Key Takeaways

- Smart investors added $26 million worth of Chainlink (LINK) amid growing ETF speculation.

- The DTCC listed Bitwise’s spot Chainlink ETF (CLNK) on its website, hinting at a potential approval in the coming days.

- Price action suggests that any four-hour candle closing below $14.90 could trigger a sharp sell-off.

The broader market trend for Chainlink (LINK) remains bearish; however, whales’ continuous accumulation hints that the asset may be on the verge of a reversal. You might be wondering what’s driving whales’ interest in LINK even as the chart flashes bearish signals and the price continues to decline.

DTCC List Bitwise’s Chainlink ETF

As per the recent update on November 11, 2025, the Depository Trust and Clearing Corporation (DTCC) has listed Bitwise’s spot Chainlink Exchange-Traded Fund (ETF) under its pre-launch category with the ticker symbol CLNK. However, the listing on DTCC does not guarantee that the spot Chainlink ETF will launch on Wall Street, though it is typically considered a bullish signal.

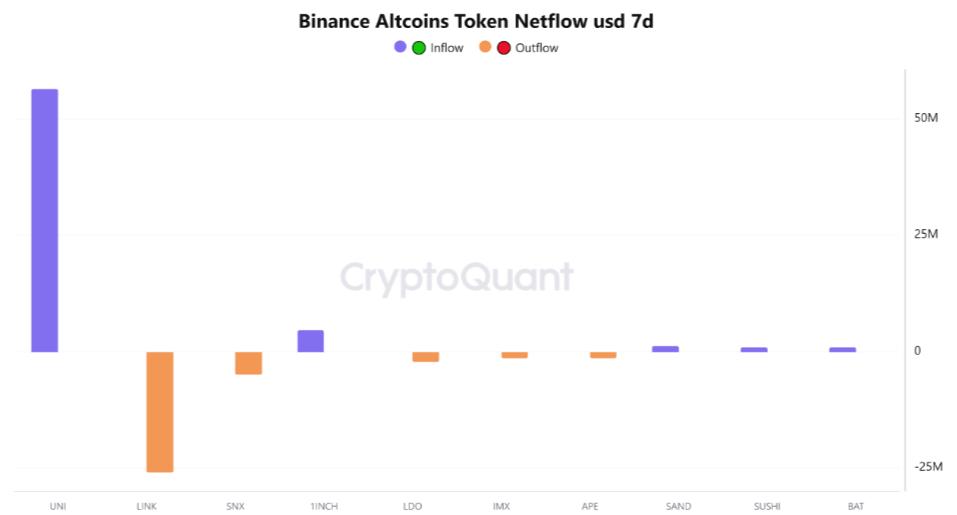

Smart Whales Add $26 Million of LINK

Following the ETF listing on DTCC, an on-chain analyst shared a report revealing that smart money is reacting wisely to this development. According to the report, while most altcoins on Binance are experiencing minor flows, LINK stands out with a significant outflow of over $26 million, marking the largest capital exit from Binance among the listed altcoins.

The expert concluded that the combination of these two events, positive fundamental ETF news and on-chain data showing a massive exchange outflow, presents a strong bullish scenario for LINK.

Given the current market sentiment, it appears that major players are aggressively accumulating LINK in anticipation of the institutional demand that a spot ETF approval could generate.

Current Price Momentum

Despite these positive developments, LINK’s price continues to decline. During the Asian trading session, the asset reached a high of $16.017 but later faded as the U.S. opening bell approached. According to the latest TradingView data, LINK is currently trading at $15, down by 1.30%.

Also Read: SOL Drops 3% as FTX Wallet Unstakes $30 Million amid Market Fear

Chainlink (LINK) Price Action and Technical Analysis

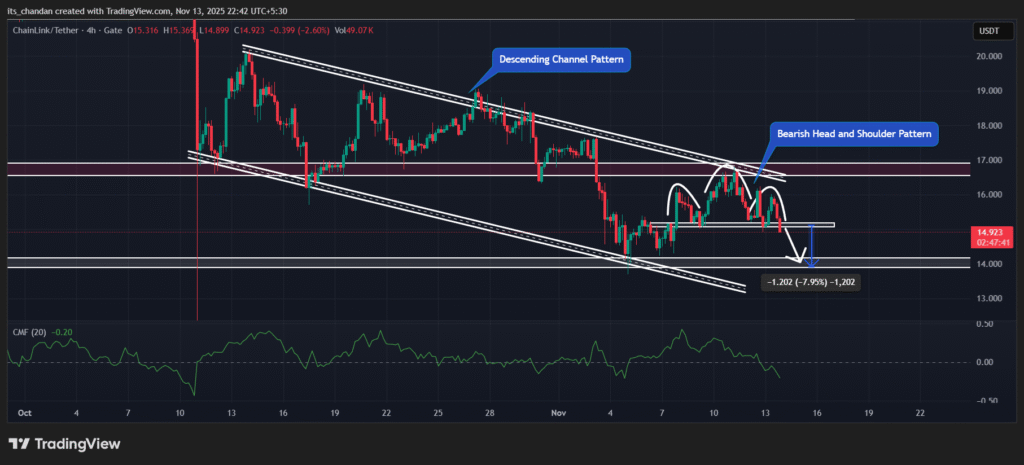

TimesCrypto’s technical analysis on the four-hour chart reveals that LINK is in a downtrend, hovering within a descending channel pattern between its upper and lower boundaries. With the recent price uptick, the asset reached the upper boundary but failed to break its bearish trend. At the same level, it has now formed another bearish Head and Shoulders pattern, suggesting that a major dip could be on the horizon.

Based on the current price action, if LINK’s four-hour candle closes below the neckline of the pattern at the $14.90 level, it could experience a price dip of over 8% and may reach the $14.00 level in the near future. However, an upside rally for LINK would only be possible if it breaks above the key resistance level of $17; otherwise, the asset may continue its sideways or downward momentum.

At press, LINK’s CMF (Chaikin Money Flow) value reaches -0.21, indicating that selling pressure is dominating the market and capital outflows are outweighing inflows.