Key Takeaways

- A crypto expert made a bold claim in a post, noting the zone to load up SUI.

- SUI’s price action hints that the asset is at a make-or-break level; if it holds the trendline, a 27% rally is possible.

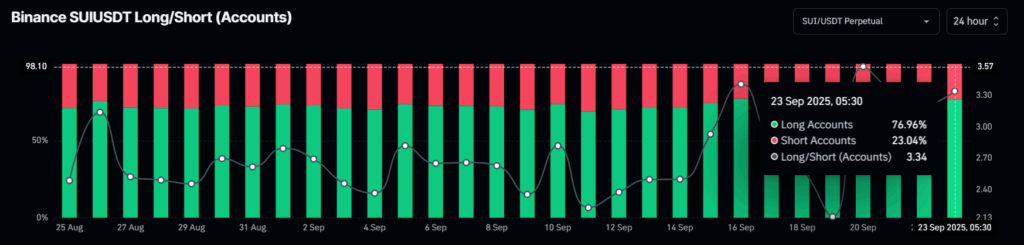

- Currently, 76.96% of Binance traders are betting on long positions.

Amid market uncertainty, bullish sentiment around Sui (SUI) is heating up as traders eye strong support at current levels. However, the past four trading days have been unfavorable for SUI, with the token recording a sharp 18% price dip. Now, experts hint it may be the right time to buy.

Expert Signal: Time to Buy SUI

Recently, a well-followed crypto expert shared a post on X stating, “This is the zone to load up SUI.” In addition, the expert also shared a daily chart showing that SUI appears to be forming an ascending triangle pattern, with the $4.2 level as the neckline. The expert added that a breakout from this pattern could propel SUI to $7.

This post on X gained widespread attention from traders and investors, as the expert directly claimed, “Zone to load SUI.”

SUI Price Momentum

Currently, SUI is trading near $3.36 and has remained unchanged over the past 24 hours. However, investors’ and traders’ participation has fallen significantly during the same period, resulting in a 45% drop in trading volume compared to the previous day.

Key Levels Indicate SUI’s Next Move

TimesCrypto’s technical analysis reveals that SUI is currently at a make-or-break situation. On the daily chart, it appears that SUI is taking support from an ascending trendline that has held since April 2025, with the recent bounce marking the third retest of this support.

The chart shows that earlier, when the price reached this level, it recorded a massive uptick, A move that could be possible again if SUI holds this ascending trendline support.

Based on the current price action, if SUI holds this trendline, history may repeat itself, and the asset could see a 27% price jump until it reaches the resistance level of $4.30. On the other hand, if the price slips and SUI fails to hold this support, a 15% price decline is possible.

Despite all this, SUI’s technical indicator, Supertrend, still shows green and remains below the asset price, indicating that the asset is in an uptrend with strong buying pressure.

On-Chain Data Shows Strong Bullish Sentiment

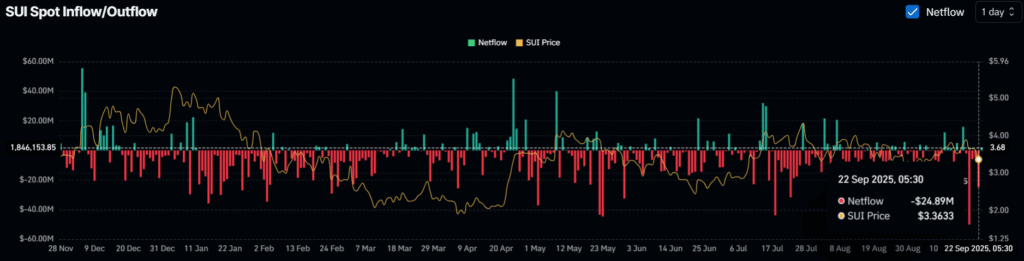

The on-chain analytics tool Coinglass reveals that both traders and investors hold a bullish outlook, as they appear to be betting on long positions and accumulating tokens.

At press time, the Binance SUIUSDT long/short ratio has reached 3.34, indicating a strong bullish outlook among traders, as confirmed by on-chain data. Coinglass shows that currently 76.96% of traders are betting on long positions, while 23.04% are on short positions.

Meanwhile, spot inflow/outflow data reveals that over the past 48 hours, exchanges have recorded an outflow of $23 million worth of SUI tokens. This substantial outflow hints at potential accumulation.

When combining these metrics, it appears that bulls are dominating the asset, hinting that it could repeat history by bouncing back.