Key Takeaways

- With a 7% dip, Solana (SOL) has reached a key make-or-break level, which appears to be a red flag, as any further decline could trigger a major crash.

- Price action suggests that a fall below $174 could bring $155 into play on the chart.

- Despite the price drop, whale interest in SOL remains strong, as the wallet address 0x8d0E opened a 20x long position on SOL worth $26.14 million.

Today’s 7% price dip in Solana (SOL) has raised eyebrows as the asset enters a make-or-break zone, sparking questions about whether history will repeat at this level or if a massive fall could be on the horizon. Amid the uncertainty, a crypto whale appears to be taking advantage by betting millions on a long position, anticipating a potential rebound from this level.

Crypto Whale Opens $26 Million SOL Long

A crypto transaction tracker, Lookonchain, shared a post on X revealing that the whale wallet address 0x8d0E recently deposited 10 million USDC into Hyperliquid and opened a 20x long position on 140,366 SOL, worth $26.14 million.

This massive long position was opened during the Asian trading session, and although the price initially surged, it has since declined and reached a key level that is now raising concerns.

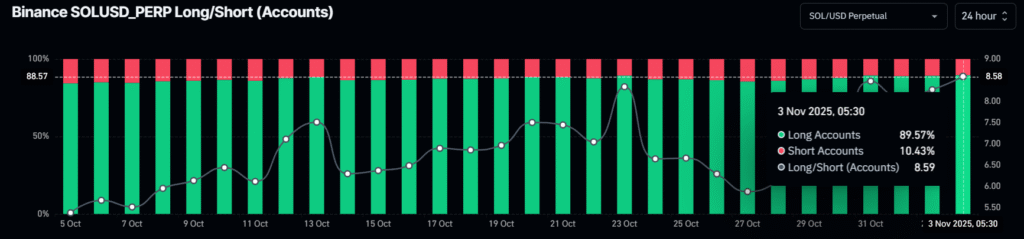

89.5% of Binance Traders Hold SOL Long Positions

It’s not just whales showing interest in long positions but traders on Binance also appear to be betting the same way, according to data from the derivatives tool Coinglass.

Today, the Binance SOLUSD Perp Long/Short ratio reached 8.59, the highest level since the beginning of October 2025. This metric indicates a strong bullish sentiment among Binance traders, with 89.57% of accounts betting on long positions, while only 10.43% are taking short positions.

SOL Price Struggles Despite Strong Bullish Bets

When combining both trader and whale activity, it appears that market participants strongly believe SOL could soon rebound; however, this optimism has not yet been reflected in the asset’s price.

According to the latest TradingView data, SOL is trading at $176 and has lost 7.05% of its value, its largest decline in the past four trading days.

Why is Solana (SOL) Price Falling?

You might be wondering what’s triggering and driving this downward momentum despite strong bullish support. The answer appears to lie in the overall market sentiment and the sharp decline in Bitcoin (BTC) and Ethereum (ETH), which have dropped by 2.40% and 5%, respectively, today.

However, this isn’t the only factor dragging SOL down. Another major reason affecting SOL and other top assets is Federal Reserve Chair Jerome Powell’s recent comments. While speaking, Powell hinted that another rate cut in December 2025 isn’t guaranteed, which made investors cautious. As a result, millions of dollars have moved into safer investments instead of crypto.

Another bearish indicator is the decline in whale interest, which has fallen for the first time in seven months, as whales are now buying fewer Bitcoins than usual.

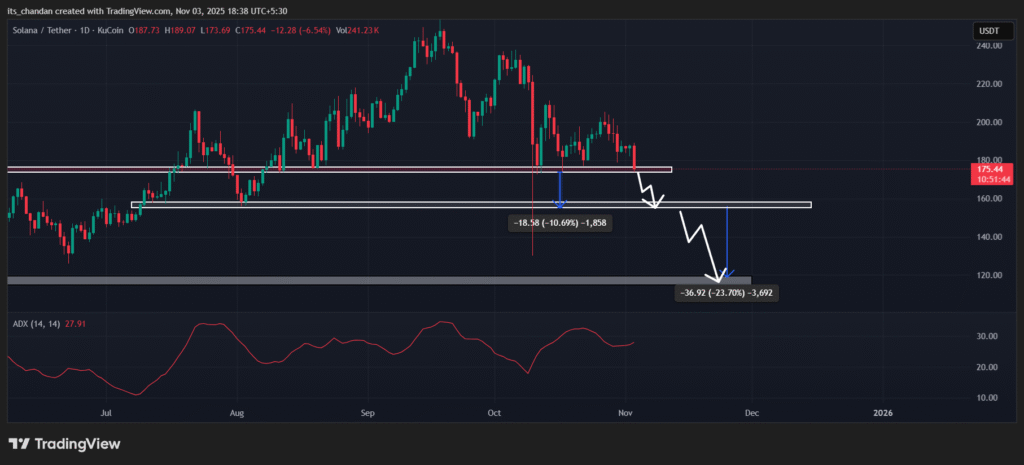

Solana (SOL) Technical Outlook: Upcoming Levels to Watch

TimesCrypto’s technical analysis on the daily chart raises an alarm, as a further decline could trigger a massive crash due to the lack of strong support below $175.

Based on the current price action, if the downward momentum continues and SOL closes a daily candle below the $174 level, it could open the door for further downside. The asset may experience a 10% drop to around $155, and if that level fails to hold, the price could fall another 23%, potentially reaching $118 in the future.

As of press time, SOL’s Average Directional Index (ADX) has crossed the threshold of 25, reaching 27.91, indicating strong directional momentum.