Key Takeaways

- Chainlink (LINK) price is down 53% from its peak of $27 in August 2025; experts hint at an ideal buying opportunity, though price action suggests more pain ahead.

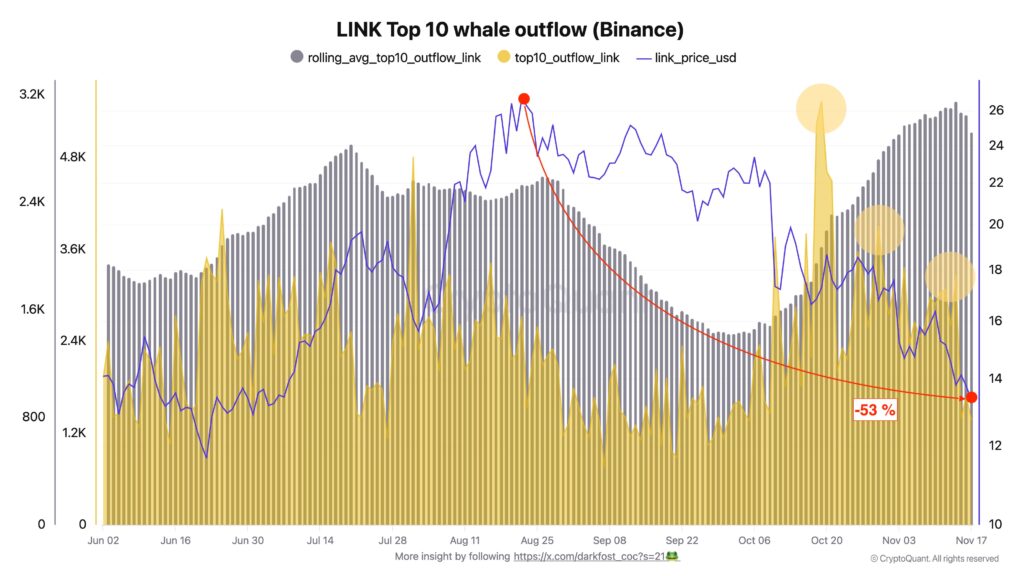

- An analyst shared on-chain data noting a sharp rise in Top 10 outflows from Binance to external wallets, suggesting increased interest from top holders.

- Price action suggests LINK is in a downtrend, and its price could drop another 15.50% if it fails to reclaim $14.20.

- The bearish trend may end if LINK price rebounds above $14.20, potentially shifting market sentiment.

After a 90-day continuous price decline, Chainlink (LINK) has lost over 53% of its value and is now catching the attention of whales, who appear to be buying the dip. An analyst highlighted on-chain data showing a sharp increase in top 10 outflows from Binance, typically a sign of accumulation by major holders.

However, the impact of this accumulation hasn’t been reflected yet on the asset’s price, as it has continued to move sideways over the past few trading days. But it raises whether this is an ideal buying opportunity or if the price will fall further in the coming days.

Chainlink Whales On Buying Spree

It has been a challenging phase for LINK, as it has continued to decline for several months, losing over 53% from its peak of $27, recorded in August 2025.

The analyst noted that such situations often attract strategic buyers, and that is exactly what the on-chain metric “LINK Top 10 Whale Outflow (Binance)” reflected, showing a clear uptick in whale activity on Binance.

Additionally, a sharp outflow from Binance has been recorded, particularly within the top 10 transactions, which are typically associated with whale movements. Such outflows from Binance to external addresses are commonly interpreted as a sign of accumulation, the analyst added.

Chainlink (LINK) Price and Declining Volume

Despite the substantial outflow, it has failed to impact LINK’s price, which remains in a downtrend and has been trading sideways over the past five trading days.

As of now, LINK is trading at $13.37, down 3.05% today, according to TradingView data. Meanwhile, the token has not only lost value but also seen a decline in trader and investor participation, as reflected in its trading volume, which dropped 32% to $730.50 million.

Also Read: Bitcoin Price: BTC’s 46-month “Death Cross” Collides with Oversold RSI; Is $75K Eyed?

Chainlink (LINK) Price Action and Technical Analysis

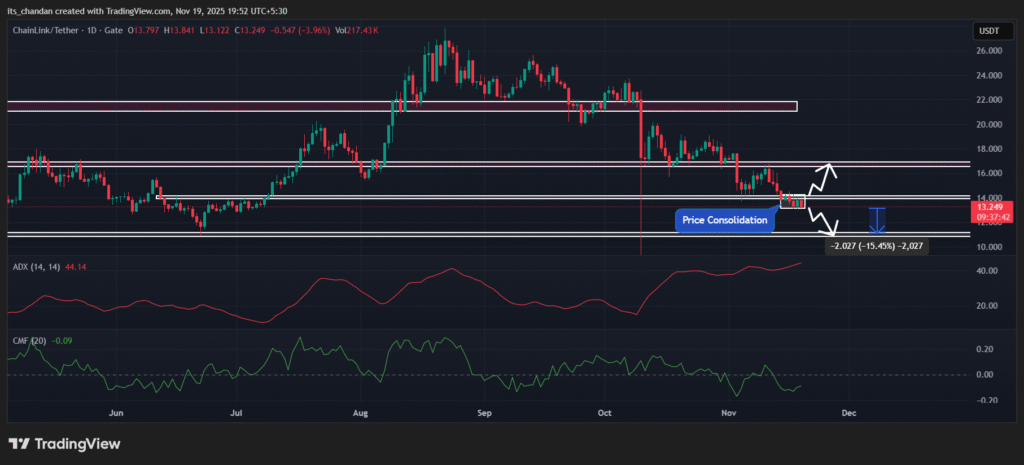

The TimesCrypto technical analysis on the daily chart indicates that falling market participation is likely driven by the current price action. As LINK continues its bearish trend, it has lost multiple key support levels, including $21, $16.70, and the recent $14.20 level, opening the door for further downside momentum.

Based on the current price action, if LINK continues its market downturn and closes a daily candle below the $13.11 level, it could see a further price drop of 15.50%, potentially reaching $11.05. However, the asset’s bearish outlook would be invalidated only if it reclaims the $14.20 level and closes a daily candle above it.

As of now, LINK’s Average Directional Index (ADX) stands at 44.14 — well above the key threshold of 25 — indicating strong directional momentum for the asset. Whereas, the Chaikin Money Flow (CMF) value stands at -0.08, indicating selling pressure and a net outflow of capital from LINK.