Key Takeaways

- Avalanche (AVAX) price action shows a bearish outlook, hinting at a potential 10% dip on the horizon.

- The AVAX bearish outlook would only be triggered if the price falls below $30; otherwise, it is invalidated.

- Avalanche’s TVL, DEX volume, and daily active addresses have shown a strong increase since September.

With a 4.5% price dip, Avalanche (AVAX) price action has turned cautious, signaling a red flag for the asset and hinting at a potential correction. This shift in market sentiment on the daily chart comes even as metrics like DEX volume, Total Value Locked (TVL), and daily active addresses continue to show Avalanche’s strength.

AVAX Price Action and Key Levels

At press time, AVAX remains steady at $30, with a lack of participation recorded over the past 24 hours, as reflected in its trading volume. Data from CoinMarketCap shows that the asset’s trading volume has dropped by 35% to $881 million.

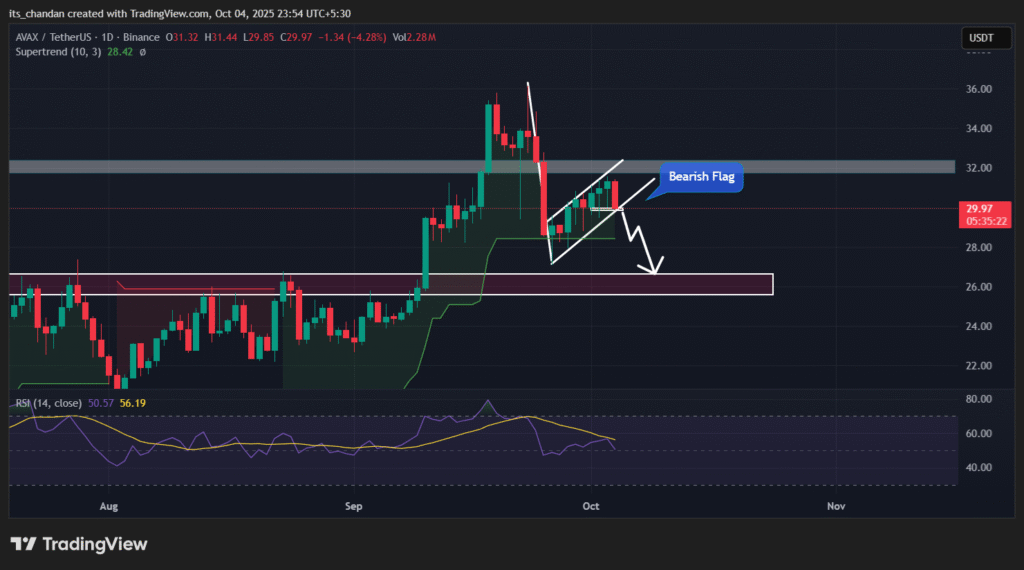

AVAX’s price decline and the current level appear to be key points for the asset. According to TradingView’s daily chart, the asset has formed a bearish flag pattern and is on the verge of a breakdown.

Based on current market sentiment, if AVAX continues to decline and closes a daily or four-hour candle below the $30 or $29.50 level, it could trigger a potential 10% price drop and reach the $26 level before the next leg up.

Technical Indicators

At press time, AVAX’s Supertrend indicator continues to display a green trend and remains below the asset’s price, indicating that AVAX is still in an uptrend with strong buying activity.

Meanwhile, the Relative Strength Index (RSI) has reached a value of 51, indicating that the asset is neither in overbought nor oversold territory but rather in a neutral zone, suggesting that the market is currently stable and waiting for a clear direction. Despite the weak price action, Avalanche still shows strong fundamentals, suggesting that a reversal could be possible if market sentiment shifts.

Strong Fundamentals Support Long-Term Upside

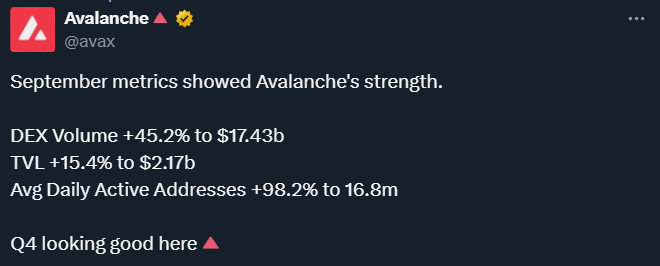

In a post on X, Avalanche revealed its September 2025 metrics, highlighting a significant 45.2% surge in DEX volume to $17.44 billion. It also shows a 15.4% increase in TVL to $2.17 billion, and a notable 98.2% spike in daily active addresses to 16.8 million.

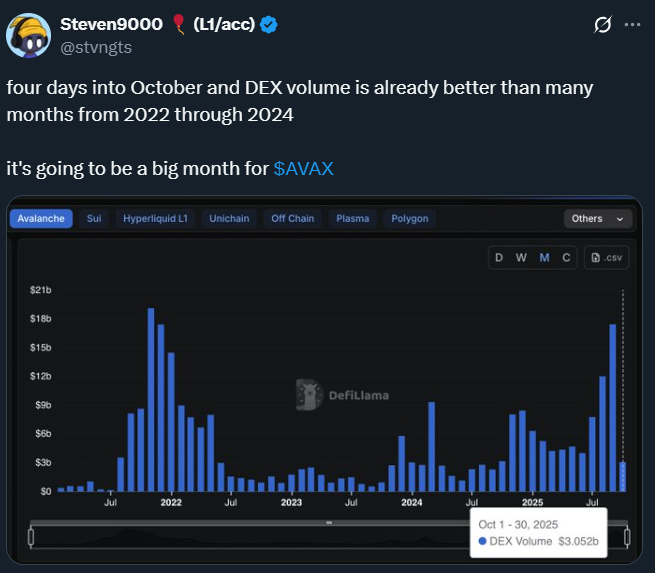

Highlighting Avalanche’s strong fundamentals, a crypto expert shared a post on X, noting that it is only four days into October and AVAX’s DEX volume has already surpassed many months from 2022 through 2024. The expert suggests that the current month could be a significant one for the asset.

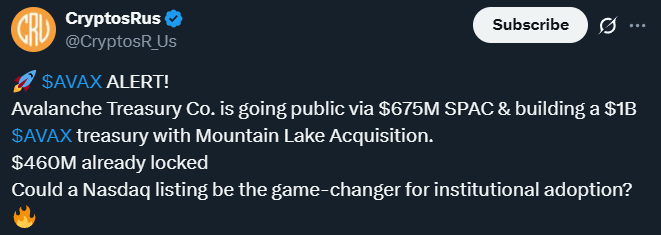

Adding to the bullish outlook, Avalanche plans to purchase more than $1 billion worth of AVAX tokens once its treasury company goes public through a merger with Mountain Lake Acquisition Corp., which is expected to list on Nasdaq in the first quarter of 2026 under the ticker symbol, “AVAT.”

Such strong fundamentals suggest that AVAX’s long-term market sentiment is bullish, with significant upside potential.

Read More: ADA, SUI, HYPE, XLM & 17 Other Altcoin ETFs Filed with SEC