Key Takeaways

- Lib Work, a Japanese real estate technology firm, acquired 29.6431 BTC, joining the country’s Bitcoin adoption wave.

- The company purchased BTC at an average price of $112,140.

- Lib Work’s share price remained unchanged, moving sideways following the acquisition report.

Japanese companies have increasingly shown a strong interest in cryptocurrencies, particularly Bitcoin (BTC). Recently, a major development emerged from a Japanese real estate technology firm, Lib Work, which acquired Bitcoin as part of its broader digital asset strategy.

Lib Work Bitcoin Acquisitions

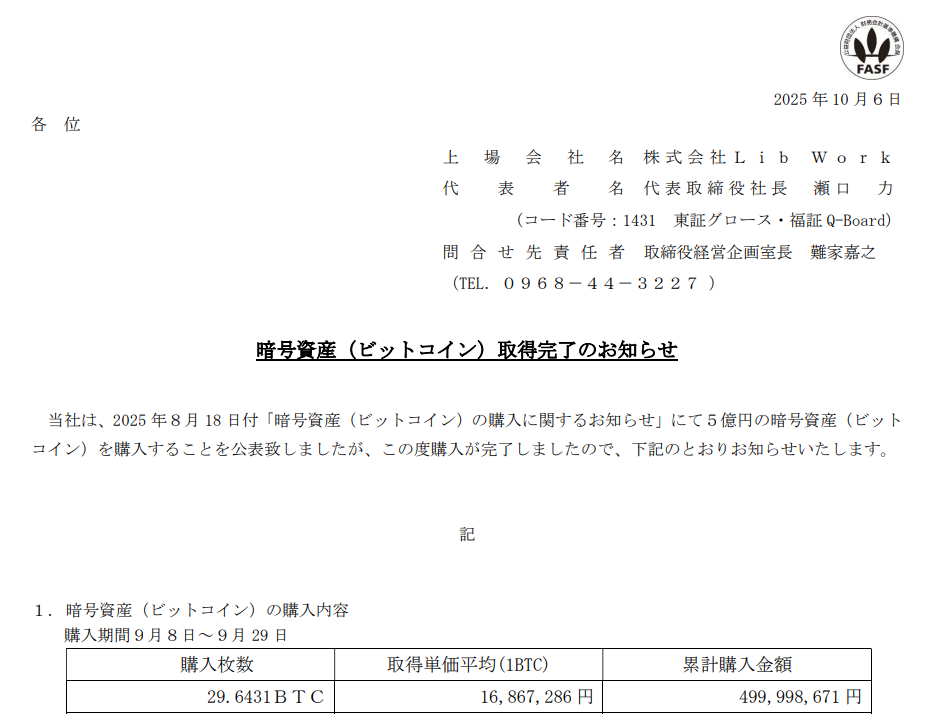

According to the report published on October 6, 2025, Lib Work acquired 29.6431 BTC in September 2025. The report reveals that the firm invested 499,998,671 JPY ($3.3 million) to purchase the BTC at an average price of 16,867,286 JPY ($112,140) per coin.

The company’s Bitcoin holdings are managed through SBI VC Trade, a Japan-based crypto exchange that provides services such as trading, custody, and operational support.

It is worth noting that the company disclosed its BTC acquisition plan on August 11, 2025, as part of its broader financial strategy. However, the investment made in September 2025 is much lower than what was initially announced. According to the report, the company had planned to invest 100 billion yen.

The report continued, stating, “We will consider acquiring crypto assets other than Bitcoin, including stablecoins and a wide range of other digital assets, if any matters requiring disclosure arise in the future.”

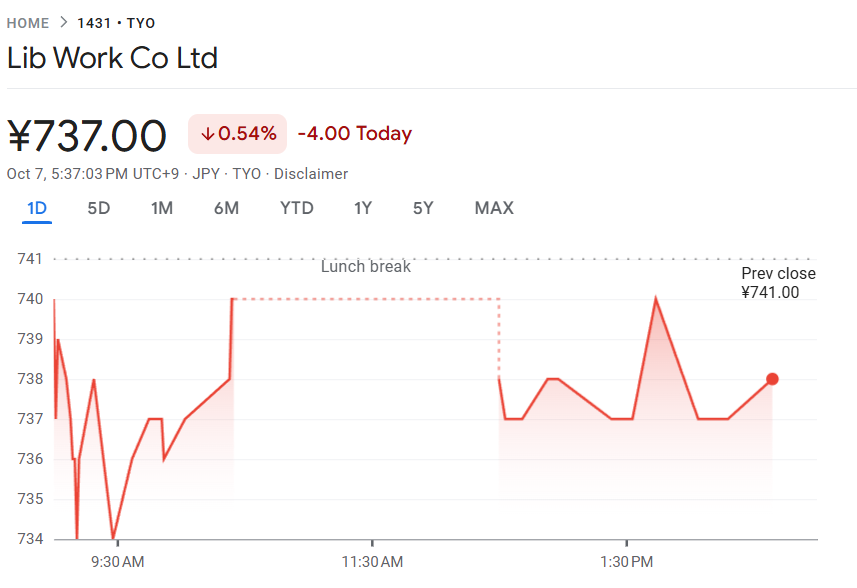

Acquisition Impact on Lib Work Share Price

Following the acquisition announcement, Lib Work’s share price remained neutral, with no major changes recorded. However, over the past month, the asset has fallen by 6%.

Lib Work Join Japan’s Bitcoin Adoption Wave

With the recent acquisition, Lib Work joins Japan’s Bitcoin adoption wave. So far, companies such as Metaplanet, Nexon Co., Remixpoint, MKB Co. Ltd, ANAP Holdings, and Quantum Solution have been actively involved in BTC and other crypto assets.

You might be wondering what is driving companies to embrace crypto. The factors attracting these major firms to invest in crypto appear to be the weakening yen, supportive regulations and legal recognition, a reasonable 20% capital gains tax on crypto, and the opportunity for portfolio diversification.

Bitcoin (BTC) Price and Its All-Time High

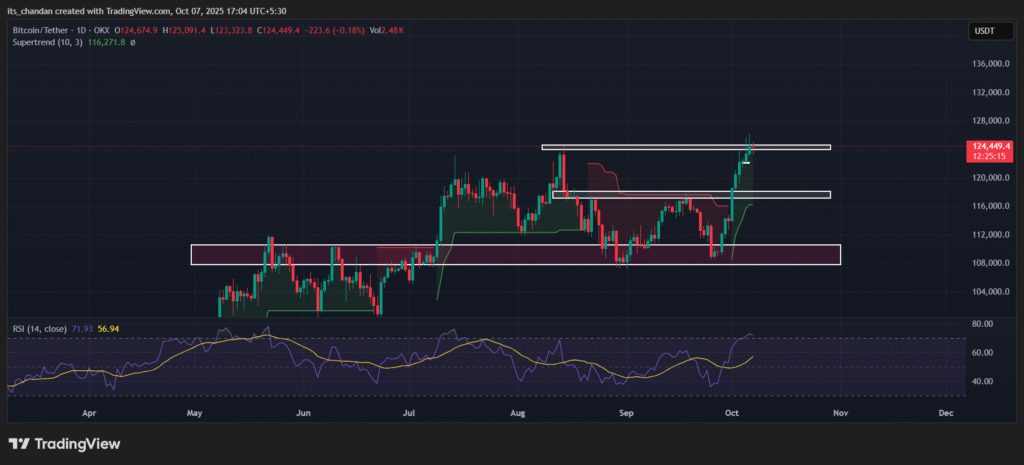

As of press time, Bitcoin is trading near $124,260, having posted a slight price dip of 0.35%, according to TradingView data.

TimesCrypto’s technical analysis reveals that BTC is in an uptrend and continues to reach new all-time highs. Data shows that over the past three days, the asset hit a high of $125,790 on October 5 and $126,200 on October 6, 2025.

Based on the current market sentiment, if BTC’s upside momentum continues and it closes a daily candle above the $125,000 level, a new high could be possible in the coming days.

Meanwhile, the Supertrend remains in the green, indicating that the asset is in an uptrend with strong buying pressure.

However, the asset’s Relative Strength Index (RSI) has reached 71.35, indicating it is in overbought territory and may experience a correction before the next leg up.