Key Takeaways

- FTX/Alameda unstaked $30.7 million worth of Solana (SOL) and moved the funds to custody, hinting that a potential distribution may be on the horizon.

- Solana’s price action suggests that SOL is at a make-or-break point; a candle closing below $155 could trigger a further 20% decline.

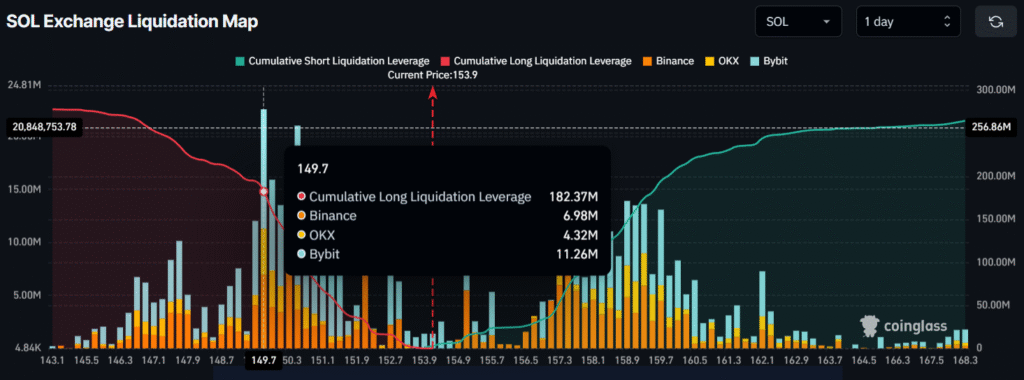

- Solana’s major liquidation levels stand at $149.7 and $157.5, where traders are over-leveraged, with strong bets recorded around the $149.7 level.

Solana (SOL) appears to be in trouble after FTX/Alameda unstaked 193,876 SOL worth $30.7 million from their staking addresses, according to crypto transaction tracker Onchain Lens. The post from the crypto tracker also revealed that the defunct exchange has moved these funds to BitGo Custody and recently transferred 88,494 SOL, worth $13.55 million, to Coinbase.

FTX/Alameda Unstake Millions Worth of SOL

FTX, once one of the largest crypto exchanges in the world, collapsed in November 2022, leaving billions of dollars’ worth of crypto funds frozen.

Following its bankruptcy, a U.S. court ordered FTX to repay affected users, with a plan estimating that $14.5 to $16.3 billion in assets could be returned. Since then, FTX has been actively managing and redistributing funds, including staked cryptocurrencies.

FTX/Alameda’s recent unstaking of 193,876 SOL marks a key step toward potential repayment, and the transfer of millions of SOL to Coinbase appears to be for potential distribution.

Following this activity, the SOL price appears to be struggling and is currently at a crucial point, suggesting a make-or-break situation for the asset. According to the latest TradingView data, SOL is trading at $155, up 1.50% in the last 24 hours. Despite this decent gain, market participation remains hesitant, as reflected by a 5.5% drop in trading volume to $5.90 billion.

Also Read: Bitcoin Edges Higher to $103K, Gold Retreats despite U.S. Reopen

Solana (SOL) Technical Outlook: Key Levels to Watch

For market participants, $155 is a key support level for Solana (SOL), as it has held this position for more than nine trading days. On the daily chart, it has been observed that several times in the past, SOL’s price briefly lost this support but quickly recovered and bounced back to the $155 level.

TimesCrypto’s technical analysis reveals that SOL is currently in a downtrend. Based on the current price action, any candle closing below the key support level of $155 could be a red flag for the asset, as it has the potential to trigger a massive decline. If this happens, SOL could experience a price drop of over 20% and may reach the $120 level. However, if it remains above $155, it still has the potential to rebound, but this could only be possible if the market sentiment shifts.

At press, Solana’s (SOL) Chaikin Money Flow (CMF) value reaches -0.11, which suggests that selling pressure is dominating the market, indicating weak buying momentum and possible further downside in the short term.

Solana (SOL) Major Liquidation Levels

Looking at the current market sentiment and SOL’s past performance around the $155 level, traders today appear to be over-leveraged at $149.7 on the lower side and $157.5 on the upper side, according to the derivatives tool Coinglass.

At these levels, traders have built $182.37 million worth of long positions and $157.5 million worth of short positions, clearly indicating a strong belief that SOL could once again bounce off its key support level.