In November 2025, when Uniswap (UNI) rallied over 46% following the founder’s Fee and Burn proposal, a crypto whale seized the opportunity to cash out at the $9.6 level. Now, the same whale is back, accumulating UNI tokens again, according to the prominent crypto tracker EmberCN.

Today, EmberCN shared a post on X, noting that the same whale has withdrawn a substantial 823,000 UNI tokens, worth $4.73 million, from Binance and Bybit.

Whales’ withdrawals from exchanges often suggest potential accumulation and can add buying pressure to the asset. In crypto, smart traders and investors frequently follow whale activity, as their transactions act as signals for upcoming trends. Additionally, these transactions sometimes help define the market bottom when an asset is in a downtrend.

However, UNI is currently trading at $5.55, down 3.25%. Despite the whale’s million-dollar accumulation, the asset has failed to continue the upside momentum it experienced on Tuesday.

The key reason constraining UNI’s upward momentum appears to be the current market sentiment. The overall market has been experiencing massive volatility for over a month, with prices fluctuating up and down.

Traders’ Bets on Short Position Soar

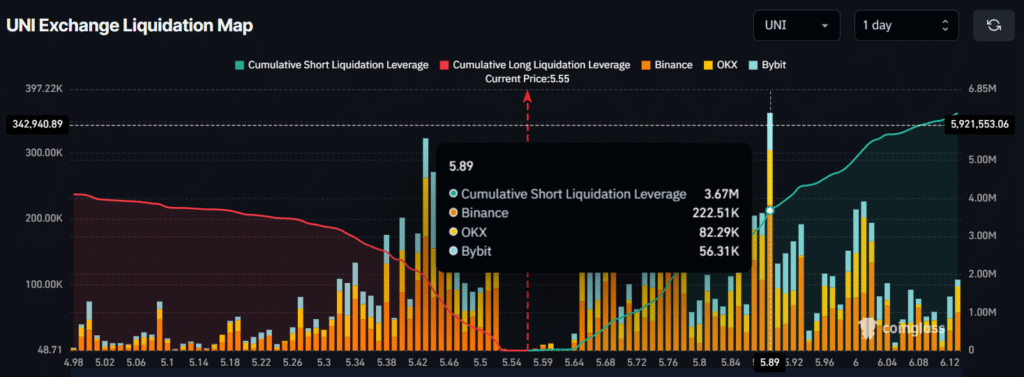

Amid the market volatility, the derivatives tool Coinglass discloses that traders are heavily betting on short positions.

Coinglass’s Exchange Liquidation Map, which highlights traders’ leveraged bets on long and short positions along with their values, shows that the $5.43 level on the lower end and the $5.89 level on the upper end are the two major liquidation points for UNI today.

At these levels, traders have built $1.90 million worth of long positions and $3.67 million worth of short positions. These long and short bets indicate how traders are reacting to the current trend.

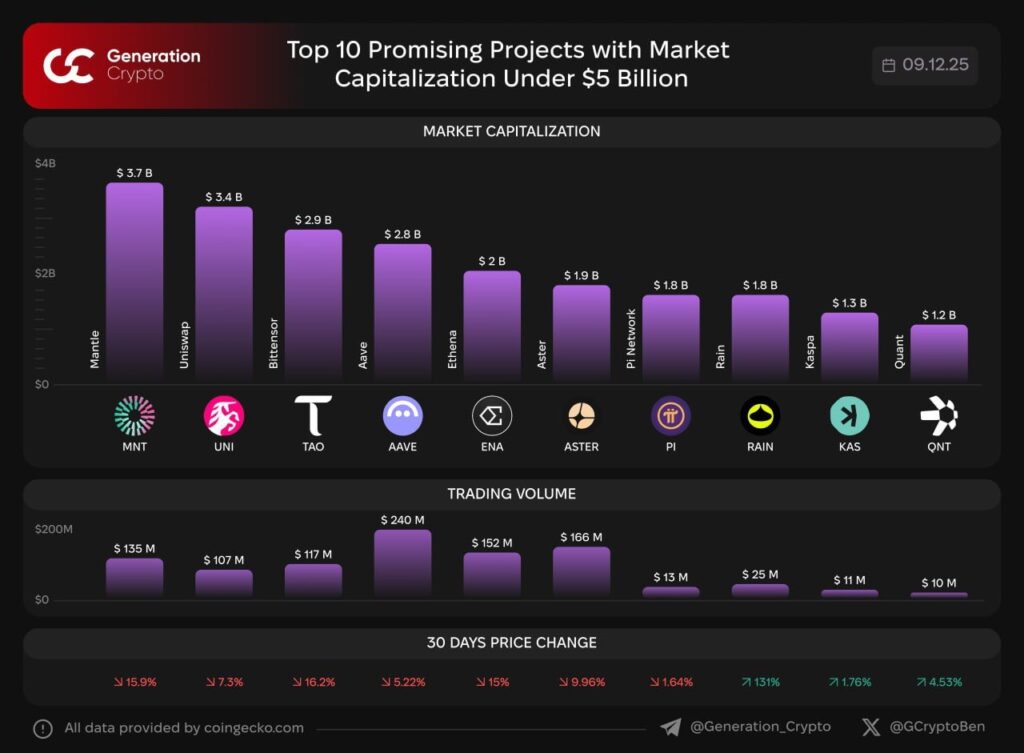

Uniswap Becomes Top Project Under $5 Billion Market Cap

Besides price, whale accumulation, and traders’ bets, a crypto expert shared a post highlighting the top 10 promising crypto projects with a market cap under $5 million, where Uniswap was spotted in 2nd place with a market capitalization of $3.40 billion.

Also Read: Bitcoin Eases to $92K, Gold Holds $4,200 as FOMC Rate Cut Looms

Conclusion

Uniswap whale is back, accumulating amid market uncertainty. Withdrawal of any asset doesn’t always lead to quick upside momentum. Sometimes, it also points to an ideal buying range and offers the chance to acquire a strong project at a lower price, as experts have noted.

Besides the optimism, sometimes whales’ withdrawal can also be used to bring liquidity into the market, but when the price of the asset struggles, these moves may even trap investors, as the sentiment and asset trend are bearish. Retail traders and investors should be cautious in such a situation and wait for the proper trend reversal signal.