Key Takeaways

- Bitcoin miners have sent over 120,000 BTC to Binance in September 2025.

- Price action suggests Bitcoin could drop 7% if it fails to hold the $107,500 level.

- An expert notes that Bitcoin is still far from its cycle top.

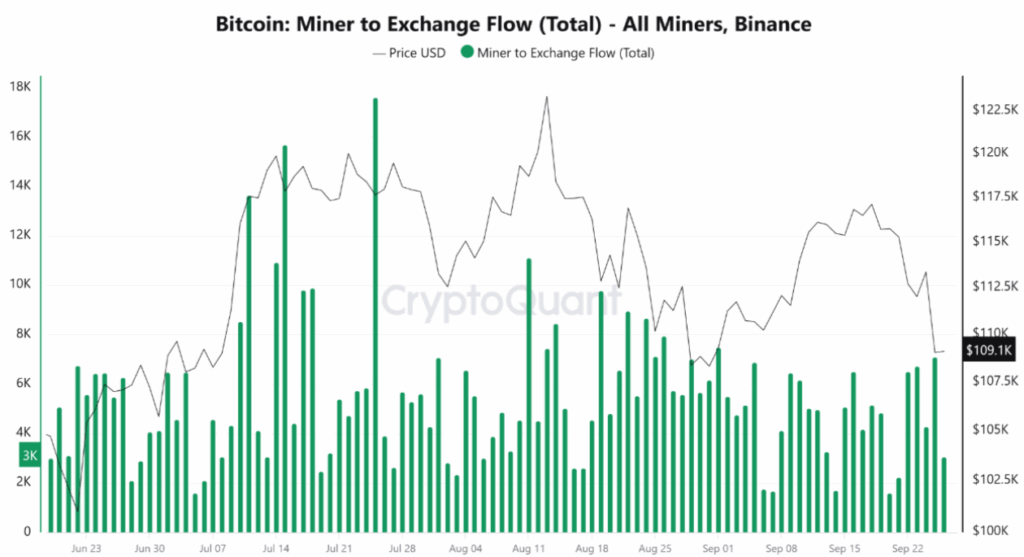

Bitcoin appears to be under selling pressure as an expert highlights miners’ recent BTC transfers. On Friday, a CryptoQuant analyst revealed that Bitcoin miners have been consistently sending significant amounts of BTC to Binance, typically between 4K–7K BTC per day.

Bitcoin Miners Sent 120K BTC, Price Crash Ahead?

So far, miners have sent over 120,000 BTC to Binance within the $117K–$109K price range in September 2025.

The expert also noted that when miners transfer large amounts of BTC to exchanges, it usually increases the available supply in order books, often signaling an intent to sell. The report further added that such transactions create additional selling pressure, weighing on price action.

Current Price and Expert Predictions

At press time, Bitcoin (BTC) is trading near $109,500, with the price remaining unchanged over the past 24 hours. During this period, investors and traders seem hesitant to participate, resulting in a 45% drop in trading volume to $40.79 billion.

In addition, BTC has declined by 12.35% from its all-time high of $124,500, recorded on August 14, 2025.

Looking at the recent price fluctuations, some experts view this as a routine correction, while others speculate on a bear cycle before the next leg up.

On X, a well-followed crypto expert shared BTC’s 2021 chart, which appears to mirror the current 2025 price action. According to the visual, if BTC repeats the 2021 pattern, there is a strong possibility that the asset could see a significant drop until it reaches the next support at the $100,000 mark.

Meanwhile, another crypto expert made a bold claim, arguing that Bitcoin is still far from its cycle top. In a post on X, the expert stated, “The US business cycle hasn’t topped yet, which is a major indicator of a cycle top. With the Fed cutting rates, I believe the crypto market has another 3–4 months before a blow-off top.”

Bitcoin (BTC) Price Action and Upcoming Levels

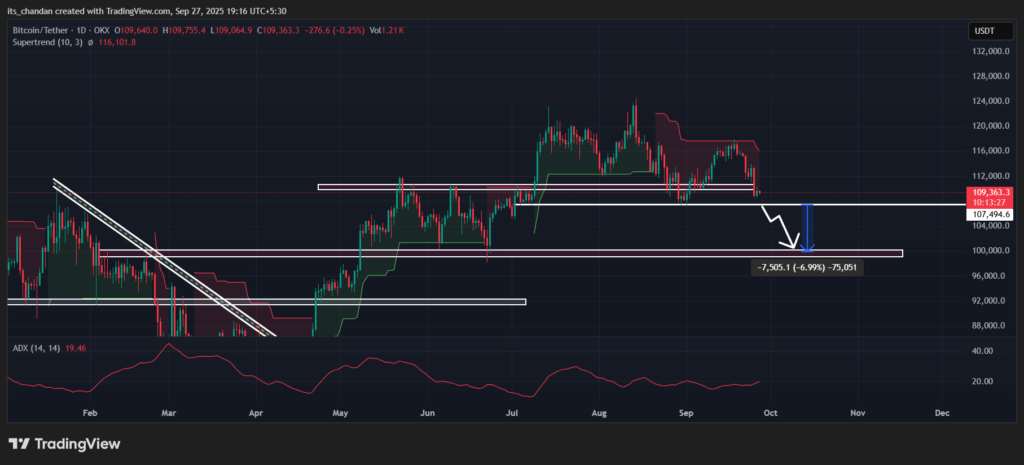

Amid mixed signals from experts, TimesCrypto’s technical analysis of the daily chart shows that BTC is hovering near a key support level at $107,500. A major concern is the formation of large red candles over the past week.

Based on the current price action, if BTC forms another red candle and breaks down the key support at $107,500, it could face a 7% decline and drop to the $100,000 mark. However, a reversal remains possible if the asset holds above this support level.

At press time, BTC’s Supertrend indicator remains red above the price, signaling a downtrend with strong selling pressure. Meanwhile, the Average Directional Index (ADX) has dropped to 19, below the 25 threshold, indicating weak momentum in the asset.