may occur.

- Exchanges recorded a historic $18.05 million worth of ONDO outflow over the past 48 hours.

Ondo Finance (ONDO) is poised for a bullish wave, supported by current sentiment, positive on-chain data, price action, and experts’ bold predictions. However, this optimism emerges as prices hover at a make-or-break level.

ONDO on the Edge: History or Breakout Ahead?

At press time, ONDO is trading near a key resistance level of $1.08, recording a modest decline of 0.40% over the past 24 hours. This dip ends a five-day bullish streak that saw a 22% rally. The price drop also dampened investor and trader participation, with trading volume falling 45% compared to the previous day.

The potential reason for the price dip is the current level of $1.125, which has a history of strong reversals. Since March 2025, ONDO has reached this level more than four times, and each time it has faced selling pressure and downside momentum.

Also Read: 21Shares Bets Big on RWA With First-Ever ONDO ETF Filing

ONDO Technicals Hint at Next Big Move

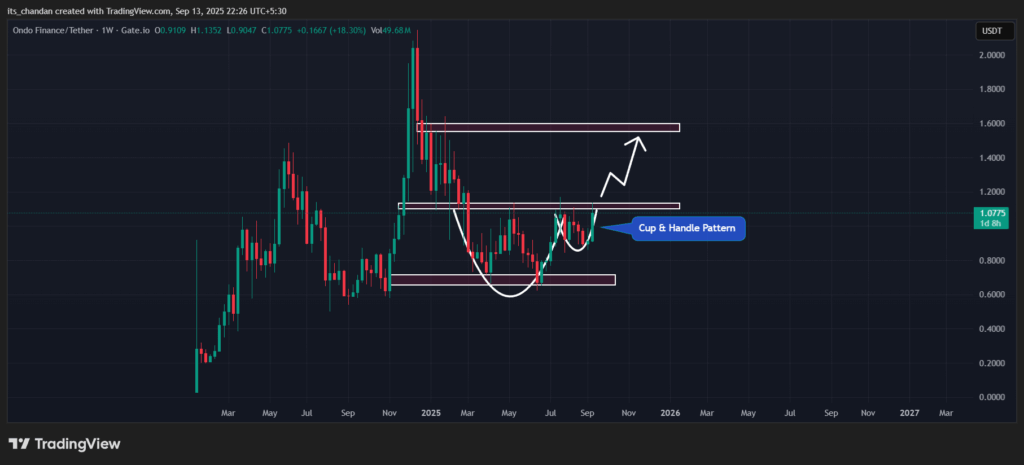

Additionally, on the weekly chart, ONDO appears to have formed a bullish Cup and Handle pattern, with the price hovering near the neckline.

TimesCrypto’s analysis indicates that if ONDO breaks this neckline and closes a daily or weekly candle above $1.15, a strong 38% price uptick could be possible, potentially reaching the $1.60 level. On the other hand, if ONDO forms a bearish candlestick pattern near this level, there is a strong possibility that history could repeat itself, and the price may decline by 20%.

At press time, technical indicators Supertrend and the Relative Strength Index (RSI) hint at a bullish signal.

Currently, the Supertrend remains green and hovers below the asset price, indicating that ONDO is in an uptrend with strong buying pressure. Meanwhile, the RSI has reached 65, suggesting that ONDO still has enough room to continue its bullish streak before entering the overbought territory.

In addition to the bullish price action, a prominent crypto expert shared a bold prediction on X, noting that if ONDO clears the $1.20 level, the next target could be $1.70. Moreover, several other predictions have surfaced on X, with some suggesting that ONDO’s next targets could be $2, $3, or even $7.

On-Chain Data Signals Mixed Sentiment

Despite the price dip at a key level, investors and long-term holders have shown strong interest in the asset.

Coinglass, an on-chain analytics tool, shows that exchanges have recorded the largest ONDO outflow worth $18.05 million over the past 48 hours. This substantial token outflow suggests continued investor interest, indicating that history may not repeat itself this time.

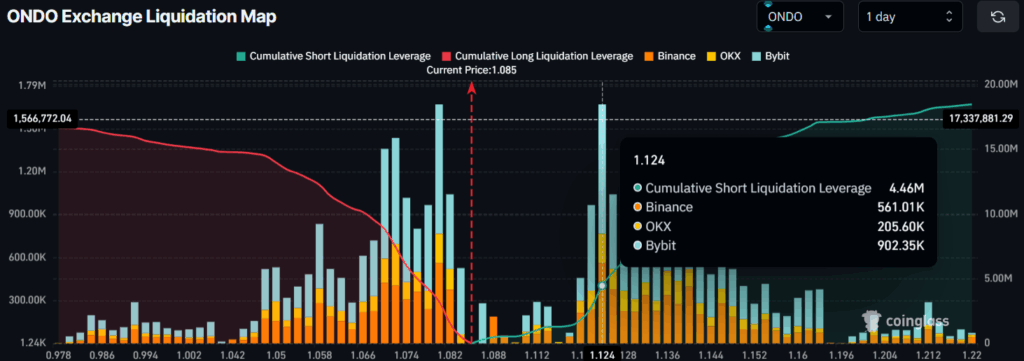

Meanwhile, traders seem to be following the current trend, as bets on short positions soar. Currently, ONDO’s major liquidation levels are at $1.08 on the lower side and $1.124 on the upper side, where traders are over-leveraged, holding $3.24 million in long positions and $4.46 million in short positions.

These on-chain metrics suggest a possible short-term correction before a breakout and significant price surge.