Key Takeaways

- U.S. Spot XRP ETFs have recorded 11 consecutive days of inflows, pushing cumulative inflows to $824 million.

- However, XRP price seems quite stable despite continuous ETFs inflows.

- A crypto analyst predicts a strong upside move, noting that XRP is currently hovering near the lower boundary of its ascending channel pattern.

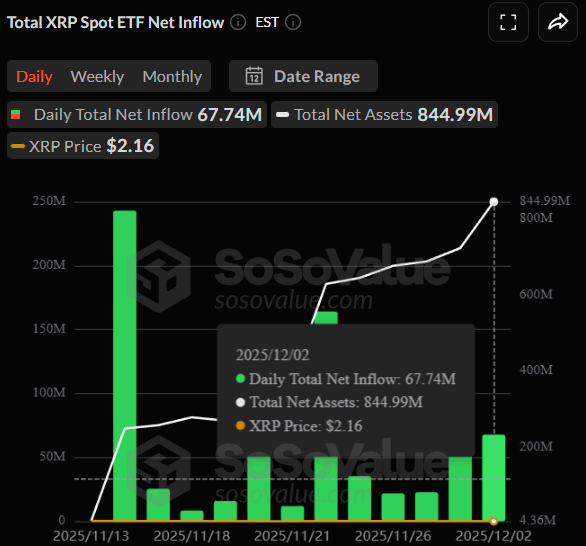

U.S. XRP spot Exchange Traded Funds (ETFs) have continued to record inflows for 11 consecutive days since November 14, 2025, according to on-chain analytics platform SoSoValue. The uninterrupted streak has pushed cumulative inflows to $824.00 million, with an additional $67.74 million added as of Tuesday.

However, these consecutive inflows come during a period of broader market uncertainty, as the overall crypto market struggles to regain momentum. Despite the strong ETF demand, XRP’s price has failed to reflect any notable upside so far.

The latest data shows total net assets across the four U.S. XRP ETFs have reached $844.99 million, accounting for roughly 0.65% of the asset’s market capitalization.

XRP ETFs Issuers Remain Positive

Amid the ongoing streak, all four XRP ETF issuers — Canary (XRPC), Bitwise (XRP), Grayscale (GXRP), and Franklin (XRPZ) — remained in positive territory. GXRP led the December 2 inflows with $45.78 million, followed by XRPZ at $8.22 million, XRP at $7.99 million, and XRPC at $5.76 million.

Bitcoin and Ethereum ETF Activity

However, U.S. Bitcoin spot ETFs recorded an inflow of $58.50 million on December 2, 2025. With this addition, total net assets across Bitcoin ETFs have reached $119.59 billion, equivalent to 6.58% of Bitcoin’s market capitalization as of December 2, 2025. In contrast, U.S. Ethereum spot ETFs saw an outflow of $9.91 million on the same day.

Despite the positive inflows in both Bitcoin and XRP ETFs, investor activity around XRP remains highly elevated, indicating growing interest and confidence in the fund.

Also Read: Vanguard Crypto ETFs Opens the Gates on its $11 Trillion Platform

How ETF Inflows Impact Asset Price?

When inflows are recorded in an ETF, it shows that investors’ capital is moving into the fund. In the current scenario, the fund must buy the underlying asset — such as XRP or Bitcoin.

It means higher inflows lead to more XRP buying, which signals strong demand and has the potential to lift the asset’s price. It also attracts additional investors to participate.

Analyst’s Bullish Prediction for XRP

Given the current market sentiment, a well-followed crypto analyst shared a post on X noting that XRP has just tapped the lower boundary of its ascending channel pattern, which it has been following since late December 2024.

The analyst further noted that the current structure points to a clean continuation, with upside targets at $2.30, $2.60, $3.00, $3.55, and $3.95. As of press time, XRP is trading at $2.17, up 1.05%.