Key Takeaways

- Forward Industries, a Solana Digital Asset Treasury (DAT) firm, has deposited 1.44 million SOL worth $201.34 million, hinting at a potential sell-off.

- Price action suggests that if SOL remains below the $131 level, it could continue in a bearish trend and may reach the $120 level in the coming days.

- $128 on the lower side and $136.8 on the upper side are the two major liquidation levels for SOL.

Bearish sentiment surrounding Solana (SOL) is intensifying as market conditions deteriorate. The digital asset treasury (DAT) firm Forward Industries’ recent action, combined with weak price action, suggests the asset is expected to continue the downside momentum in the short term.

DAT Deposit 1.44 Million SOL amid Volatility

Recently, blockchain transaction tracker Onchain Lens shared on X that Forward Industries deposited 1.443 million SOL worth $201.34 million into Coinbase Prime.

So far, it is not yet confirmed whether the DAT firm is selling its SOL holdings or if it is just an unusual transaction. However, its impact was seen in the recent SOL price action.

Current Price Momentum

According to CoinMarketCap data, SOL is trading at $137.20, posting a 2.80% dip today. However, over the past 24 hours, it recorded an intraday low of $129.23. In addition, market participants have shown strong interest in the asset, resulting in a massive 76% surge in trading volume to $6.71 billion.

In the realm of finance, rising volume during a price decline indicates strong bearish market sentiment, suggesting that market participants are positioning themselves for downside momentum or taking bearish trades.

Also Read: Ethereum Chart Eyes $2,758 as BlackRock Dumps $176 Million in ETH

Solana (SOL) Technical Outlook: Upcoming Levels to Watch

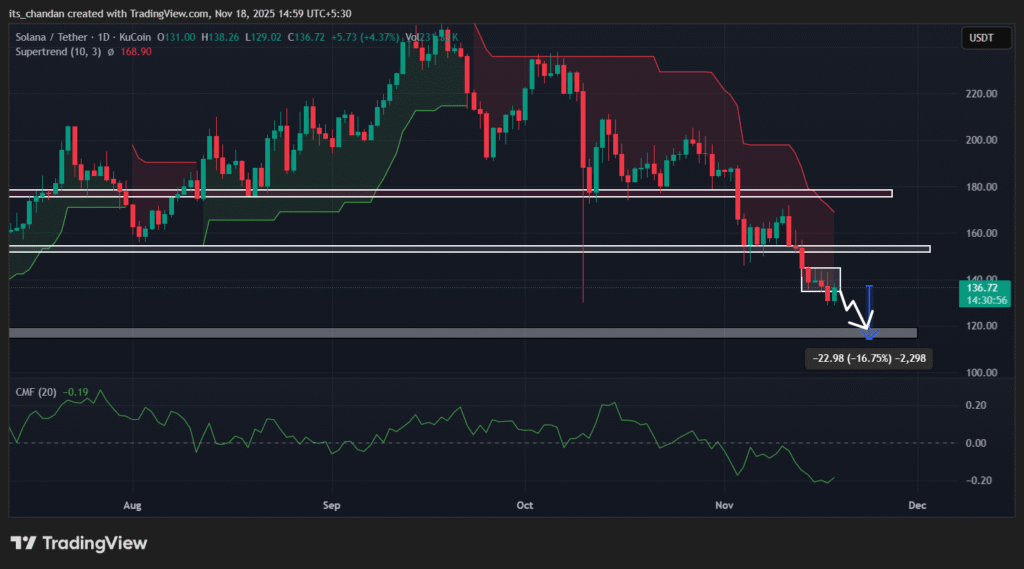

Amid this market uncertainty, Solana (SOL) appears bearish, and it seems likely that the downside momentum could continue in the coming days. On the daily chart, the asset has weakened its overall market structure by breaking down from a small consolidation zone below the key support level of $155 and moving lower.

Based on the current price action, if SOL remains below the $145 level, it could experience a 16.70% price dip and may reach the $120 level in the coming days. On the other hand, if bearish momentum fades and SOL holds above the $131 support, it could see a price uptick and potentially rise toward the $150 level in the coming days.

As of press time, SOL’s CMF (Chaikin Money Flow) value has reached -0.18, indicating strong selling pressure and a clear outflow of capital from the asset.

Meanwhile, the Supertrend indicator continues to strengthen the downside momentum, as it holds a red trend and hovers above the asset’s price—signaling that SOL remains in a downtrend with persistent selling pressure.

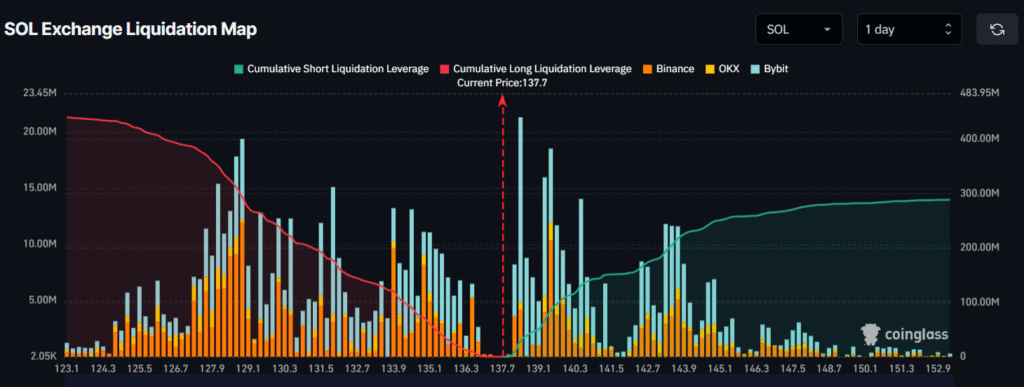

SOL’s Major Liquidation Levels

Looking at SOL’s liquidation levels, it appears that traders are closely following the current price action, according to the derivative tool Coinglass.

As per Coinglass data, SOL’s major liquidation levels currently stand at $128 on the lower side and $139.8 on the upper side. At these levels, traders have built $51.68 million worth of long positions and $187.71 million worth of short positions.

When combined with the DAT firm’s multi-million-dollar SOL deposit, the metrics suggest that both the long- and short-term sentiment for SOL remains bearish and may persist until the price reaches $120 in the coming days.