Key Takeaways

- With an 8.50% price jump, BNB has flipped XRP in terms of market cap, becoming the third-largest crypto asset.

- Amid the price uptick, traders holding short positions were hit the hardest, with $17.43 million in shorts liquidated over the past 24 hours.

- Price action suggests that if the upside momentum continues, BNB could reach the $1,504.78 level in the future.

BNB, the native token of the Binance ecosystem, is making waves with its impressive performance. Today, following an 8.50% price uptick, BNB crossed the $1,300 mark for the first time and reached an all-time high of $1,349, according to TradingView data.

BNB Flips XRP and Defies Market Trend

BNB’s impressive rally has not only outperformed major assets, including Bitcoin (BTC) and Ethereum (ETH), but has also flipped XRP and Tether to become the world’s third-largest crypto by market cap.

According to CoinMarketCap data, BNB is currently trading at $1,309, with a market cap of $182.32 billion, ranking third after Bitcoin and Ethereum, which have market caps of $2.49 trillion and $572.88 billion, respectively.

BNB Registers $17.43 Million Short Liquidations

Binance Coin’s upside momentum has hardly impacted traders holding short positions. According to Coinglass, BNB’s strong upward move has accelerated short liquidations as it continues to climb into uncharted price levels.

According to Coinglass data, BNB has recorded a staggering $19.73 million in liquidations over the last 24 hours. Of this, the majority came from short positions, totaling $17.43 million, while $2.30 million worth of long positions were liquidated.

The recent BNB price uptick may raise questions among crypto investors about what is driving the asset’s crazy move, why its upward momentum is continuing, and how long the asset can sustain this movement in the coming days.

BNB Chain’s Strong Fundamentals

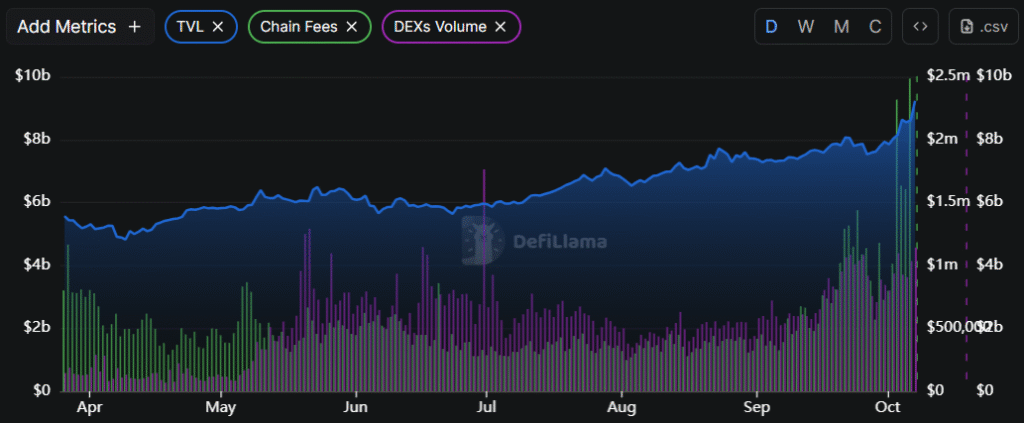

According to the data aggregator DeFiLlama, BNB Chain’s DeFi activity has surged significantly in 2025, especially in October. Data shows that the network’s Total Value Locked (TVL) has now reached $9.238 billion, the highest since May 2025. At the same time, DEX trading volumes have increased from $3.204 billion to $4.141 billion, while chain fees have risen from $798,159 to $2.48 million since the beginning of October 2025.

This strong growth signaling heightened user activity and strong capital inflows into BNB-based protocols. This rise in on-chain engagement aligns with BNB’s recent price rally, reflecting renewed investor confidence and growing participation across the ecosystem.

BNB Price Action and Key Levels To Watch

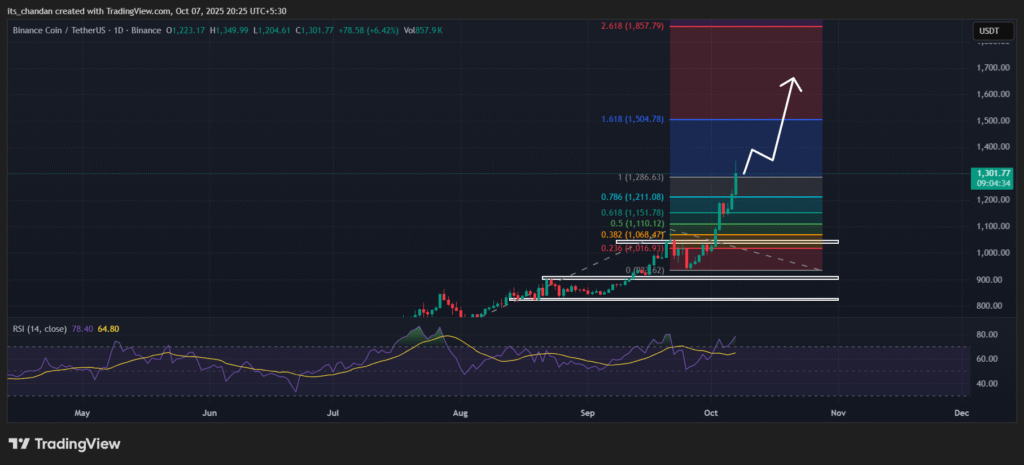

According to TradingView, BNB’s daily chart shows an uptrend for the price trajectory. However, due to a lack of historical data, forecasting the asset’s upcoming levels appears challenging.

Amid this, the Trend-based Fibonacci Extension, a technical analysis tool that uses the Fibonacci sequence to project potential price targets beyond a previous trend, suggests that BNB’s price could reach $1,504.78 and $1,857.79 in the coming days.

Besides these bold predictions, BNB’s technical indicator, the Relative Strength Index (RSI), has reached 78.39, indicating that the asset is in overbought territory and could see a short-term correction before the next leg up.

Read More: Kazakhstan Buys BNB for State Crypto Fund, Price Soars 5%