Consecutive inflows into XRP Spot ETFs (Exchange-Traded Funds) in the United States have pushed the total net assets to $1.12 billion, with a cumulative total net inflow of $1.00 billion as of December 15, 2025, according to the on-chain analytics platform SoSoValue. The growing inflow of ETFs suggests strong institutional demand for the underlying asset.

Inflow in ETFs shows flows of new capital into the funds. When investors buy any ETF shares, the money flows into the ETF. In the case of XRP, its ETFs continue to record inflows, indicating strong demand from Wall Street investors. This consecutive inflow also reflects investors’ long-term confidence in the asset, especially as it was recorded during a period of market uncertainty.

However, the price of the underlying asset remains unchanged because of broader market trends, but it has the potential to add buying pressure on the asset. As of writing, XRP is trading at $1.88, down 6.05% over the past 23 hours, as per Coinmarketcap data.

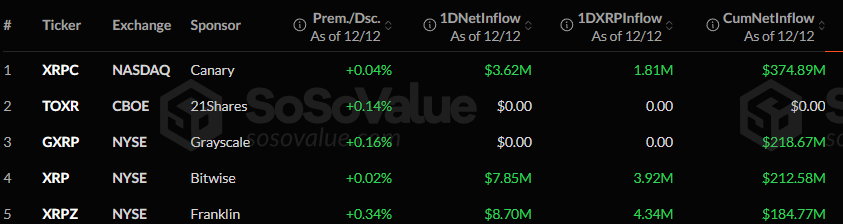

So far, five ETF issuers offer spot XRP, including Canary Capital (XRPC), 21Shares (TOXR), Grayscale (GXRP), Bitwise (XRP), and Franklin (XRPZ).

CEO Praises XRP Spot ETFs Following $1 Billion AUM

Following the record inflows, Steven McClurg, CEO of Canary Capital, shared a post on X, noting that while Solana ETFs launched before XRP, XRP ETFs have now surpassed SOL in total AUM.

He continued, “expected this. SOL is much more efficient to hold on-chain and to stake directly for retail audiences, whereas XRP has more institutional demand and no staking. As with everything, there will be an audience that prefers direct ownership and one that prefers the ease of financial instruments. Some will do both.”

Expert Predicts $10 Billion Inflows for XRP Spot ETFs by 2026

Looking at the consecutive inflows into spot XRP ETFs since their launch, a crypto expert made a bold prediction on X, which is now garnering widespread attention from the crypto community. In the post, the expert noted that AUM has crossed the $1 billion mark with just five spot ETFs. They also highlighted that this inflow occurred without exposure from BlackRock or the 10–15 ETFs typically seen in Bitcoin and Ethereum.

In the post, the expert predicted that if spot XRP ETFs’ inflow continues with its $200M/week, the total ETF inflow could cross $10 billion by 2026. The expert stated, “Retail is emotionally selling dips. Institutions are mechanically buying value.”

Also Read: Doha Bank Lists $150M Digital Bonds on London Stock Exchange Using DLT

Conclusion

Overall, the consistent inflows into spot XRP ETFs signal strong institutional interest in XRP, even as broader market conditions keep prices under pressure. While XRP’s price has yet to react, sustained ETF buying could gradually add upside pressure over time. If this trend continues—and more issuers or major institutions step in, spot XRP ETFs may become a key catalyst shaping XRP’s long-term outlook.