Sam Bankman-Fried’s defunct crypto trading firm Alameda Research is once again unlocking millions of dollars’ worth of Solana (SOL). Earlier today, on-chain transaction tracker Onchain Lens reported that Alameda unstaked 194,861 SOL worth $25.50 million and moved the funds to BitGo Custody.

The crypto tracker further disclosed that the firm has so far deposited a substantial 88,877 SOL worth $12.13 million. It’s not the first time Alameda Research has performed such activities.

Why It Matters

For context, the firm collapsed along with FTX in late 2022, but it still holds a massive stake in SOL. As Alameda remains under bankruptcy proceedings, it has been undertaking its SOL on a scheduled basis. The reason is to avoid volatility and a sharp sell-off. The firm is doing all these unlockings and gradual selloffs to repay all the creditors.

Despite continuously unlocking and selling millions of dollars’ worth of SOL, the firm still holds an enormous amount of it.

Historically, whenever Alameda or FTX moved their SOL to exchanges, it added strong selling pressure and triggered volatility, resulting in notable price declines—as recorded on March 4 and March 12, 2025. On these dates, they unlocked and moved more than $431 million and $23 million worth of SOL, respectively.

But today, the SOL price is up 1.90% and is currently trading around the $139 level. However, market participants remain cautious, as reflected in the trading volume, which plummeted 27% to $5.15 billion.

A decline in trading volume during a price rise suggests fear among traders and investors, potentially due to SOL’s past performance, along with the ongoing volatility in the broader crypto market.

Also Read: Bitcoin Price: BTC Locks Gains For Third Week in a Row-More Upside Ahead!

Traders’ Eyes On Short Positions

Given the current market sentiment, it appears that traders are simply following the broader trend, which continues to show signs of struggle.

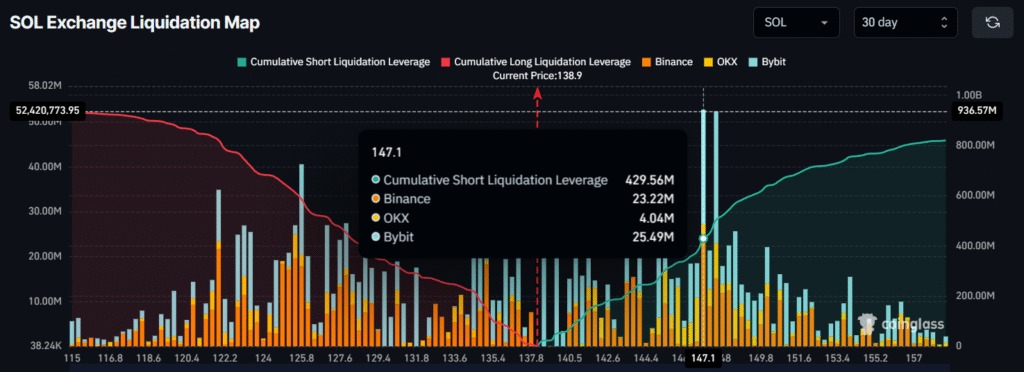

Traders are currently over-leveraged at $135.1 on the lower side and $147.1 on the upper side, according to the Exchange Liquidation Map from derivatives platform Coinglass, which highlights their leveraged bets and position values.

At these levels, traders have built $149.07 million worth of long leveraged positions and $429.56 million worth of short leveraged positions, indicating that intraday sentiment remains bearish.

Wall Street poured $11.02 million into Solana ETFs

The inflows into ETFs suggest that investors’ capital is moving into listed funds, and such activity acts as a bullish signal because it adds buying pressure on the asset.

The inflows into ETFs suggest that investors’ capital is moving into listed funds, and this acts as a bullish signal because it adds buying pressure on the asset.

Conclusion

Overall, Alameda’s steady unstaking and these slow sell-offs are still making traders a bit uncomfortable, mainly because of their past moves. Today’s unlock didn’t cause any downside move, but the fall in trading volume shows that people are not fully confident.

However, Wall Street continues to show strong interest in the asset. The $11 million inflow into U.S. spot Solana ETFs signals that investors are quietly eyeing SOL despite the market uncertainty.