Key Takeaways

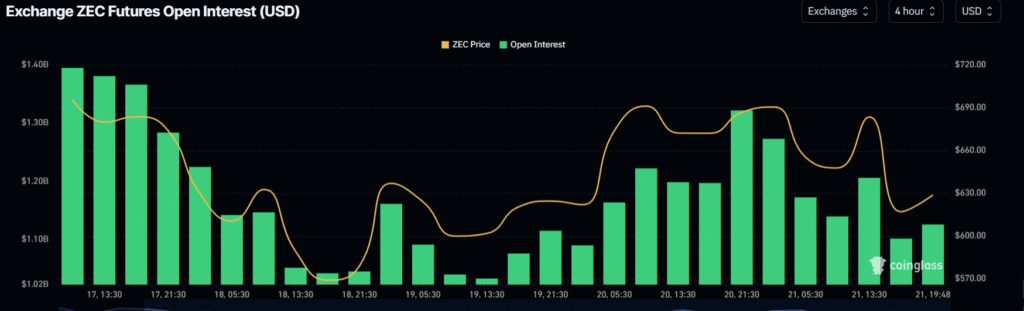

- Zcash (ZEC) Open Interest (OI) dipped 15.49% to $1.14 billion from Thursday’s high of $1.35 billion.

- ZEC is trading at $615, down 5.35% today amid a shift in market sentiment.

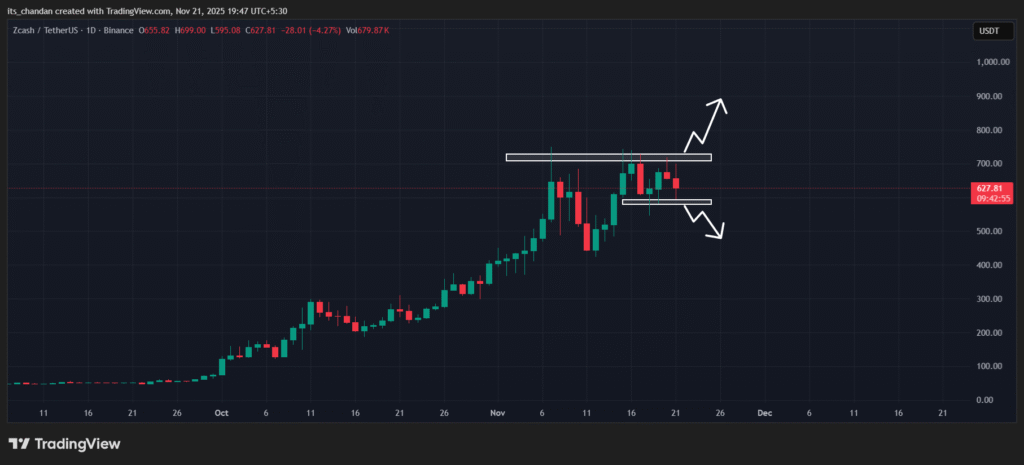

- Price action suggests a major ZEC rally would only be possible if it breaks out of the $575.90–$700 range.

After briefly defying the market trend, privacy-focused cryptocurrency Zcash (ZEC) has fallen in line with the current trend, down 5.35% today. The price dip occurred after hitting its key resistance level of $711, a level historically associated with price reversals.

Despite the price continuing to decline, the asset has attracted strong interest from crypto experts, as highlighted on X. One well-known expert also noted on X that ZEC could soon reach $1,000. Meanwhile, BitMEX co-founder and former CEO Arthur Hayes has expressed interest in the ZEC token as well.

Zcash (ZEC) Price Action and Upcoming Levels

As of press time, ZEC is trading at $615, down 5.32% today, according to TradingView data.

The asset’s price decline has altered the market structure. Yesterday, a previously formed bullish pattern appeared to have been invalidated. ZEC has formed a bearish inverted hammer candlestick pattern at the key resistance level of $711, and it has been continuously declining since then.

TimesCrypto’s technical analysis of the daily chart reveals that ZEC still has local support at the $575.90 level, which may prevent further price declines. Based on the current price action, if ZEC holds above this support, there is a strong possibility that it could continue moving sideways between $575.90 and $700, a range it has been trading in since November 15, 2025.

However, a major ZEC rally could happen if it breaks out of the $575.90 and $700 levels.

Also Read: Bears Eye “Golden Fibonacci Ratio”; What Does it Mean for BTC Price?

Coinglass Flashes Bearish Signal

On-chain analytics platform Coinglass reveals that ZEC’s bearish pressure is reinforced by a 15.49% fall in Open Interest (OI) to $1.14 billion, indicating weakening trader confidence and a potential continuation of the downward trend in Zcash’s price.

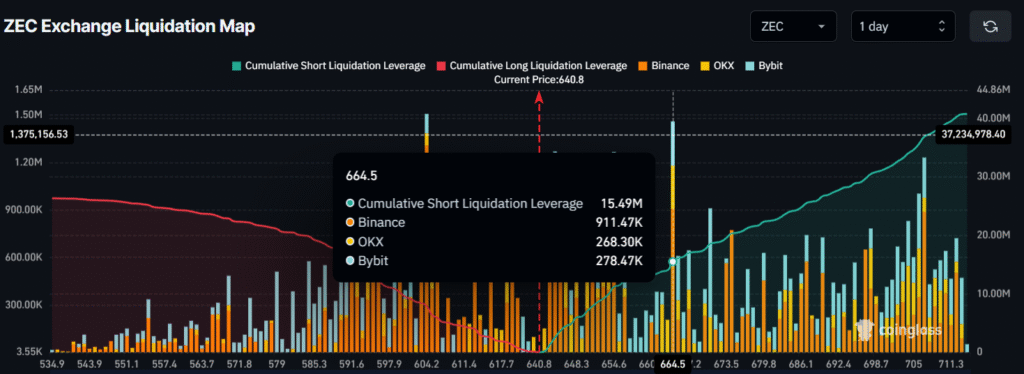

Meanwhile, traders are strongly following the current trend by betting on short positions. According to Coinglass data, ZEC’s major liquidation levels currently stand at $604.2 on the lower side and $664.5 on the upper side. At these levels, traders have built $7.89 million worth of long positions versus $15.49 million worth of short positions.

Falling OI, bearish price action, and strong short interest suggest ZEC may face a challenging phase in the coming days.