Key Takeaways

- The share of XRP supply in profit has fallen to 58.5%, the lowest level since November 2024.

- Current price action suggests that if XRP sustains above the $2.17 level, it may see an uptick of over 18% and reach the $2.65 level.

- Intraday traders are strongly betting on long positions; over the past 24 hours, they have opened $95.26 million worth of longs at $2.105.

XRP supply profitability continues to decline, with only 58.5% of token holders currently in profit. This marks the lowest level since November 2024, when XRP traded near $0.53, far below today’s $2.21, according to on-chain analytics platform Glassnode.

Despite XRP surging more than 4× from $0.51 in October 2024 to a peak of $3.66 in July 2025, overall profitability has unexpectedly dropped.

The key catalyst behind this decline is the growing number of late entrants who bought XRP at higher price levels. These holders are now sitting on losses, creating a fragile market structure. If XRP’s price drops further, these late buyers may panic-sell, potentially triggering a much larger downside move.

XRP Price and Shift in Market Sentiment

Besides the decline in XRP holders’ profitability, today’s broader crypto market recovery has helped the asset reclaim a key level.

According to the latest TradingView data, XRP is currently trading at $2.22 after recording a 2.95% daily uptick. As the price climbed, market participation also increased notably, reflected in the asset’s trading volume, which jumped 25% to $6.77 billion.

With the current momentum, the XRP price has shown signs of recovery, a pattern the asset has repeated multiple times in the past, including on October 16, 2025, and November 4, 2025.

Also Read: Bitcoin Bears Poke $91,500, Gold Rebounds amid Upbeat U.S. Data

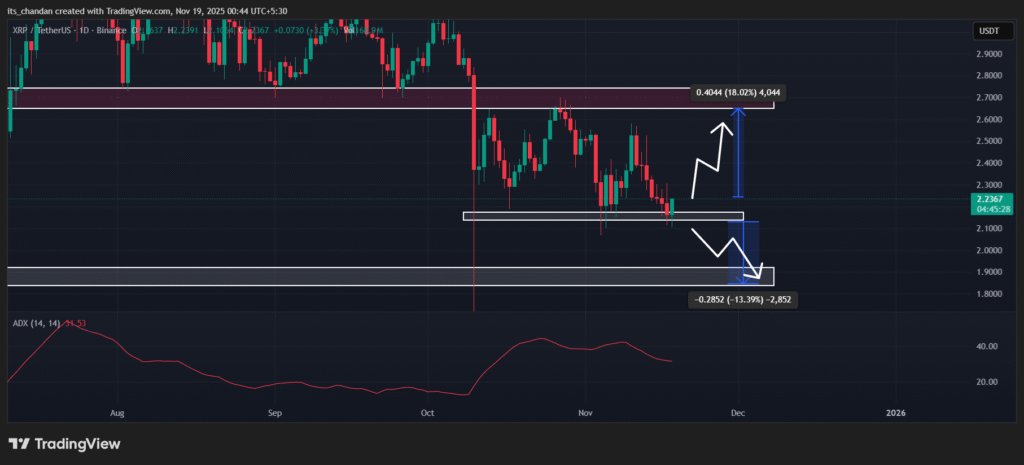

XRP Price Action and Technical Analysis

TimesCrypto’s technical analysis on the daily chart reveals that XRP is in a downtrend, but since October 10, 2025, it has been hovering within a small consolidation zone between the $2.17 and $2.65 levels.

With the recent price decline, XRP has now reached the lower boundary of this range — a level that has historically triggered price reversals.

The current price action suggests that if XRP sustains above the $2.17 level, it could see an impressive recovery and potentially climb back to $2.60 or even $2.65, as it has done in the past. However, if XRP fails to hold this level, it could face a 13% decline and drop to the key support at $1.845 in the coming days.

As of press time, XRP’s Average Directional Index (ADX) has reached 31.53, indicating strong directional momentum in the asset.

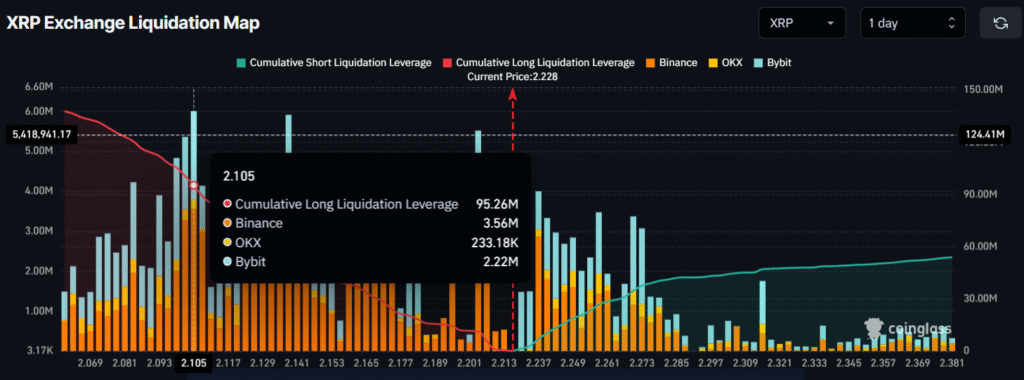

Coinglass Reveals Traders’ Sentiment Turning Bullish

With improving price action, on-chain analytics platform Coinglass reveals that traders have begun following the current trend, as bets on long positions continue to rise.

According to XRP’s exchange liquidation map, the asset’s major liquidation levels currently stand at $2.105 on the lower side and $2.315 on the upper side.

At these levels, traders have built $95.26 million worth of long positions and $47 million worth of short positions, which clearly indicates that bulls are currently dominating the asset.