Key Takeaways

- Avalanche (AVAX) rises 12%, reaching an eight-month high of $33.

- Price action suggests AVAX has opened the path for a potential 36% rally.

- Over the past 24 hours, AVAX’s trading volume surged by 190%.

With a 12% price uptick, Avalanche (AVAX) has topped the crypto market, reaching an eight-month high of $33. This strong rally has turned the asset bullish and opened the path for a further significant price increase.

Why is the Avalanche (AVAX) Price Rising?

You might be wondering what triggered Avalanche’s strong rally. The answer is the launch of KRW1, a fully centralized, Won-backed stablecoin powered by Avalanche, together with BDACS, a South Korean digital asset custody service provider, and supported by Woori Bank.

Avalanche, in a post on X, stated that this project, currently in a pilot phase following a full PoC, marks an important step toward regulated, bank-integrated digital money in Korea.

In addition, another catalyst behind AVAX’s upside rally is the Fed’s 25 bps rate cut, which shifted broader market sentiment.

Current Price and Surge in Trading Volume

Currently, AVAX is trading near $33.20 and has surge by 12% over the past 24 hours. According to CoinMarketCap data, this notable price uptick was recorded following the KRW1 announcement.

Meanwhile, investor and trader participation during this period has skyrocketed, resulting in a 190% increase in trading volume compared to the previous day.

This notable surge in trading volume, observed during the asset’s strong rally, indicates that market participants are more interested in the asset and its upside momentum. Essentially, it is a bullish sign for AVAX.

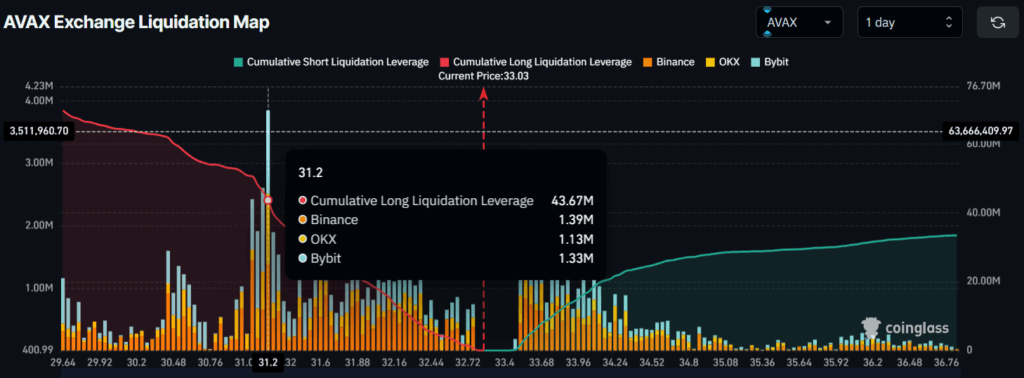

Traders Strongly Believe in $31.20 Level

Amid this, on-chain analytics tool Coinglass reveals that traders have gone heavily into long positions. According to the data, AVAX’s major liquidation levels, where traders are over-leveraged, are at $31.20 on the lower side and $33.56 on the upper side.

At these levels, they have built $43.67 million worth of long positions and $3.55 million worth of short positions.

This makes it clear that bulls are dominating and also shows their belief that AVAX’s price is unlikely to fall below the $31.20 level anytime soon.

AVAX Technical Outlook: Upcoming Levels to Watch

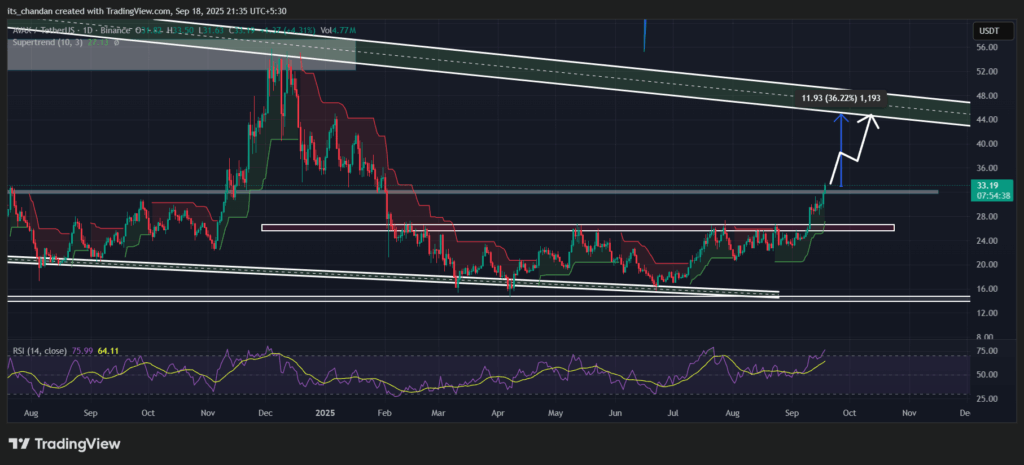

According to TimesCrypto’s technical analysis, AVAX appears bullish and is poised for further price gains. Its recent 12% uptick triggered a resistance breakout that had formed in February 2025. On the one-day time frame, the AVAX chart looks clean, showing no immediate hurdles.

Based on current price action, if the asset sustains above the $32 level, there is a strong possibility that AVAX could see a 36% price surge and may reach the $44 level, which holds trendline resistance.

Adding to the bullish strength, AVAX’s Supertrend indicator continues to hold its green thread, trading below the asset price. This shows that AVAX is in an uptrend with strong buying pressure.

However, the Relative Strength Index (RSI) value reached 75, indicating that AVAX is currently overbought and may face a short-term pullback.