Key Takeaways

- Hong Kong has approved the world’s first Solana ETF, launched by asset manager ChinaAMC.

- The ChinaAMC product will begin trading on October 27 with a $100 minimum investment.

- This marks Hong Kong’s third spot crypto exchange-traded fund (ETF) approval, following Bitcoin and Ethereum products.

Table of Contents

A Tactical Step in Global Crypto Competition

In a significant development for digital asset markets, Hong Kong has approved the world’s first Solana ETF, launched by fund manager ChinaAMC. The product, set to begin trading on October 27, represents Asia’s first Solana-focused exchange-traded fund (ETF) and positions Hong Kong ahead of United States regulators in the emerging crypto ETF space.

The ChinaAMC spot offering will be physically backed by SOL tokens, providing investors with direct exposure to Solana’s price performance through traditional financial channels.

Read also: Promising SOL Strategies Set for Nasdaq Debut, Boosting Solana’s Institutional Profile

Expanding Hong Kong’s Digital Asset Ecosystem

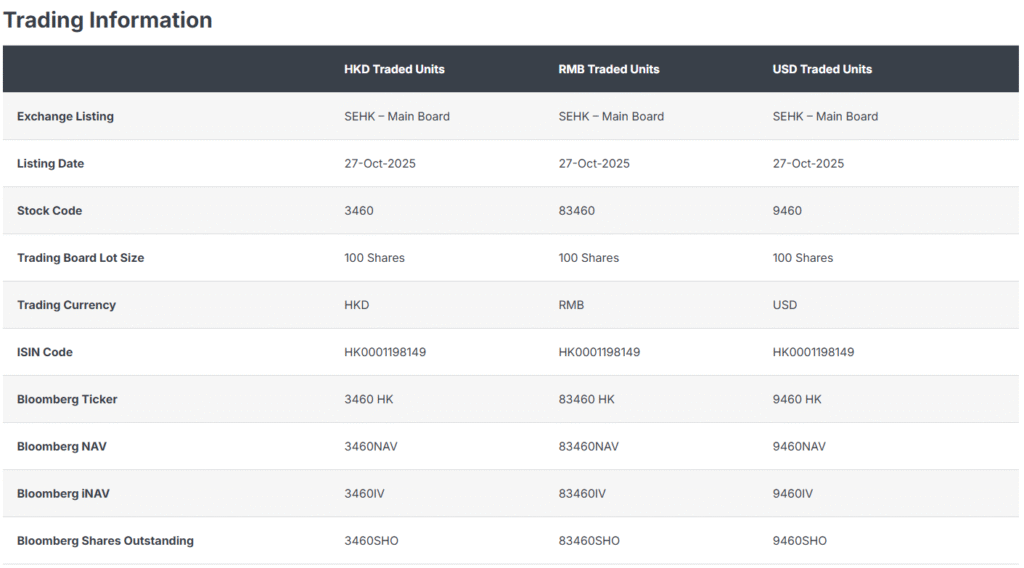

The approval of the first Solana ETF strengthens Hong Kong’s strategic position as Asia’s premier digital asset hub. The ChinaAMC product will support trading in Hong Kong dollars, yuan, and U.S. dollars, appealing to both institutional and retail investors with a minimum investment threshold of a relatively low $100.

This follows the approval of spot Bitcoin and Ethereum ETFs by Hong Kong in April 2024 and shows how, despite growing regulatory scrutiny from Beijing, the city continues to add to its crypto investment options.

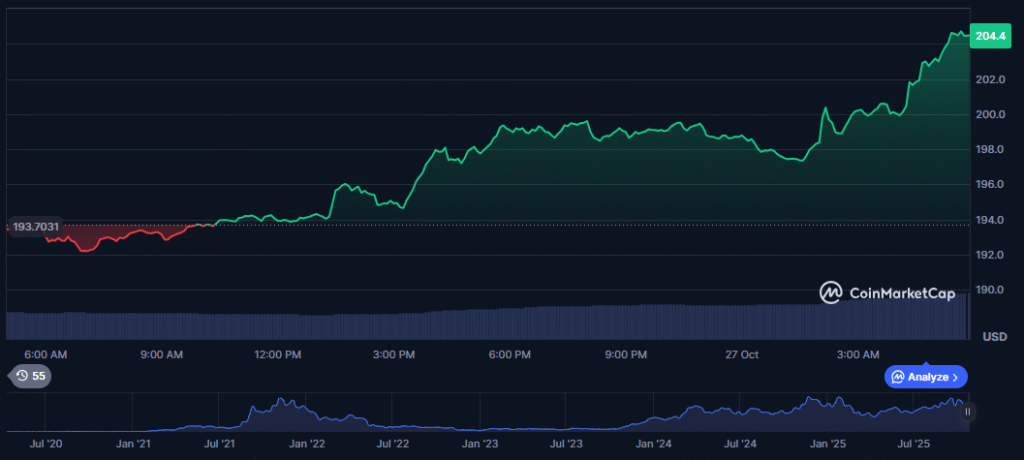

Following the U.S.-China tariffs talks and the ETF news, Solana (SOL) price surged 5.65% in the 24-hour time frame to $204 at the time of writing.

Read also: Gemini Solana Credit Card Offers 4% Spending Rewards & 6.77% Staking Yield

A Milestone for Solana and Crypto Adoption

With the inaugural Solana ETF, the Solana ecosystem receives an enormous stamp of validation, having grown into one of Ethereum’s foremost competitors since its inception in 2017. While the ChinaAMC prospectus appropriately cautioned investors about Solana’s volatility, noting its 42.28% single-day drop in 2022, the ETF approval nonetheless signals growing institutional acceptance of alternative layer-1 blockchain networks beyond the two largest crypto assets.

FAQs

When does the first Solana ETF begin trading?

The ChinaAMC Solana ETF is scheduled to begin trading on October 27, 2025, following its approval by Hong Kong’s Securities and Futures Commission.

How does this compare to U.S. crypto ETF approvals?

Hong Kong has now approved spot ETFs for Bitcoin, Ethereum, and Solana, while the U.S. has only approved Bitcoin spot ETFs, putting Hong Kong ahead in the diversification of crypto investment products.

What are the investment requirements?

The ChinaAMC Solana ETF has a minimum investment threshold of approximately $100, making it accessible to both retail and institutional investors through traditional brokerage accounts.

For more ETF-related stories, read: Solana ETF $SSK Smashes $33M Debut: Staking Rewards Fuel Institutional Demand