Key Takeaways

- Hedera (HBAR) price action suggests that the asset is at a make-or-break level, where a further decline could lead to an additional 15% drop.

- HBAR’s bearish thesis would be validated only if the asset closes a daily candle below the $0.159 level, otherwise, it would be invalidated.

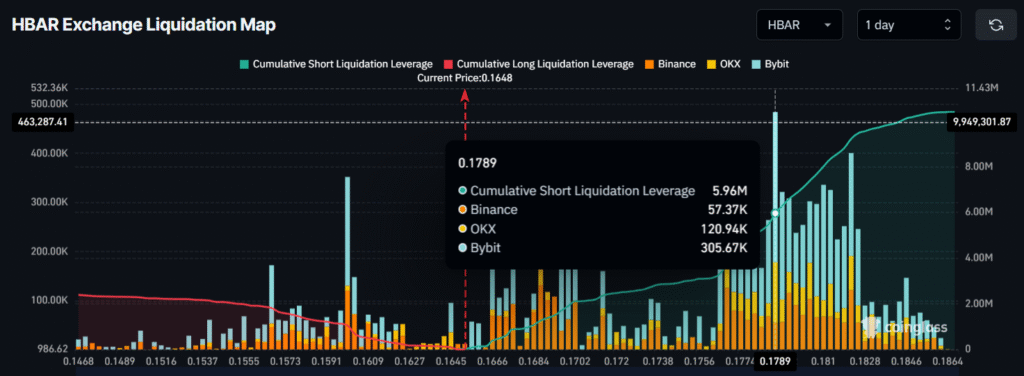

- Derivatives data reveals that traders are heavily betting on the bearish side, having opened $5.96 million worth of short positions.

The losing streak in Hedera (HBAR) continues for the fourth consecutive day, pushing the asset toward a key support level at $0.16. Market uncertainty and recent price action suggest that HBAR is likely to extend its bearish trend in the coming days.

Today, the token has dropped 5% and is trading around $0.166, hovering near its crucial support zone.

Hedera (HBAR) Technical Outlook: Upcoming Levels

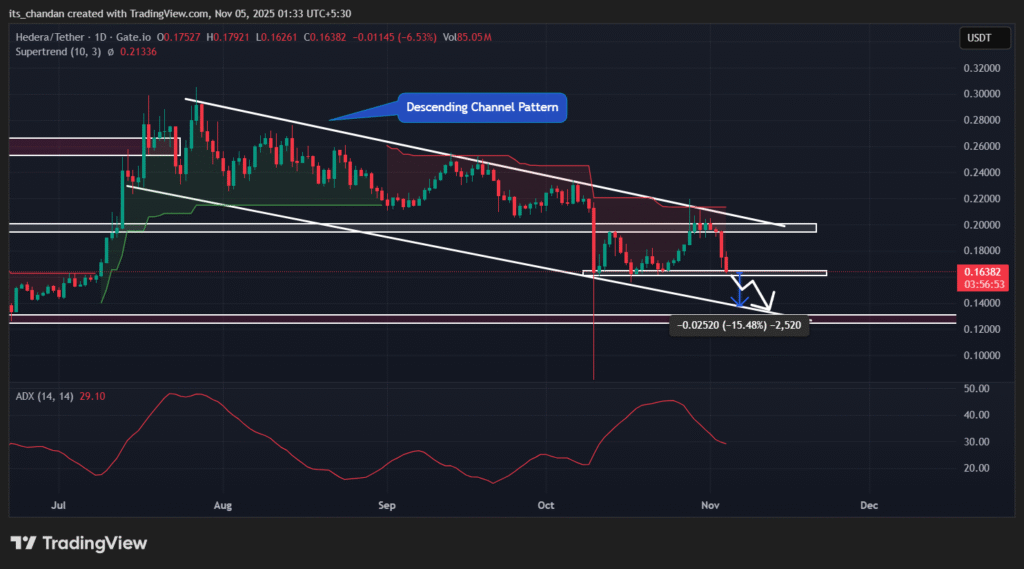

TimesCrypto’s technical analysis on the daily chart reveals that HBAR has been hovering within a bearish descending channel pattern since July 2025. However, the recent consecutive price declines have pushed HBAR to a key support level at $0.16, marking the fourth time the asset has approached this level.

Previously, whenever HBAR reached this key support, it witnessed a price reversal and upward momentum. But this time, market sentiment appears different, suggesting that the asset could breach this support level.

Based on the current price action, if HBAR fails to hold its support and closes a daily candle below the $0.159 level, it could extend its downside streak and witness another 15% decline, reaching the next support at $0.132. On the other hand, if HBAR manages to hold this level, a price reversal could be possible, with history potentially repeating as the price rebounds.

At press time, the HBAR Supertrend indicator continues to display a red trend and hovers above the asset price, suggesting that HBAR remains in a downtrend with strong selling pressure. Meanwhile, the Average Directional Index (ADX) value has reached 29.10, staying above the key threshold of 25, which indicates strong directional momentum in the asset.

HBAR’s bearish outlook has been further strengthened by derivatives data, which reveals that traders are increasingly following the current trend by heavily betting on the short side.

Also Read: Why is Crypto Down Today? BTC Breaks below $104K!

Bearish Outlook From Derivatives Tool

According to the derivatives tool Coinglass, today’s major liquidation levels stand at $0.16 on the lower side (support) and $0.1789 on the upper side (resistance), where traders appear to be over-leveraged.

If the current momentum continues and HBAR falls below $0.16, long positions worth $1.05 million could be liquidated. Conversely, if sentiment shifts and the price surges above $0.1789, it could trigger the liquidation of approximately $5.96 million in short positions.

As of press time, HBAR’s long/short ratio stands at 0.926, indicating strong bearish sentiment among traders. This confirms that bearish sentiment is currently dominating the asset.