Key Takeaways

- Solana (SOL) is on whales’ radar, as one whale added $5.03 million worth of SOL while another opened $4 million worth of long positions.

- Price action suggests that an upside rally for SOL is only possible if it clears the $155 resistance level; otherwise, sideways or downside momentum may continue.

- Derivative data reveals that traders still hold a bearish view, having built $81.51 million worth of short positions at the $144.1 level.

Despite the bearish market trend, Solana (SOL) has appeared on whales’ radar as they have begun accumulating and placing long bets, hinting at a potential end to the downtrend. These accumulation activities and long positions were recorded right after the asset lost its key support at $155.

Whales’ Bullish Activity Hints at Potential Reversal

According to recent data shared by the on-chain analytics platform Onchain Lens, whales have added 5 million USDC to the Hyperliquid decentralized exchange and later spent $5.04 million to buy 35,335 SOL at an average price of $143.

Not just this whale, but another whale also deposited 4 million USDC to Hyperliquid and opened SOL long positions with 20x leverage, which are currently valued at $18 million.

It is unclear whether this is an ideal buying opportunity or if the price will continue its bearish streak, but it currently appears to be leaning in that direction.

Current Price Momentum

As per the latest TradingView data, the impact of these bullish bets is already evident on the SOL price, which has jumped 1.45% and is currently trading at $141.20. With today’s price uptick, the asset appears to have ended its prolonged bearish trend.

Meanwhile, market participation has also increased, as reflected in the trading volume, which climbed 23% to $23 billion.

The rising trading volume alongside the price increase suggests that market participants are interested in an uptrend, and this is a bullish sign for today.

Also Read: Is More Trouble Ahead for Dogecoin? Investors Dump 160 Million DOGE

Solana (SOL) Price Action and Technical Analysis

Despite the recent price rise and whales’ strong bullish outlook, Solana’s price action tells a different story.

According to TimesCrypto’s technical analysis, Solana (SOL) remains in a downtrend after losing the key support at $155. Moreover, it continues to trade below the 200-day Exponential Moving Average (EMA) on the daily chart.

It appears challenging to forecast whether the asset will continue its downside move or reverse due to the rising bullish participation of whales.

Based on the current price action, SOL’s bullish strength is likely only if it reclaims the $155 level. If it does, there is a strong possibility that the asset could see a price uptick of over 15% and reach the $178 level.

Meanwhile, it is also possible that SOL could rally to $155 for a potential retest. If SOL fails to hold above the $155 level, it has the potential to drop to $120. However, a quick downside move would only be possible if it falls below the $135 level.

As of now, SOL’s CMF (Chaikin Money Flow) value reaches -0.19, indicating that selling pressure is dominating the market, with capital flowing out of the asset and weakening bullish momentum.

Derivative Tool Hints at Short-Term Bearish Sentiment

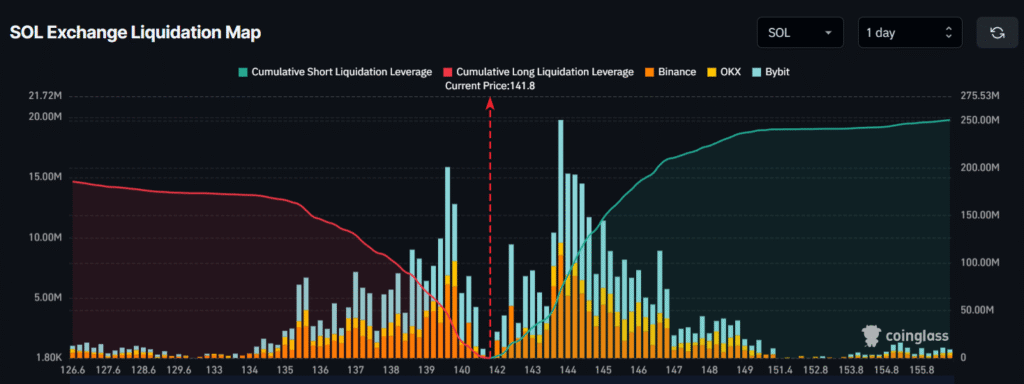

Moreover, Solana’s bearish price action is reinforced by the derivative tool Coinglass, which suggests that traders are strongly betting on the bearish side.

As per recent data, SOL’s major liquidation levels currently stand at $139.5 on the lower side and $144.1 on the upper side, acting as key support and resistance for the asset.

At these levels, traders have built $35.01 million worth of long positions and $81.51 million worth of short positions, indicating that bulls are exhausted while bears are currently dominating the asset.

Combining whales’ bullish bets with the current price action and derivative data, it appears that the short-term market sentiment for SOL is bearish, whereas the long-term outlook hints at strong potential for the asset.