Key Takeaways

- The Aster team has increased the token buyback rate from $5,000 to $7,500 per minute.

- Price action reveals that ASTER is trapped within a narrow range, and a major rally will only be possible if it clears the $1.25 level.

- Amid market uncertainty, long-term holders appear to be accumulating tokens. So far today, over $12.86 million worth of tokens have left exchanges.

It has been more than three weeks since Astar’s native token, ASTER, has continued to move sideways below a key support level. However, today’s token buyback update also failed to lift the asset’s price, raising questions about whether ASTER will continue its sideways momentum in the coming days or finally see an upward move.

Aster Token Buyback Soars

Recently, a crypto expert shared a post on X noting that the Aster team has increased their buyback rate from $5,000 to $7,500 per minute. If this pace continues and remains constant, it would amount to $450,000 per hour and $10.8 million per day.

So far, Aster has burned 50% of all buybacks, worth $5.4 million in ASTER tokens, which are now permanently removed from circulation each day.

Current Price Momentum and Rising Trading Volume

The impact of this token buyback update remains neutral on the asset’s price, even as the overall crypto market experiences upward momentum. According to the latest TradingView data, the asset is currently trading at $1.08, reflecting a 1.85% price dip today.

Despite the price continuing to move sideways within a narrow consolidation range, investors and traders have shown strong interest in the asset, as evident from the trading volume, which has surged 52% to $667 million.

Also Read: UK Launches First-Ever Crypto Investment Fraud Protection Campaign Targeting Men Under 45

ASTER Price Action and Critical Technical Levels

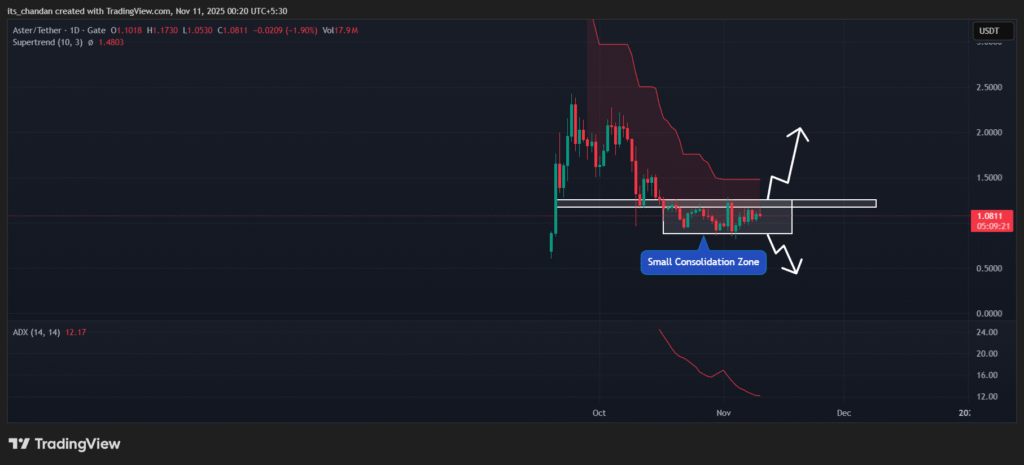

Looking at the current scenario, TimesCrypto’s technical analysis on the daily chart reveals that ASTER has been in a tight consolidation range between $0.88 and $1.255 since October 17, 2025, below a key resistance level.

During this period, ASTER has made multiple attempts to break out of this consolidation but has failed each time.

The current price action suggests that if the ASTER price fails to break out, it will likely continue moving sideways. However, a clear upward or downward momentum will only be possible if the asset exits the consolidation zone.

If the price surges and closes a daily candle above the $1.26 level, it could open the door for an upside rally. Conversely, a breakdown below the $0.88 level could trigger a sharp decline.

At press time, both technical indicators — the Average Directional Index (ADX) and Supertrend — continue to hold a bearish outlook.

On the daily chart, the Supertrend indicator remains in a red trend above the asset’s price, indicating that ASTER is in a downtrend. Meanwhile, the ADX value stands at 12.17, below the key threshold of 25, suggesting weak directional momentum in the asset.

$12.86 Million of ASTER Exit Exchanges

Despite the price struggling to gain momentum, data from the derivative platform Coinglass reveals that investors and long-term holders are showing strong interest in the asset.

According to the spot inflow/outflow data, exchanges across the crypto landscape have witnessed an outflow of $12.86 million worth of ASTER tokens so far today, indicating potential accumulation.

When combining the derivative data with the price action, it appears that ASTER has strong upside potential; however, the current market sentiment remains bearish for the asset.