Solana (SOL) price rebounds in the U.S. session, defying the early bearish sentiment. The coin moves in tandem with a broader crypto market recovery. There is a mixed sentiment around Solana amid whales’ multi-million-dollar dumps, massive long liquidations, and ETF inflows. As of press time, SOL/USD is exchanging hands at $141.0, up 6.23% for the day.

Recently, the prominent crypto tracker EmberCN shared a post on X stating that the whale wallet address “7VMT” has continued taking profits by depositing 100,000 SOL worth $13.57 million to Binance on December 8, 2025, adding selling pressure on the asset.

Since unlocking its 991,000 SOL in April 2025, the whale has transferred 615,000 SOL worth $107 million to Binance in batches over eight months at an average price of $175. The post on X further revealed that the wallet is still holding 733,000 SOL worth $99.16 million and has earned 357,000 SOL in staking rewards over the past four and a half years.

Whale Sell-Off Aligns With Long Liquidations

Crypto whales are those who own a massive portion of any asset—whether it’s Solana (SOL), Bitcoin (BTC), Ethereum (ETH), or others. These whales have a strong influence on asset prices, as market participants view their transactions and activity as indicators of potential upcoming moves in the market.

In the current scenario, whale’s million worth of SOL transferred to Binance takes place when the overall market is struggling, which has now strengthened Solana’s bearish outlook and added selling pressure on the asset.

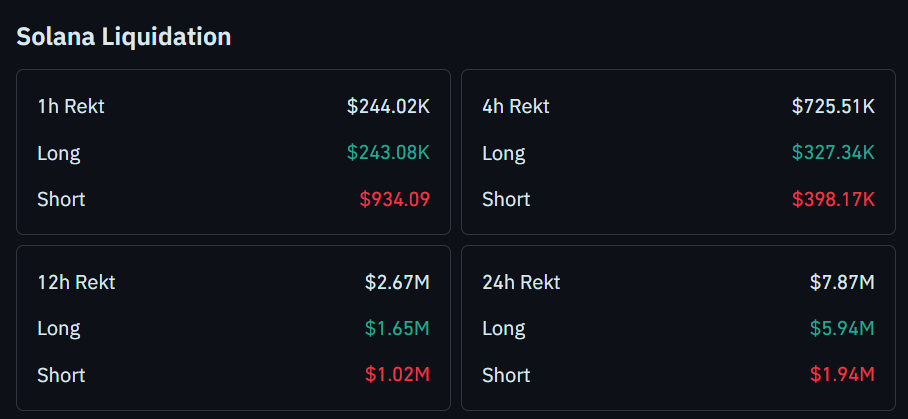

Amid this situation, traders holding long leveraged positions have been liquidated for $5.94 million, compared to $1.94 million in short liquidations, as on-chain analytics firm Coinglass shows for the past 24 hours.

Inflows Into Spot Solana ETFs

However, the spot Solana Exchange-Traded Funds (ETFs) witnessed Wall Street investors participating in the coin’s accumulation. According to the on-chain analytics tool SoSoValue, the spot Solana ETFs recorded an inflow of $1.18 million.

The recent whale’s movement does not necessarily mean a bearish sentiment. Sometimes these transfers are done to provide liquidity in the market. However, it coincides with the ETF inflow, suggesting the SOL price might be near the bottom in the short term.

Also Read: $74.7 Million Flows Into Ethereum, XRP, and Solana ETFs, Altcoin Season Index Still at 18!