Key Takeaways

- Bitcoin’s price posted a sharp decline following U.S. President Trump’s remark that the planned meeting with China’s President may not happen.

- BTC price fell steeply from $114,000 to the $108,500 level, reaching a make-or-break point.

- Price action suggests that if BTC fails to hold above the $107,500 level, it could drop toward the $100,000 level in the near future.

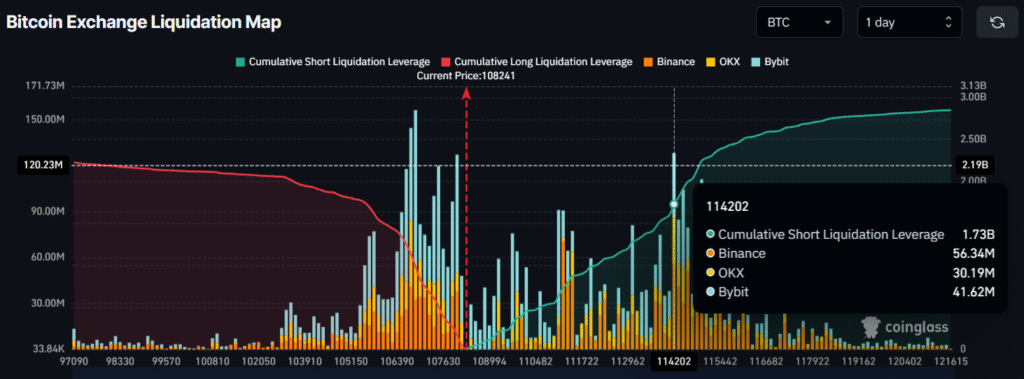

- Traders’ sentiment has turned bearish, with $1.73 billion worth of short positions opened around the $114,202 level.

The bullish market sentiment for Bitcoin (BTC) is at risk after U.S. President Donald Trump made a bold statement regarding his upcoming trade talks with China. According to local media reports, Trump indicated that his planned meeting with Chinese President Xi Jinping may not happen.

Trump’s Statement Sparks Bitcoin Sell-off

For context, earlier, when Trump imposed a 100% tariff on China for rare earth metals, the overall crypto market collapsed massively, triggering over $19.20 billion in liquidations. However, Trump later remarked that he planned to meet China’s President Xi Jinping in South Korea, which helped the market rebound.

Today, following Trump’s statement, Bitcoin’s price plunged significantly, falling from $114,000 to $108,500. As per the latest data, BTC is trading near $108,488, posting a decline of over 1.90%.

Despite the notable price drop, market participants have shown strong interest in the asset, as reflected in the trading volume, which has surged over 55% to $104.65 billion.

Bitcoin Price Action and Technical Analysis

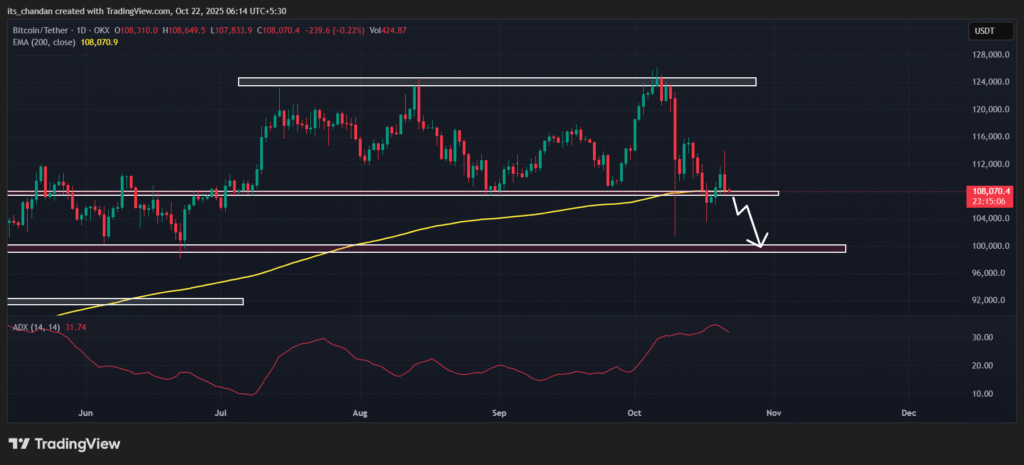

With the recent decline, Bitcoin’s price has once again reached a make-or-break point as it hovers near a strong support level of $107,500. According to TimeCrypto’s technical analysis, this key support has a strong history of triggering price reversals since July 2025.

Historically, whenever the asset’s price falls to this level, it tends to rebound significantly.

However, this time, market sentiment has shifted following the U.S. President’s latest remarks on trade talks with China.

Based on the current price action and sentiment, if BTC holds the $107,500 level, it could rebound again. But if it fails to hold and falls below this key support, a massive decline could follow, potentially pushing the price toward the next support at $100,000.

Right now, along with the $107,500 support, Bitcoin’s price is also getting support from the 200-day Exponential Moving Average (EMA), indicating that the asset remains in an uptrend. Meanwhile, the Average Directional Index (ADX) has reached 31.74, above the key threshold of 25, suggesting that the asset has strong directional momentum.

Traders Place Bearish Bets, More Pain Ahead?

Given the current market sentiment, a well-known crypto expert shared a post on X hinting that whales are aligning with the prevailing trend. In the post, the expert revealed that a potential insider has been significantly increasing his short positions, now holding an active short worth $235 million with 10x leverage and a liquidation level of $123,270.

In addition, data from the derivatives platform Coinglass reveals that BTC’s major liquidation levels currently stand at $106,886 on the lower side and $114,202 on the upper side, with the highest interest among traders. The data shows that traders have built $991.4 million worth of short positions and $1.73 billion worth of long positions around these levels.

Combining all these metrics, it appears that Bitcoin is under strong selling pressure, and even a slight drop from the current level could open the door for a massive downside move.