Key Takeaways

- Whales have added 4.66 million ASTER tokens ($4.79M) despite the ongoing price decline.

- The primary factors driving ASTER’s price lower are the current market sentiment and weak fundamentals.

- ASTER’s upward momentum could only resume if the asset reclaims the $1.20 level; otherwise, it may continue its downtrend.

With today’s 7% price dip, Aster (ASTER) has extended its losing streak, breaking below the key $1 support level. Despite the continued price decline, whales have shown strong interest in the asset as they appear to be accumulating tokens.

Whales’ Strategic Accumulation Amid Dip

Today, on-chain analytics platform TheDataNerd revealed that three new wallets withdrew a total of 4.66 million ASTER tokens worth $4.79 million from Binance. This accumulation was recorded at an average price of $1.02.

This shows that the whales’ massive accumulation has failed to trigger a price rebound, as strong seller dominance continues to prevail.

Also Read: ASTER on Whales Radar: Analyst Predicts $4 Upside in November

Current Price and Rising Volume

Despite the whales’ potential accumulation, ASTER has lost 7% of its value and is currently trading at $0.98, according to TradingView data. However, market participants have shown strong interest in the asset, as reflected in the trading volume, which surged 32% to $815 million, according to CoinMarketCap data.

Typically, when trading volume rises during a sharp price decline, it suggests that most market participants are more interested in driving the price lower. Currently, this appears to be a bearish sign for token holders, raising concerns about a possible further downward continuation.

Key Drivers Behind ASTER’s Persistent Price Drop

Despite massive whale accumulation, ASTER’s price continues to decline, leaving many wondering what’s driving it lower. The primary factor appears to be the bearish market sentiment, but the real blow comes from its steadily weakening fundamentals.

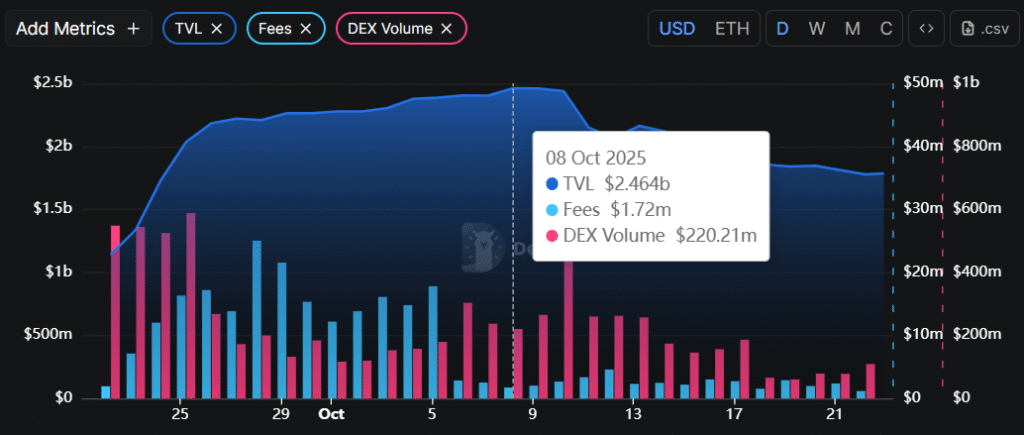

According to DeFi aggregator DeFiLlama, Aster’s Total Value Locked (TVL) has continued to decline, plunging from $2.464 billion to $1.788 billion between October 8 and October 23, 2025.

Along with the TVL, the protocol’s revenue and DEX volume have also dropped significantly, falling from $1.72 million to $1.17 million and from $220 million to $109.06 million, respectively, during the same period.

However, over the past few days, DEX volume has been rising slightly, though not enough to have a significant impact on ASTER’s price.

Aster (ASTER) Technical Analysis and Key Levels to Watch

TimesCrypto’s technical analysis reveals that ASTER has turned bearish and may continue its downward momentum until it reclaims the $1.20 level, which has now turned into resistance.

Based on the current price action, if the asset remains below $1.20, it could face significant downside momentum. However, if ASTER reclaims this support level, it could return to its bullish trend and continue its upward movement.

As of now, ASTER’s Average Directional Index (ADX) has reached 19.11, which is below the key threshold of 25, indicating weak directional momentum.

Combining the price action, fundamentals, and whale activity, it appears that ASTER has strong long-term potential; however, the short-term outlook seems bearish due to a lack of interest and confidence in the asset.