Key Takeaways

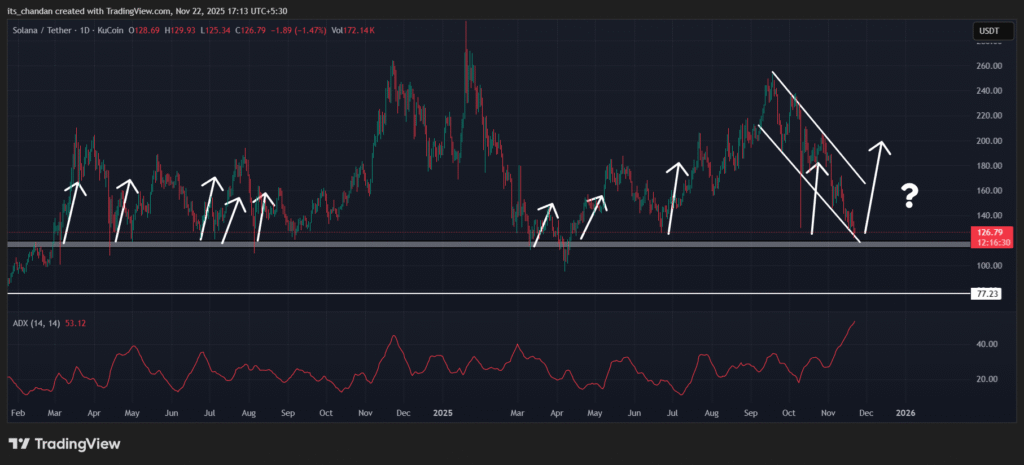

- Solana price has slipped below $127.0 for the first time since April 2025.

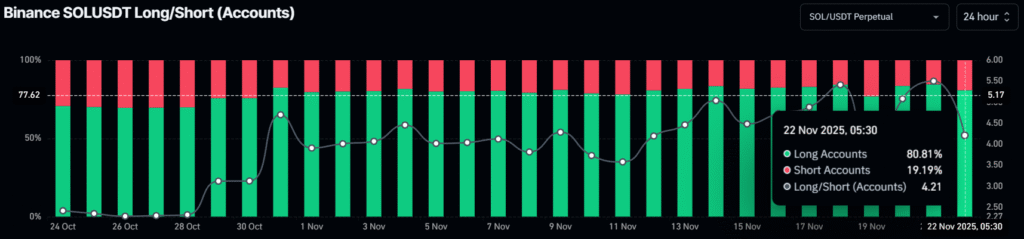

- Despite the bearish trend, 80.81% of Solana traders on Binance are going long on SOL.

- U.S. Solana Spot ETFs continue to record strong demand, with inflows persisting since launch.

- SOL price is nearing the $120 zone, which historically has triggered sharp reversals.

While the broader market is witnessing intense selling pressure, particularly for Solana (SOL), traders on Binance are taking the opposite stance, showing strong interest in the asset. Over the past 24 hours, data reveal that Binance traders are holding a strong bullish market sentiment.

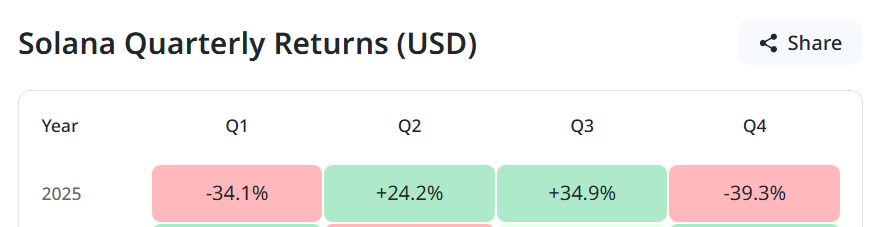

So far in Q4, Solana has plummeted more than 40%, falling to a five-month low and continuing to trade inside a descending channel, a sign of persistent bearish pressure.

Despite this negative outlook, traders on Binance have shown strong confidence in the asset, raising questions about what is driving their interest in SOL even amid a bearish market structure.

Also Read: Bears Eye “Golden Fibonacci Ratio”; What Does it Mean for BTC Price?

80% of Binance Traders Go Long on Solana

According to the on-chain analytics platform Coinglass, the Binance SOLUSDT Long/Short ratio has reached 4.21, indicating strong bullish dominance among traders.

This suggests that Binance traders have built 4.21 long positions for every short position. Currently, 80.81% of traders are holding long positions, while only 19.19% remain in short positions.

So far, the asset hasn’t shown any positive reaction, as it is down by 1.55% today and is currently trading at $126.

In addition, SOL’s persistent downward momentum has pushed the asset down by 32.5% in November 2025 — marking the second time this has happened since 2020.

But what is driving traders’ bullish outlook amid the current situation? The key factors that may be supporting this sentiment appear to be rising Wall Street demand, as U.S. Solana Spot ETFs continue to record inflows, along with the price approaching a strong key support level.

Solana Spot ETFs Demand Continues to Accelerate

According to on-chain analytics platform SoSoValue, since Solana’s entry into Wall Street, traditional investors and institutions have shown strong interest in the asset.

The latest on-chain data reveals that today marks the 17th consecutive day of inflows into Spot Solana ETFs, with today’s inflow totaling $10.58 million. These ETF inflows indicate that investors are depositing more capital into the fund — a bullish sign for the asset.

Will the $120 Level Trigger Another Reversal?

Another catalyst reinforcing traders’ bullish bets is the price approaching the $120 level. According to TimesCrypto’s technical analysis, the $120 zone has a strong history of triggering price reversals. Since the beginning of 2024, SOL has tested the $120 level multiple times, and each time the price has rebounded sharply after touching it.

If buyers defend the $120 level once again, historical price action suggests that SOL could attempt another recovery rally.

At press time, SOL’s Average Directional Index (ADX) stands at 53.12 — well above the key 25 threshold — confirming strong directional momentum behind the current trend.