Key Takeaways

- Bitcoin (BTC) exchange reserves drop by 21,954 BTC over the past 24 hours.

- Abraxas Capital withdraws 1,060 BTC, worth $119.6 million, from Binance.

- Despite whales’ bullish activity, BTC price action hints at a bearish signal, with a potential 2.5% dip possible.

Billions in crypto were liquidated during the recent market dip, but Bitcoin whales seized the opportunity to buy. Over the past 24 hours, exchanges have recorded a massive fall in their BTC reserves, suggesting strong accumulation by investors, whales, and institutions.

Bitcoin Exchange Reserve Continues to Decline

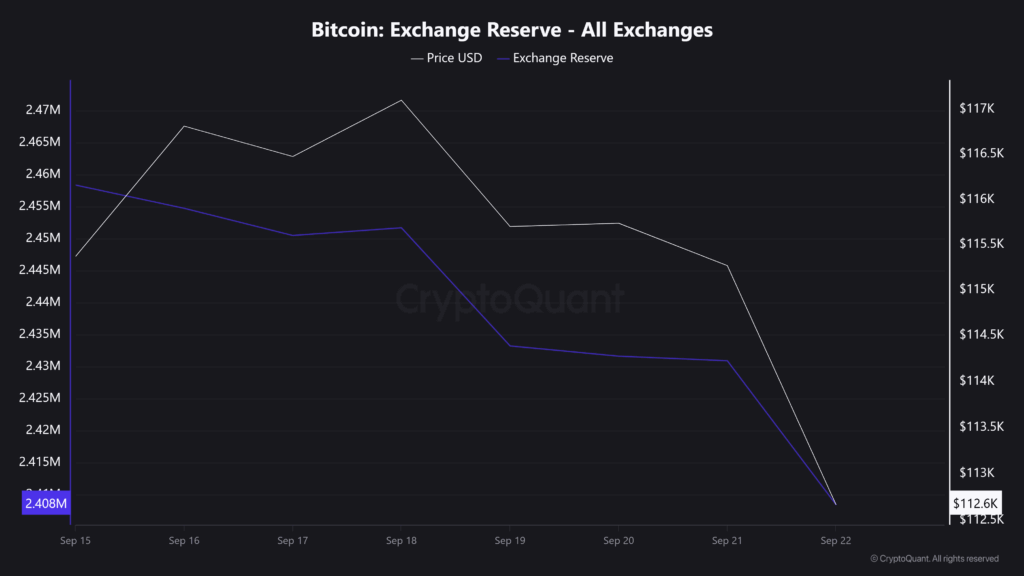

CryptoQuant, an on-chain analytics tool, revealed that Bitcoin exchange reserves have fallen significantly by 21,954 BTC over the past 24 hours and 49,424 BTC over the past week. Such a substantial outflow of BTC hints at strong accumulation by whales and long-term investors.

Amid this accumulation, Abraxas Capital withdrew 1,060 BTC, worth $119.6 million, from Binance, as reported by the crypto transaction tracker Lookonchain.

Generally, whenever exchange reserves for any asset fall, it indicates rising demand. However, in BTC’s case, instead of the price surging, it has continued to decline.

Current Price and 190% Surge in Trading Volume

Currently, BTC is trading near $112,800, having recorded a 2.25% dip over the past 24 hours. However, investors and traders have shown strong interest in the asset amid this decline, resulting in BTC’s trading volume jumping 190% compared to the previous day.

Such a drop in exchange reserves often raises the question of whether this is an ideal opportunity to buy BTC or if the price will continue its downward momentum.

Bitcoin (BTC) Technical Outlook: Upcoming Levels

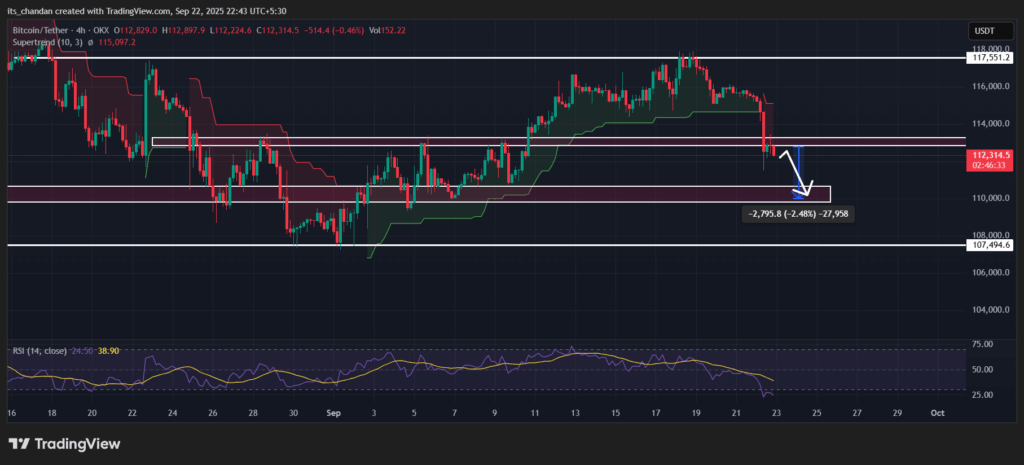

According to TimesCrypto’s technical analysis, BTC has lost its key support level of $112,900 and is poised for a price decline. On the four-hour chart, the asset has successfully broken the support level and is currently moving sideways.

The current price action suggests that if BTC fails to reclaim the $113,600 level, a strong downside rally could occur. If this happens, BTC could see another 2.5% price dip and may reach the $110,000 level.

At press, the technical indicator Supertrend has turned red and is hovering above the BTC price, indicating that the asset is currently in a downtrend. Meanwhile, the Relative Strength Index (RSI) has fallen to the 26.30 level, signaling that Bitcoin is in an oversold condition, which could hint at a potential short-term rebound if buying pressure increases.

Traders’ Eyes on Short Positions

Given the current market sentiment, intraday traders appear to have a strong bearish outlook.

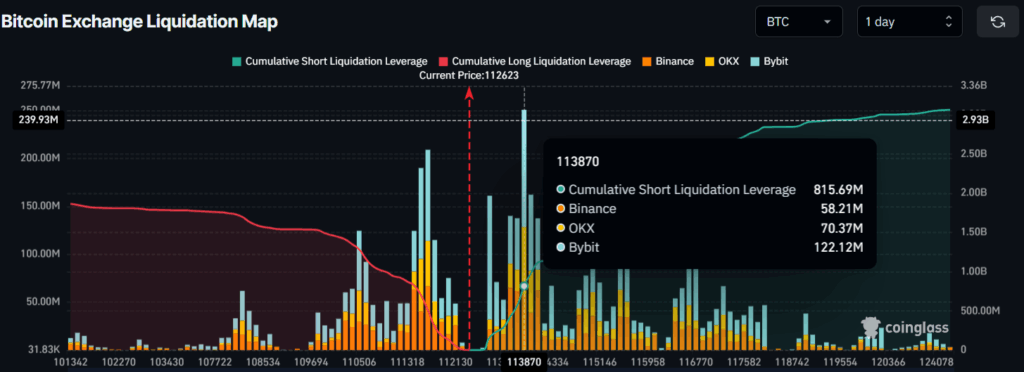

Coinglass, a crypto analytics tool, reveals that $111,666 on the lower side and $113,870 are the two major liquidation levels for BTC, where traders are over-leveraged. At these levels, traders have built $509.61 million worth of long positions and $815.69 million worth of short positions.

This clearly shows that traders hold a bearish outlook, believing that BTC’s price won’t cross the $113,870 level anytime soon. If it does, the $815.69 million in short positions could be liquidated, leading to a quick price recovery.

When combining these metrics, it appears that short-term market sentiment is bearish, while long-term sentiment remains bullish, driven by whales and institutions.