Key Takeaways

- Whales have collectively purchased 132.05 million ASTER tokens, worth $302.03 million, in the last 24 hours.

- Aster’s TVL and revenue continue to rise, reaching new peaks.

- Price action hints at a potential correction before the next leg up.

In recent days, Aster (ASTER) has made waves in the crypto landscape, thanks to its performance and whale participation. However, today the sentiment seems to be turning toward a correction phase, as the overall crypto market tumbled by 1.38% to $3.83 trillion, with the impact evident on ASTER’s price.

This shift in the overall market has dragged ASTER’s price down by 8% over the past 24 hours. The asset is currently trading near the $2.07 level, with a 10% decline in trading volume also recorded.

Whales Scoop $43M of ASTER Tokens

Despite the ongoing decline, whales’ interest in the asset continues to grow, with data suggesting they are on a buying spree.

Crypto transaction tracker Lookonchain shared multiple posts showing whales’ recent purchases. In total, whales have collectively acquired 132.05 million ASTER tokens, worth $302.03 million, across different exchanges, including Binance, Gate.io, and Bybit, over the past 24 hours.

This continuous buying activity hints at the whales’ strong confidence in ASTER and its long-term potential.

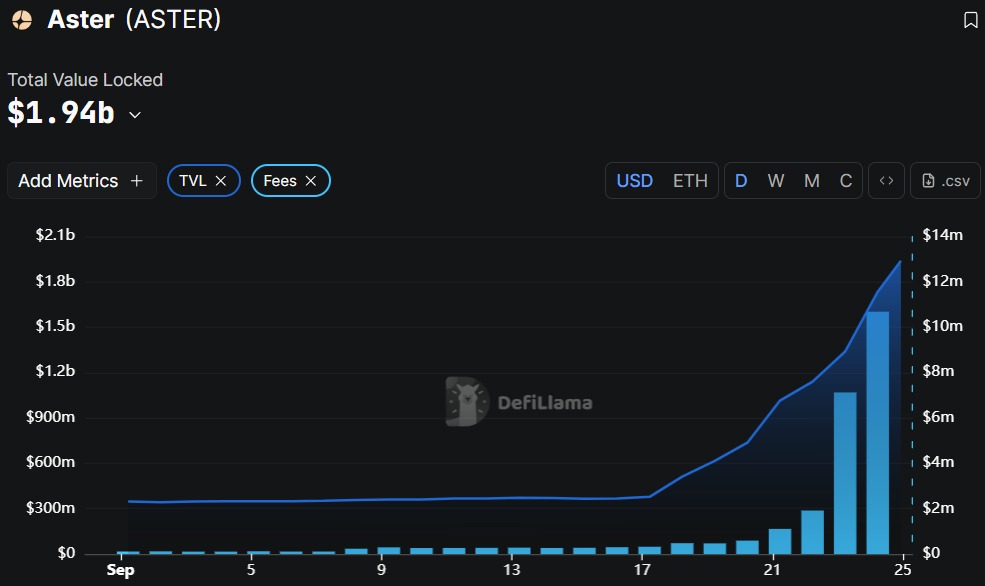

Rising TVL and Revenue

The key catalyst behind whales’ strong interest is Aster’s rising revenue and Total Value Locked (TVL).

On-chain analytics tool DeFiLlama reveals that over the past 72 hours, Aster has experienced a surge in TVL, increasing from $1.14 billion to $1.94 billion, while revenue has jumped from $1.92 million to $10.68 million.

The strong participation of whales, combined with robust fundamentals, suggests that Aster could experience further price appreciation in the coming days.

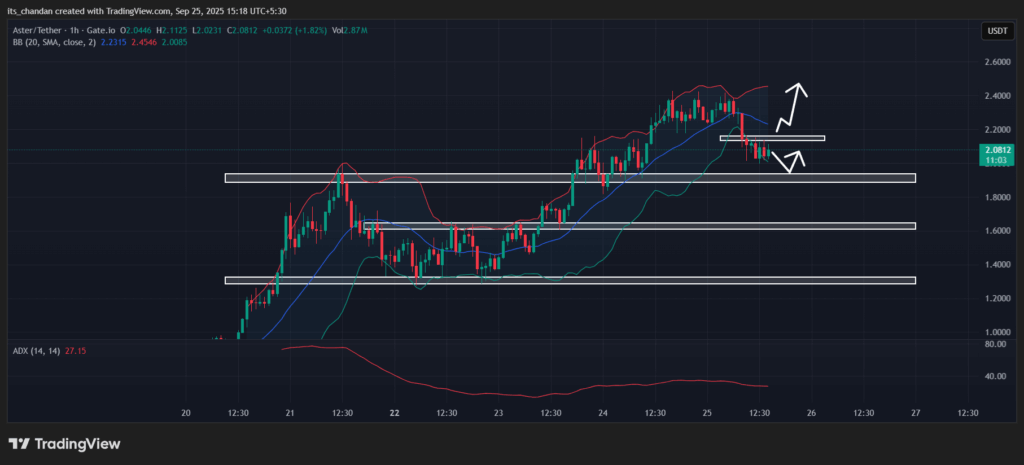

Aster (ASTER) Price Action and Technical Analysis

TimesCrypto’s technical analysis suggests that ASTER is currently undergoing a correction and may face a short-term downside move before the next leg up. On the hourly chart, the asset appears to be moving sideways near the lower boundary of the Bollinger Bands, which suggests it is in oversold territory. This indicates that a potential recovery could be on the horizon.

Based on the current price action, an upside rally is only possible if the price clears the $2.16 level, otherwise, it may drop to the local support at $1.92 before a rally begins.

At press time, ASTER’s Average Directional Index (ADX) value has reached 27, above the threshold of 25, indicating a strengthening trend and the potential for continued volatility in the price action.

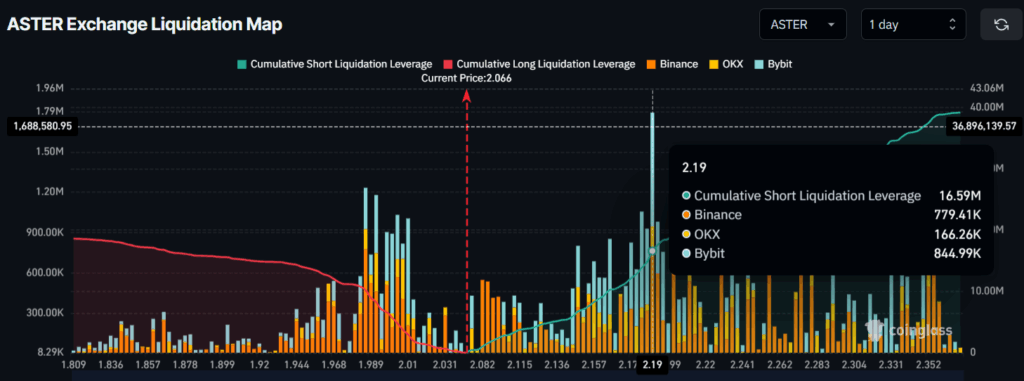

Trader Sentiment

Given the current market sentiment, traders appear to be following the broader trend, as bets on short positions have skyrocketed over the past 24 hours. Coinglass, an on-chain analytics tool, reveals that ASTER’s major liquidation levels, where traders have been heavily betting, stand at $1.98 on the lower side (support) and $2.19 on the upper side (resistance).

At these levels, traders have built $10.21 million worth of long positions and $16.59 million worth of short positions. This metric clearly highlights the current sentiment, which appears to be bearish.