Key Takeaways

- With a 0.55% price uptick, Tron (TRX) not only defies yesterday’s market dip but also sustains its breakout of a prolonged descending channel pattern.

- TRX is at a critical level; if it fails to clear $0.3010 resistance, it could see a price dip of 6.75%.

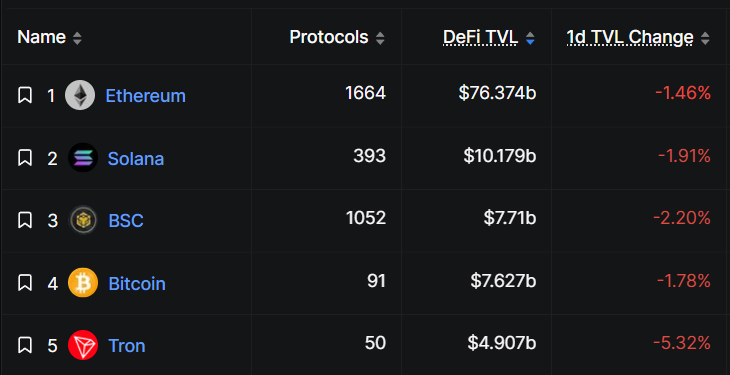

- Despite rising prices, Tron’s TVL dropped 5.32% today, higher than BTC, ETH, and SOL, raising concerns about a potential fakeout.

Tron (TRX) has sustained yesterday’s gains and continues its uptrend. Although the asset has broken out of its prolonged bearish trend, its declining Total Value Locked (TVL) and a key hurdle at $0.3010 remain red flags.

Tron (TRX) Defies the Market Trend

According to the latest TradingView data, TRX is trading at $0.298, up 0.555%. The increase in the asset’s price has attracted strong market participation, resulting in a 24% jump in trading volume, indicating heightened activity from traders and investors.

Amid TRX’s upside rally, a crypto expert shared a post on X, noting that $0.304 is a strong sell wall for the asset due to its past price history.

Exploring further, the on-chain analytics platform DeFiLlama reveals that Tron has weak fundamentals. According to the data, Tron’s TVL has dropped by 5.32% today, higher than Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), which recorded declines of 1.78%, 1.46%, and 1.91%, respectively. TVL measures the total value of assets locked within a protocol, reflecting overall liquidity, user confidence, and network growth.

Also Read: BTC bounces Within Falling Wedge on Key Day; $106K Eyed!

Tron (TRX) Price Action and Technical Analysis

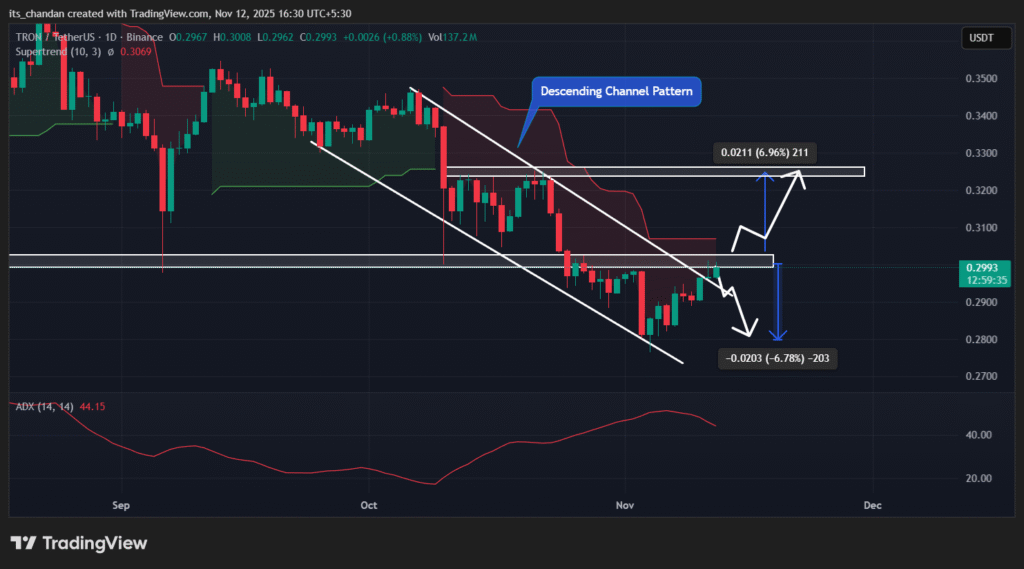

TimesCrypto’s technical analysis reveals that TRX has recently broken out of a prolonged descending channel pattern that began in October 2025.

However, the asset is currently facing resistance at the $0.3010 horizontal level, which has a history of price reversals. The question now is whether this breakout is a fakeout or if the price will continue to rise.

As per the current price action, if TRX continues to rise and closes a daily candle above the $0.3040 level, it could see a further price jump of around 7%, potentially reaching $0.325.

On the other hand, if TRX fails to breach this key resistance level, it could experience a price dip of 6.75%, potentially dropping to the key support at $0.28 in the coming days.

Currently, TRX’s Supertrend indicator remains in a red trend above the asset’s price, suggesting a downtrend with strong selling pressure. Meanwhile, the Average Directional Index (ADX) has reached 44.15 (well above the key threshold of 25), indicating strong directional momentum, which hints that the current trend could continue in the near term.