Key Takeaways

- With today’s 8.55% price dip, XRP has broken down from its prolonged consolidation and has now opened the door for further downside.

- Price action suggests that XRP could see a further 14% decline toward the $1.85 level, but only if it remains below the $2.135 mark, allowing bears to maintain control.

- Traders’ bets on short positions have skyrocketed, with $102.43 million in new shorts added today, as traders expect XRP to remain below the $2.178 level in the near term.

After facing strong selling pressure on November 19, 2025, XRP now appears to be stabilizing as the asset posts a decent gain today. However, the recent breakdown, which opened the door for further downside, remains intact, with XRP still hovering below its key support level.

The cooling selling pressure is not limited to XRP as it is being observed across the broader crypto market as well. Major assets like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) have recorded modest gains of 0.70%, 0.25%, and 4.75%, respectively.

XRP Price and Rising Volume

XRP price is currently trading at $2.13, having posted a modest 1.25% price increase today. Meanwhile, investors and traders are showing strong interest in the asset, as reflected in the trading volume, which has surged 32% to $6.1 billion.

Rising trading volume during a price rally suggests that market participants are showing strong interest in the asset’s upward momentum.

Traders Built $102 Million in Short Positions

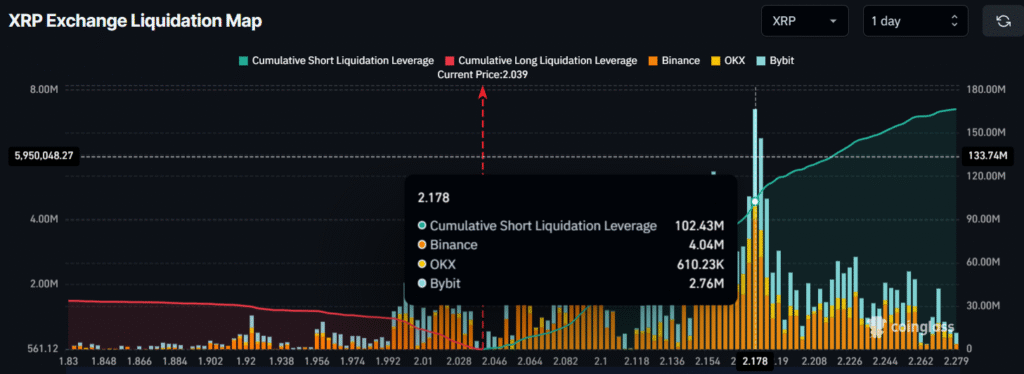

Given the current market sentiment, the on-chain analytics platform Coinglass reveals that traders are closely tracking the broader trend, as bets on short positions continue to rise.

According to the data, XRP’s key liquidation levels stand at $2.004 on the lower side and $2.178 on the upper side.

At these levels, traders have built $16.76 million worth of short positions and $102.43 million worth of long positions, suggesting that bullish dominance is fading while bears are currently in control of the asset.

Also Read: U.S. Crypto Bill Moves Forward With Senate Vote Planned for Early Next Year; Will It Pass?

XRP Spot ETFs Inflow Declines

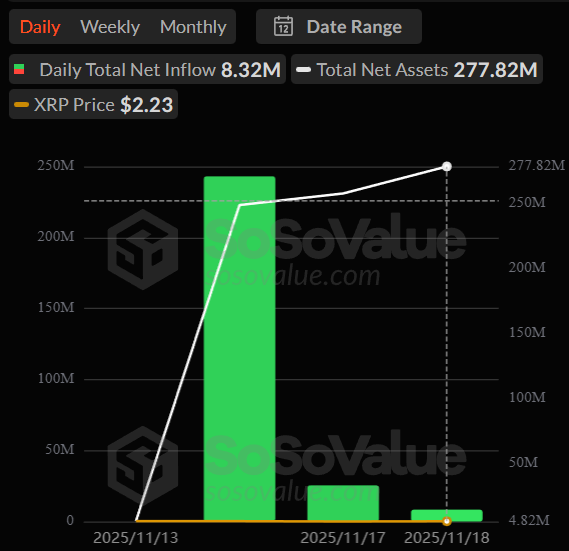

In addition, demand for U.S. XRP Spot ETFs also appears to be cooling, as inflows continue to decline.

According to the on-chain analytics platform SoSoValue, the market has recorded inflows for three consecutive trading days, but the amounts have steadily decreased.

Over the past three trading sessions, Spot ETFs saw inflows of $243.05 million, $25.41 million, and $8.32 million — indicating fading interest from Wall Street investors.

XRP Price Action and Technical Analysis

TimesCrypto’s technical analysis on the daily chart reveals that XRP is in a downtrend and has recently exited a prolonged consolidation zone, which it had been holding since October 10, 2025, between the $2.135 and $2.65 levels.

The asset has already closed a daily candle below this consolidation zone, suggesting a successful breakdown, and today it appears to be retesting the breakdown level.

Based on the current price action, if the XRP remains below the $2.135 level, it could see a further decline of 14% and may reach the $1.85 level. This is due to a potential shift from bullish to bearish dominance following the consolidation breakdown. However, if it reclaims the level, bears may exit, ending the bearish outlook.

As of press time, both technical indicators — Chaikin Money Flow (CMF) and the Average Directional Index (ADX) — are strengthening the bearish outlook. On the daily chart, the CMF has dropped to -0.10, indicating sustained selling pressure and weakening buyer inflows. Meanwhile, the ADX has climbed to 31.88, signaling strong directional momentum in the asset.