Key Takeaways

- Bitcoin (BTC) lost the key support level of $121,000, with price action hinting at a potential 3.50% downside move on the horizon.

- Traders’ short positions are three times larger than long positions, indicating a strong bearish outlook.

- An expert shared a bearish view, noting that many new perpetual positions are opening as the price declines.

With a 2.50% dip, Bitcoin (BTC) is poised to erase all gains from the past five trading days ahead of the weekly close. Both price action and on-chain signals suggest the bull run is in trouble, indicating a potential significant decline.

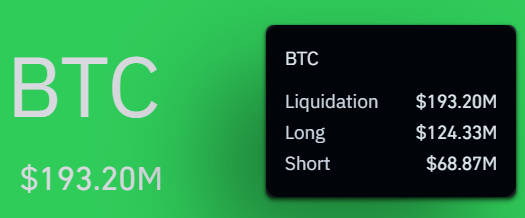

$193M Liquidated Amid Bitcoin’s Recent Dip

Following the opening bell on Thursday’s Wall Street, Bitcoin price plunged 2.50%, breaching a key support level of $121,000. At press time, BTC is trading near $120,650, and with the fall, millions worth of long positions have been liquidated over the past 24 hours.

Coinglass, a derivatives data tracking tool, reveals that Bitcoin’s recent fall has liquidated over $193.20 million worth of traders’ long and short positions. Among these, long-position holders were hit the hardest, with $124.33 million liquidated, while short-position holders saw $68.87 million liquidated.

Expert Shares Bearish Outlook

Looking at the current market sentiment, a well-followed crypto expert shared a post on X, noting, “The market still quotes bid liquidity around $121K–$120K, but what we need to see next is the absorption of sellers to rule out a sweep lower.” The commentary further stated, “A lot of new perp positioning opening into declining price here, quite likely to be dominated by new shorts opening.”

The expert commentary suggests caution for Bitcoin; however, buying pressure could stabilize the market and bring bulls back toward their long-term potential. If it fails, a strong decline is also possible.

Bitcoin Price Performance: Important Levels

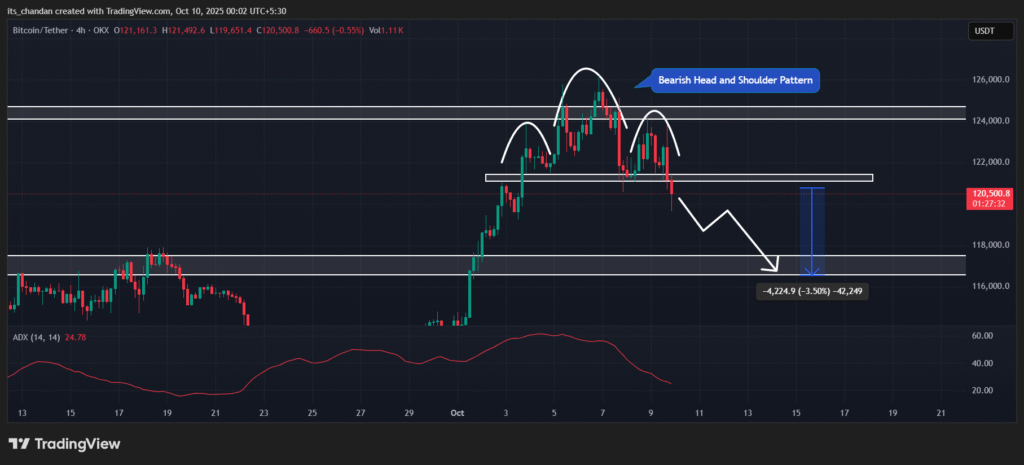

According to TradingView’s four-hour chart, Bitcoin has turned bearish, breaking out of a head-and-shoulders pattern, indicating that the asset is poised to continue its downward momentum. However, BTC is experiencing a sharp price recovery, which remains a concern for sellers, raising questions about whether this is a liquidity sweep, a fakeout, or a breakout retest.

Based on the current price action, if the downward momentum continues and BTC remains below the $121,500 level, its bearish outlook will stay intact. In this scenario, BTC could see a further decline of 3.50%, potentially reaching the $116,550 level.

On the other hand, if the price reclaims the $121,500 level, BTC’s bearish outlook would be invalidated, and a reversal may occur.

At press time, the Average Directional Index (ADX) stands near 24.78, close to the 25 threshold, indicating that the asset has a strong directional trend, which appears to be bearish for Bitcoin.

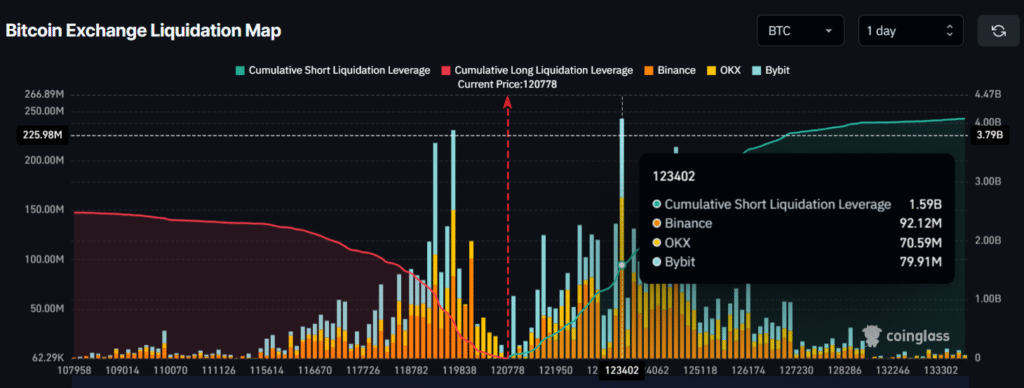

Short Bets Exceed Long Bets By 3x

Given the current market sentiment, it appears that traders are closely monitoring the trend, as bets on the short side have skyrocketed. Data from Coinglass reveals that BTC’s major liquidation levels stand at $119,706 on the lower side and $123,402 on the upper side. At these levels, traders are over-leveraged and have built $634.08 million worth of long positions and $1.59 billion worth of short positions, nearly three times the long bets.

This shows that traders currently have a strong bearish outlook, with a firm belief that BTC won’t cross the $123,402 level anytime soon. Moreover, surpassing the resistance at $125,000 seems even more difficult as experts believe that the current bull run is close to exhaustion.

Read More: Ethereum Price Eyes $5000 as Fusaka Upgrade Inches Closer