Key Takeaways

- Amid the recent dip, Hyperliquid (HYPE) has come under whales’ radar, with millions worth of tokens accumulated.

- Price action suggests that HYPE could soar by 20% and reach $48, but only if it clears the $41.50 level.

- Traders have been strongly betting around $36.6 on the lower side and $41.2 on the upper side.

Amid the market uncertainty, crypto investors have shown strong interest in Hyperliquid (HYPE), building millions worth of bets on it — an impact already evident in the asset’s price. According to blockchain-based transaction tracker Onchain Lens, a crypto whale recently deposited 14 million USDC into Hyperliquid and started buying HYPE spots, while another whale did the same by depositing 15.02 million USDC and began purchasing HYPE tokens.

Hyperliquid (HYPE) Current Price and Rising Trading Volume

This confidence shown by the whales hints at HYPE’s strong upside potential and also raises the question of whether this is an ideal time to go long or add it to the wallet for the long term.

At press time, HYPE is trading at $40.50, posting a gain of over 5.50%, according to TradingView data. Along with the price increase, market participation also rose, as the asset’s trading volume jumped by 27% to $610 million.

Also Read: Bitcoin Dips to 101K as Labor Market Gloom and AI Fears Weigh on Wall Street

HYPE Price Action and Upcoming Levels

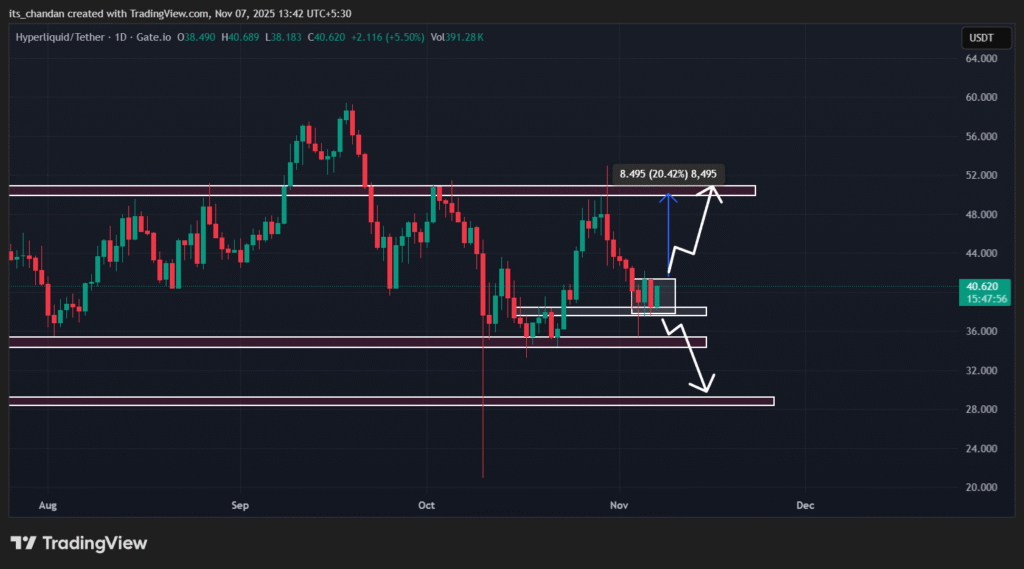

TimesCrypto’s technical analysis on the daily chart reveals that HYPE has recently bounced off its key support level, where it has been hovering and consolidating between $37.70 and $41.50 for the past four trading days.

The current price action and historical patterns suggest that an upside rally for HYPE would only be possible if it breaks above the consolidation’s upper boundary. If the HYPE price does so and closes a daily candle above $41.50, it could increase the chances of upward momentum and may soar by 20% to reach the $48 level in the future.

However, if it fails, the possibility of further consolidation increases, and HYPE could continue trading within the range. On the other hand, a downside momentum could occur if the asset closes below the $37.70 level.

As of press time, HYPE CMF (Chaikin Money Flow) value reaches 0.04, indicating moderate buying pressure and a slight inflow of capital into the asset.

Meanwhile, the Supertrend indicator continues its green trend and is hovering below the asset price, suggesting that the asset is in an uptrend with strong buying pressure.

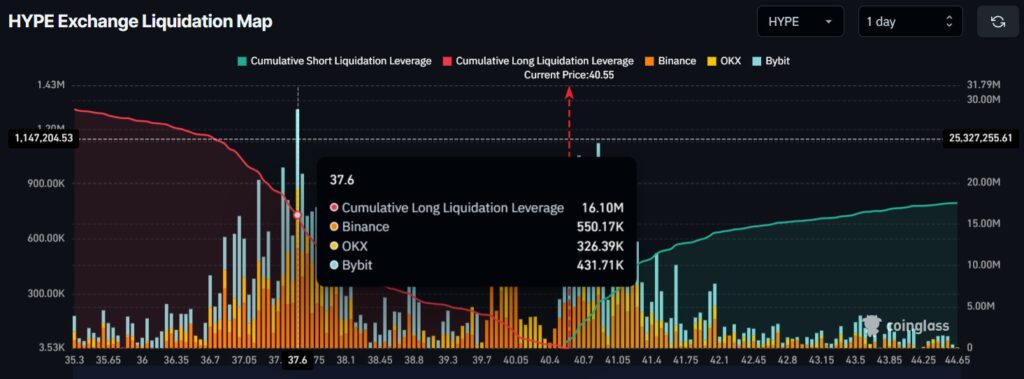

HYPE Major Liquidation Levels

With the participation of these whales and a strong bullish outlook, the derivative platform CoinGlass reveals that HYPE traders are also following the same trend by heavily betting on long positions.

According to the latest data, major HYPE liquidation levels are found at $36.6 on the lower side (support) and $41.2 on the upper side (resistance). At these levels, traders are over-leveraged, with $16.10 million worth of long positions and $9.50 million worth of short positions, indicating the bulls’ dominance over HYPE.